In the context of the significant drop in energy prices, our decision makers have been hesitant to act on that and from the position where we had by far the lowest price of natural gas for industry of all EU countries, as of mid-2014, we have got on the 7th position, with other six countries being at a very short distance from us.

In the context of the significant drop in energy prices, our decision makers have been hesitant to act on that and from the position where we had by far the lowest price of natural gas for industry of all EU countries, as of mid-2014, we have got on the 7th position, with other six countries being at a very short distance from us.

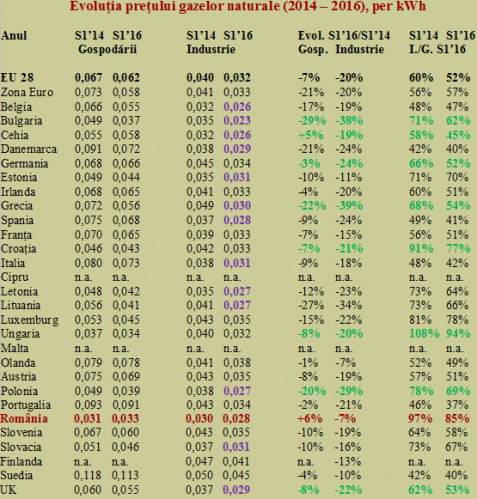

The average price of natural gas used by the Romanian industry declined in the past two years by only 7%, which made this resource to reach a comparable price to other 13 countries from mid-2014 until now. At the same time, we missed the opportunity to get decisively closer to the European practice whereby people pay much higher prices than the industry to benefit from increased competitiveness and jobs.

With a ratio between the average price for industry and households of 85% in mid-2016 (improved from 94% in mid-2014, according to the Eurostat centralized and certified data), we stayed on the second lowest position in the EU at this indicator and far from the EU average of 52% (see table).

*

- Evolution of natural gas prices (2014-2016), per kWh

- Year Semester 1’ 14 Semester 1’16 Semester 1’ 14 Semester 1’16

- Households Industry

- Change S1’16/S1’14

*

Except for the Czechs, we are the only ones that have dared to slightly raise the price for the population, but comparative data shows that others took advantage of our timidity to better positioned themselves in terms of production costs on the energy sources. So we could see prices below those from Romania in countries like Belgium (?!) or Poland and the Czech Republic (countries that heavily sell us chemicals).

Neither Hungary, our main trading partner and source of deficit, did miss the opportunity to cut down by 20% the price of natural gas for industry. Then we are left to wonder why we cannot correct the situation of the main producing sector that brings us in the position of chronic deficit year after year, which systematically puts pressure on the current account balance and the exchange rate.

Prices of natural gas for industry – at the same level as in countries without resources

Against this background, it is hard to understand how we managed to apply prices for industry equal to those in Spain (!), a country that has no natural gas reserves and is located just opposite the continent to Russia. This is also the reason why this country and its neighbour from the Iberian Peninsula, Portugal, have “Swedish” values of the price ratio between industry and population.

Because regardless of the effort made by household to pay the bills, it is more important to keep production as competitive as possible, including with relatively inexpensive energy resources, be they resulted from the indirect subsidizing by the population. This is evident in the case of Germany that took advantage of the situation created to bring the price ratio mentioned above to the European average (close attention to the developments in Greece, suppose that Russia did not discreetly intervene to increase their influence).

Worse is that six other countries positioned far from us on the price scale came within the margin of 10% compared to us in terms of the price of natural gas for industry, which further affected our competitiveness on the single market. The list includes the UK (although the country has significant natural gas reserves in the North Sea, it goes by the principle once learned that “natural gas should not be burned, but used it in the chemical production”), Denmark and, ironically, Italy.

Altogether, the comparative advantage of the natural gas reserves should have been used primarily and decisively in the industry, not for the population. The jobs, national production and potential current account surplus obtained by exporting products made with cheap gas are more important than low bills on domestic consumption. Invoices, no matter how small, can be paid only if there are jobs, national production and a favourable exchange rate.