Many of the economic promises from the government program that PSD launched during the election campaign repeat older themes from the collection of economic policies of the party that won the 2016 parliamentary elections.

Many of the economic promises from the government program that PSD launched during the election campaign repeat older themes from the collection of economic policies of the party that won the 2016 parliamentary elections.

Given that most of the promised measures would be difficult to budget even with a maximum deficit considered and, on the other hand, these promises would clearly involve a generous budget, below is a short and simple list comprising both the tax reduction and the increases of salaries and expenses in the areas where the party decided that people has expectations.

PSD’s economic program provides:

- Setting up of a Sovereign Fund for Development and Investment (FSDI) to finance large energy and road infrastructure projects, railways and projects from other economic sectors. FSDI should get financing in turn by issuing bonds (25 bn. lei), dividends from state companies (10 bn. lei) and „attracting other sources” (25 bn. lei)

- Reaching a rate of absorption of 72.5% (127.3 billion lei) of the EU funds in the next four years

- (Re) establishing the Ministry of SMEs, Entrepreneurship and Tourism, because „99% of companies are SMEs, which generate 60% of GDP and employ 60% of the workforce,” according to the PSD’s economic program.

- By 1 December 2018, relationship between the state and business environment shall be fully computerized, „all tax obligations will be paid via the Internet. Companies will submit all the required forms online. Systems from all public institutions will be inter-connected.”

- Grouping the legislative standards into an Economic Code and an Administrative Code.

Many of the PSD’s promises involve salary increases and tax decreases at the individual level, whose impact on the economy have not been yet fully clarified:

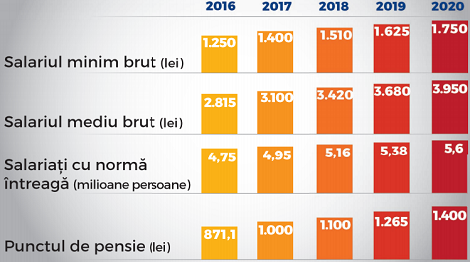

- Salary and pension increases between 40 and 60%, as follows: – minimum gross wage to 1,750 in 2020; – pension point to 1,400 in 2020; – minimum pension of 640 lei as of next year;

*

- Minimum gross wage (lei)

- Average gross wage (lei)

- Full time employees (million people)

- Pension point (lei)

*

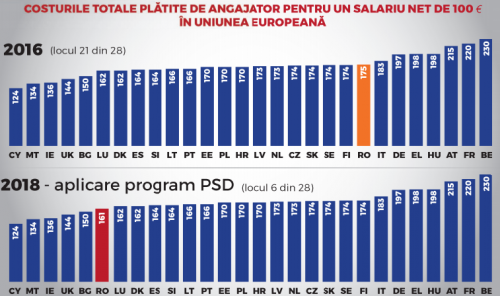

- Decreasing employee contributions to pension and health systems, cancelling the unemployment contributions, cancelling contributions for the liberal professions. In total, the decrease of contributions will be from 39.25% now to 35% by 2018.

*

- Total employer’s costs for a net salary of 100 euros in the EU states

- 2016 (21st position of 28 countries)

- 2018 – applying the PSD’s program (6th of 28 countries)

*

- Income tax would decrease to 0% from 16% (2016), as of 1 January 2018 for the employees with a maximum monthly gross salary of 2,000 lei and from 16% to 10% (2018) for those with a monthly gross salary exceeding 2,000 lei.

- Doctors and IT specialists will no longer pay income tax, regardless of their income

- To the self-employed, PSD promises zero income tax (0)%, for incomes below or equal to 24,000 lei a year and a decrease from 16%, the current level, to 10%, for those with annual incomes above 24,000 lei

- Agricultural income tax will be repealed as of 1 January 2018. Tax on agricultural land (46 lei / ha, now) will be 0 (zero)% for the land worked and 100 lei / ha for fallow land (as of January 1, 2018)

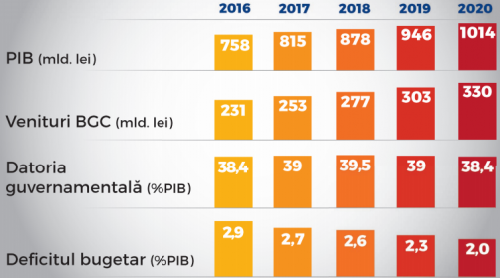

GDP is expected to grow from 758 billion lei in 2016, to 1,014 billion lei in 2020 while the deficit would decrease from 2.9% to 2% in the same time frame.

*

- GDP (bn. lei)

- Revenues of BGC – general consolidated budget (bl. lei)

- Public debt (% GDP)

- Budget deficit (% GDP)

*