Romania has positioned itself in the EU as the country with the lowest public revenues as a share of GDP and we shall record in 2017 a new negative record in this respect, with only 30.5% of GDP estimated at the last budget amendment.

Romania has positioned itself in the EU as the country with the lowest public revenues as a share of GDP and we shall record in 2017 a new negative record in this respect, with only 30.5% of GDP estimated at the last budget amendment.

We remind that figures advanced by the Government were RON 255.778 million for the revenues of the general consolidated budget and RON 280.522 million for the expenditures, to a GDP rebounded by almost RON 22 billion, to RON 837.1 billion.

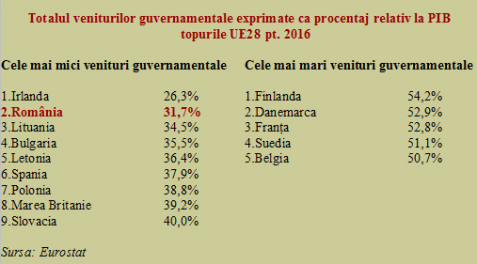

For reference, we also present you the ranking of the European states by the revenue share of GDP, according to data processed and certified by Eurostat, with the important mention that Ireland stayed systematically around 33% -34% of GDP two years ago, when the relocation of multinationals alarmed by a potential exit of the UK from the EU (which has happened in the end) and their results reported in a relatively small economy artificially boosted the GDP and consequently reduced the share of public revenues in GDP.

*

- Total government revenues as a share of GDP – rankings of EU28 for 2016

- Lowest budget revenues Highest budget revenues

*

It is noteworthy that by this key indicator for a state’s ability to meet its commitments, most European countries are placed between 40% and 50% of GDP. Moreover, five developed Western countries even exceeded 50% of GDP, precisely because the higher and rising level of development allowed that.

As for the average values for the EU28 budgets, they registered levels of 44.9% of GDP in revenue and 46.6% of GDP in expenditure last year, with an average deficit of -1.7% of GDP.

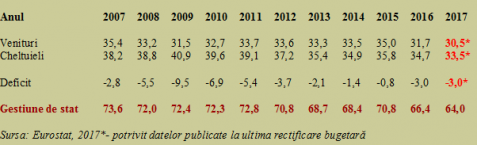

In our case, as in nobody else’s case, the deficit was pushed from a very honourable -0.8% of GDP in 2015 to the maximum threshold allowed of -3% of GDP, which the current Government would like to meet in 2017.

*

- Year

- Revenue

- Expenditure

- Deficit

- State management

- Source: Eurostat, 2017, according to the public data announced at the latest budget amendment

*

Much worse, although the deficit would remain the same (there are more and more clear signs that it will be exceeded), the percentages of government-administered amounts have fallen again to levels hard to understand for a foreign economist. Including the ridiculously low amount that the public spending will reach, which contrasts with the perception intended for the increases in wages and pensions.

How you consume more and live worse: an analysis of figures

Beyond this fundamental issue for Romania’s future development, we are confronted with a real national security issue. A state with less and less money (even in relation to an economy being mostly under outside control) is a weak state. It will not be able to secure the main areas remained under its responsibility, after its bizarre rapid and damaging withdrawal from the economy.

In this connection, it is enough to mention a Eurostat analysis based on final data for 2015 (GDP is „set in stone” after two years) showing that we still have left for allocations only 4.2% of GDP for health (EU28 average is 7.2%), 3.1% for education (EU28 average4.9%) and 11.5% for social protection (EU28 average 19.2%). The other data circulated over time, forget them, these are the final data.

We should remember, the value of 1% for defence is equally evident for Eurostat too, for now. Which means that it will have to be doubled as a share of GDP based on declining revenues. Which, as they say, is sublime but completely missing. No matter what engineering the best financial expert could do with the public money, we could say that „you can’t put in what God’s left out.”

We already have shares of GDP for health, education and social protection at about 60% of the EU average related to the penultimate GDP per capita at the EU level, which is a direct attack on the real welfare and even the physical existence of the population, as citizens who are supposed to benefit from the European living standard in a European country.

Even if the money in the Bucharest capital city is more in terms of purchasing power than in Berlin or Lisbon (which conceals the real country image) but there is no influx of Germans or Portuguese seen here. Not even foreign (and domestic!) emigrants are crazy about the public services provided by the place that plays the role of an outside window for Romania.

Of course, stealing publicly managed money seems to have become a national sport for the combination of corrupt politicians and unscrupulous businesspeople (it seems to be the key to success in the Romanian society but not only). However, reducing taxation and the disinvolvement of the state instead of moral recovery is a major trap.

Undertaking social policies when you have budget deficits and public investment deficits denotes political cynicism and a lack of vision and interest for future generations.

Except for 2007 (the „promotional” year of the EU accession, when some companies that came to occupy the Romanian market aligned at the starting line for the race to profits) and 2015, one can see how the share of revenues stood at 32% -33% of GDP, irrespective of tax adjustments and now collapse to the 30% threshold.

Over the last ten years, the variation in the public deficit has been overwhelmingly caused by the level of expenditure and not the revenue amounts. This is the reason why it has been chosen the most convenient option of cutting the expenditure and not the normal one, from the perspective of convergence with the European practice in the matter, of increasing the revenues.

In fact, nobody came to promote the idea, otherwise a common sense, that the living standards depend not only on the money available in the pocket but also the quality of public services offered by the state and the local authorities (the real reason why the Syrian refugees go to countries that are foreign in culture, such as Germany and Sweden and not rich Arab countries in the Gulf).

The tax relief policy based on expectations that Romanians would consume more and that would stimulate the economic growth has a major hurdle. Beyond unsustainability and deficits, they might consume more, in the sense of giving more money on different things but would live worse. More ill, more uneducated and lost in bureaucratic procedures.

In fact, fiscal policy should be dimensioned based on defining some European quality standards acknowledged by the state for public services rather than some right or left wing political headquarters, which since 2015 continue to mix cutting tax with increasing benefits. That is, taxation should respond to the command of the society as a whole. Not a group of individuals, whoever they are.