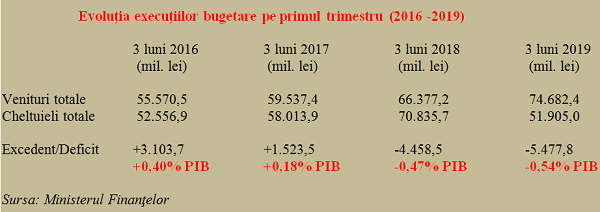

The general consolidated budget recorded, after the first two months of 2019, a deficit of about RON 5.5 billion, equivalent to 0.54% of the GDP estimated for the current year.

The general consolidated budget recorded, after the first two months of 2019, a deficit of about RON 5.5 billion, equivalent to 0.54% of the GDP estimated for the current year.

This result is weaker than in the same period of last year when the public finance negative difference in in the similar period was almost RON 4.5 billion or 0.47% of 2018 GDP communicated in the provisional version.

The good part is that the deficit gap compared to the same period of the previous year is minor, the less good part is that in Q1 2016 and Q1 2017 the results of budget implementation were on surplus.

It should be noted the continuous deterioration of values (which can be interpreted though as an equalization of the implementation in order to avoid packing large monthly deficits at the end of the year) and the difference of almost one percentage point between 2016 and 2019, although the annual deficit figures are similar (-2.6% of GDP in 2016 and -2.76% of GDP in 2019).

*

- Evolution of budget implementation in the first quarter (2016-2019)

- 3 months 2016 (million RON) 3 months 2017 (million RON) 3 months 2018 (million RON) 3 months 2019 (million RON)

- Total revenues

- Total expenditure

- Surplus/Deficit

*

If we make the correlation with the result at the end of 2018, or 2.91% of actual GDP recorded in official statistics, it would seem that we are off the charts and we will have to adjust the expenditure compared to last year in order to meet the deficit target. Unfortunately, we are in the electoral year and the 15% increase in pensions will be made in the last third of 2019.

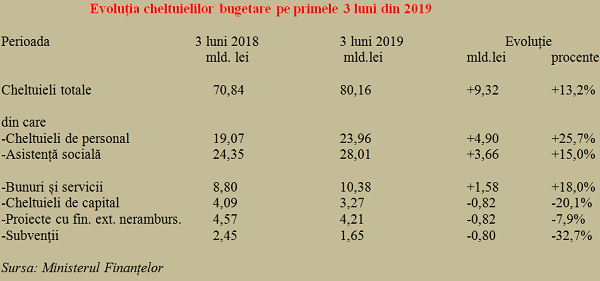

Noteworthy, the revenue growth rate in the first quarter was slightly below the expenditure growth (+ 12.5% in revenue versus + 13.2% in expenditure, both in nominal terms).

If we make the adjustment with the average inflation, we obtain real values of + 8.5% in revenues and + 9.1% in expenditure, roughly double the economic growth in 2018.

Wages and social protection, in exchange for investment decrease

Although it has increased in percentage terms by 24.2%, the corporate tax maintained at an extremely low level that is slightly above half a billion RON. That is, about seven times less than the salary and income tax of RON 3.65 billion (otherwise decreasing by no less than 25% following the tax rate decrease from 16% to 10%).

The insurance contributions took the first position in the public revenues replacing the VAT-excise mix, after having advanced by RON 3.73 billion compared to the same period of the previous year (from RON 13.85 billion to RON 17.59 billion, that is from a contribution of 32.7% in total revenues to 37.7%.

In terms of indirect revenues, there is a significant increase in VAT amounts collected (+ 14.8% from about RON 13.3 billion to RON 15.3 billion) as well as in amounts from excise taxes (+16.8 from RON 5.8 billion to RON 6.8 billion). While about three billion RON came from this source, the difference to the extra amount of roughly eight billion RON collected in Q1 2019 came, approximately, from the nearly five billion RON representing additional insurance contributions received as a result of wage increases.

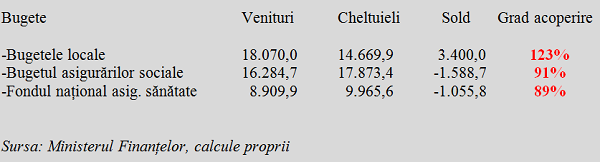

Traditional surplus of local budgets recorded in the early part of the year doubled in March and reached RON 3.4 billion, with an expenditure coverage ratio of 123%, as a result of an expenditure cut below the level of the previous year.

The social insurance budget (the deficit of which maintained at a similar level compared to the end of the previous month) and the national health insurance fund budget (which has massively increased, about two and a half times in March compared to February) recorded coverage ratios around 90%.

*

- Budgets Revenues Expenditure Balance Coverage ratio

- – Local budgets

- – social insurance budget

- – national health insurance fund

*

Salaries and some social protection, in exchange for a decline in investments and in co-financing projects implemented with European money

Simply put, additional amounts collected in social contributions went to wage increases in the public sector (+ 25.7%) and those from excise duties and VAT went to a slightly lower increase if we are to make a comparison, in social assistance (+ 15%). Both positioned above the overall average, along with the expenditure for goods and services (+ 18%).

*

- Evolution of budget expenditure in the first three months of 2019

- Period 3 months 2018 (billion RON) 3 months 2019 (billion RON) Change

- Billion RON Percentages

- Total expenditure

- Of which

- – staff expenditure

- – social assistance

- – goods and services

- – capital spending

- – projects implemented with external non-reimbursable financing

- – subsidies

*

The compensation, in order to keep the growth rate in expenditures close to the rate in revenues, was made by:

- Cutting investment spending (-20.1%),

- Cutting amounts for projects with non-reimbursable external financing (-7.9%) and

- a slower distribution of subsidies (-32.7% compared to Q1 2018 but having a strong recovery from -63.1% recorded at the end of February).

In summary, at the general consolidated budget level, the robust increase in budget revenues was directed towards the increase in the expenditure with wages and social protection at the expense of investments and projects implemented with local budgets, in order to maintain the overall financial balance at a reasonable level.