Eurostatistics is a synthesis based on a set of standardized and harmonized benchmarks for the comparability between countries at the European level (Principal European Economic Indicators – PEEIs in English).

Eurostatistics is a synthesis based on a set of standardized and harmonized benchmarks for the comparability between countries at the European level (Principal European Economic Indicators – PEEIs in English).

These indicators are published and reviewed monthly, in order to provide a synthetic picture of a national economy and recent developments.

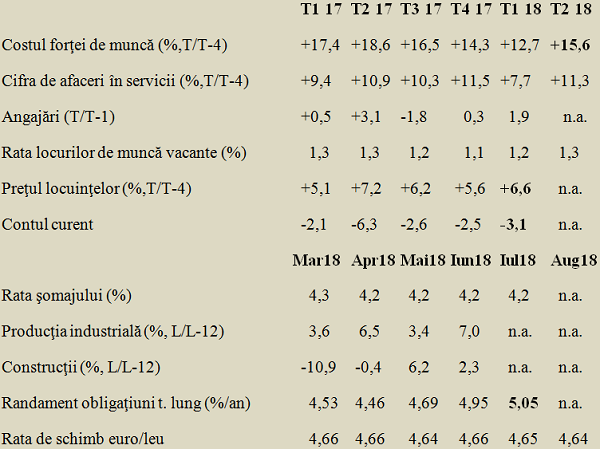

Here is the way it looks, on the website of the EU statistical body, a selection of the indicators of interest for the way Romania is seen from the outside, from the perspective of the centralized analysis at the level of the EU and the conclusions that can be drawn from recent economic evolutions:

*

- Q1 2017 Q2 2017 Q3 2017 Q4 2017 Q1 2018 Q2 2018

- Labour costs (%, Q/Q4)

- Turnover in the services field (%, Q/Q4)

- Employment (Q/Q-1)

- Job vacancy rate (%)

- Housing prices (%, Q/Q4)

- Current account

- Mar 18 Apr 18 May 18 June 18 July 18 Aug 18

- Unemployment rate (%)

- Industrial production (%, M/M-12)

- Construction (%, M/M-12)

- Long-term bond yield (%/year)

- Euro/RON exchange rate

*

Remarks

Firstly, the steady increase in labour cost draws attention, an increase well above the economic advance and constantly speeding up.

What does not appear (because of the dilution in the overall average) in European statistics is even more important, namely the significantly intensified rhythm of increases in the public sector compared to the private sector.

It is noteworthy in this context that since the beginning of 2017 the turnover evolution in the services sector was far from keeping up with the evolution of revenues which rose far beyond the productivity advance and were reflected in the evolution of labour costs. But the service sector is predominant in the GDP structure in any advanced economy.

With the benefit of a slowdown in the inflation index, the extra money went at a significant proportion to the real estate sector. This is where heavy struggles take place to maintain it, at the very least, within the macroeconomic stability benchmark of + 6% displayed on the scoreboard in Q2 2017, then moderated but returned to the trouble area earlier this year.

The employment, set on the downward trend in Q3 2017, returned to better values in the two following quarters, although the job vacancy rate slightly increased back from 1.1% to 1.3%, namely where it was also at the beginning of 2017. The signals are that it is becoming increasingly difficult to find people with certain specializations and skill levels.

The unemployment rate has maintained constant and relatively low compared to the European average, but it would look quite different after adjusting it with those who went to work abroad. Here is the explanation of the relatively low budget revenue collection as a share of GDP (about 70% of the EU average), although the taxation level is not low. But with 70% of the country’s workforce left, we can only have 70% of the revenue collection at a 100% load of those who stayed to support the state budget.

Incidentally, what about the social solidarity between generations in terms of paying the pensions? Those who stayed to work in Romania also support the parents of that 30 % who went to more promising places. Who, from higher wages, also send money home directly to those who are jointly supported by lower wages offered in the country.

For now, the evolution of industrial production, the one that sets the tone for the whole economy, remains robust, but the merits belong exclusively to the private sector, as there is no involvement of the state in terms of significant investments. The latest data on the construction sector also shows a recovery, but the trend remains to be confirmed in the next quarters.

Unfortunately, yields of government long-term bond rose above the 5% level at the beginning of Q3 2018 and will have consequences on interest payments, already up by 20% in the first seven months of the year, despite the decrease in the public debt share in GDP.

In spite of the current account deficit increase and the decrease in economic performance, including an increase in the trade deficit, the euro/RON exchange rate remained relatively stable and even returned to slightly lower levels in the summer months, as the attempt of exceeding the threshold of 4.65 RON/euro has been halted in the middle of the year.

All in all, data show that we should curb the forced march of increasing incomes, be they wages or pensions, to correlate them much more closely with the labour productivity and the results of the real economy. While not yet problematic, the picture of the economic data monitored by Eurostat raises questions about the macroeconomic stability.

Something that is like health, which you do not value enough until you lose it.