Most of the Romanian companies’ investments are risky – because they use resources in the short term, they are oriented towards „what everyone does”, therefore they are out of phase in terms of profitability. Besides, Romanian companies’ investments have a reduced multiplier effect across the economy, according to a study released on Monday by economic analyst Iancu Guda.

Most of the Romanian companies’ investments are risky – because they use resources in the short term, they are oriented towards „what everyone does”, therefore they are out of phase in terms of profitability. Besides, Romanian companies’ investments have a reduced multiplier effect across the economy, according to a study released on Monday by economic analyst Iancu Guda.

The lack of financing sources adds to the picture: the delay in paying suppliers generated almost 39% of the amount of RON 77 billion invested in 2016 – according to the latest official data.

Otherwise, the loan financing from banks generated RON 37 billion („this is the total level of new loans granted by the banking sector to all private companies in 2016) and own resources only RON 10 billion, of which 7 billion – reinvested profit and 3 billion by supplementing the share capital.

Study findings are:

- „Financing long-term investment is not sustainable, with almost 40% being covered by short-term resources;

- Investments have a strong focus on residential construction and real estate transactions, which:

- are out of phase (not made at the right time),

- suffer from the herd instinct (we invest in real estate because most of the others do the same and „we are not good at something else”) and myopia (in the sense that they focus only on the present and do not consider the medium-term evolution of demand and financing costs);

- Except for software development activities, the sectors with the highest investment rate (consumption, tourism, social welfare services) do not have a multiplier effect on the economy;

- Increased wage spending, unfair competition (by tax evasion and underground economy) and strong competition from imported products have reduced the level of investment made by the companies that are most affected by these phenomena;

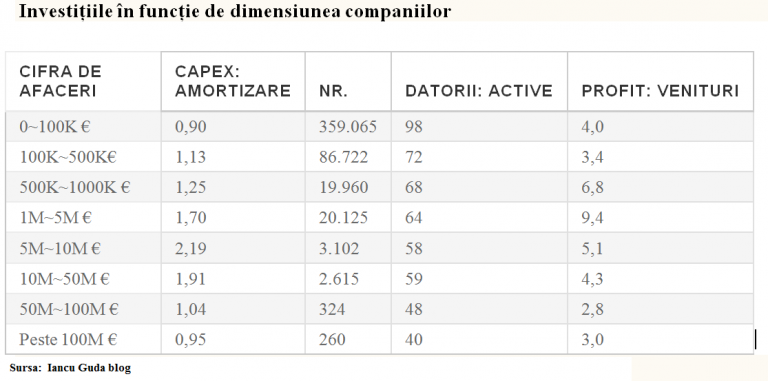

Small businesses (with revenues below one million euros) and large companies (with revenues over EUR 50 million) have a common attribute (though for different reasons):

„have a rate of investment in tangible assets almost equal to their ageing (the ratio between CapEx and depreciation is close to 1),” according to the study mentioned.

*

- Investment by companies’ size

- Turnover CapEx : depreciation Number Debts : assets Profit : revenues

*

The difference is that while small companies are constrained by limited access to financing, large ones will have entered a period of assimilation and making the most of older investments, according to the article „Five issues of Romanian companies’ investments„.

- „Small firms cannot make significant investments because of the difficult access to financing and the polarization effect (excessive concentration of revenues to large firms);

- The moderation of investments on the side of very large firms can be explained by economies of scale (recovery of past investments) and sometimes some self-sufficiency, management convenience and resistance to changing the business model,” according to the source mentioned.

Instead, „the medium business segment, with revenues between EUR 1 and 50 million, is very interesting because they have a rate of investment in tangible assets almost twice as high as their depreciation, while the indebtedness is close to the optimum level (60% – 65%) and the level of profit obtained is the highest”.

At the same time, companies established before 2000 register the highest level of investments, namely RON 32.7 billion.

„Despite that, their investments cover only the level of depreciation, so the value of the tangible assets is relatively stable”.

The companies established in the last five years have the highest level of investments compared to the depreciation, with the ratio of 2.79, according to the economist Iancu Guda, who is also the President of the Romanian Association of Financial Banking Analysts (AAFBR).