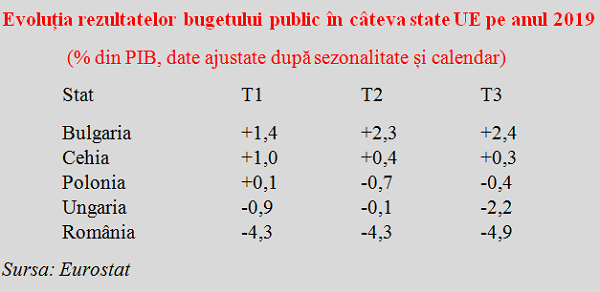

Romania managed again to stand out at the EU level by recording the highest level of the public deficit in the third quarter of 2019, namely -4.9% of GDP.

Romania managed again to stand out at the EU level by recording the highest level of the public deficit in the third quarter of 2019, namely -4.9% of GDP.

For reference, we mention that France (-2.5%), Hungary (-2.2%) and Slovakia (-1.9%) rank far behind us, all within the range allowed of up to -3% of GDP, the EU average is -0.9%, and Eurozone average is -0.7%.

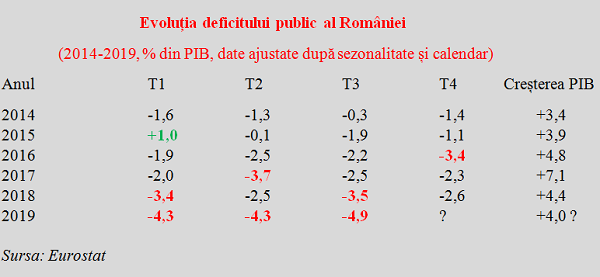

If we look back at the period of robust economic growth after the recovery from the economic crisis, it is very strange why the public deficit started to increase right during the times when the economic growth was also higher, after which it has not been maintained under control, despite the obvious reversal of the GDP growth trend.

Although in 2014 or 2015 pensions and allowances for children were small and even much smaller, the budget balance has been maintained under control and we even reached the medium-term objective of stability in a structural deficit limited to 1% of GDP. Then, the fading-out in the collective memory of the unfortunate consequences of 2008 adventure when we were increasing wages and pensions just when the crisis was approaching, brought us to the madness of debt generating consumption and GDP augmentation based on domestic demand and massive imports.

*

- Evolution of Romanian public deficit

- (2014-2019, % of GDP, data adjusted by seasonality and calendar)

- Year Q1 Q2 Q3 Q4 GDP change

*

So, more hesitant at first, we increased the public deficit to the threshold of 3% of GDP and then crossed it only once a quarter in 2016 and 2017. Then, we saw „this way is close enough”, we exceeded in two out of four quarters and, by the approach „in for a penny, in for a pound”, we followed a geometric progression path with the deficit in two quarters in 2018 and all four quarters in 2019.

Then, instead of going back to the normality from other European countries with a similar level of development to ours, we decided to stretch the limits and see how far the budget can be forced without exploding.

Wages, pensions and allowances were probably needed in Bulgaria as well, even more than in our case, but data published by Eurostat does not show that neighbours from the south of the Danube are seekers of living based on the public deficit and debt increases. Neither in Central Europe does the practice exist (anymore) (at least there they built highways from borrowed amounts).

*

- Evolution of public budget results in some EU countries in 2019

- (% of GDP, data adjusted by seasonality and calendar)

- Country Q1 Q2 Q3

- Bulgaria

- Czech Republic

- Poland

- Hungary

- Romania

*

All in all, the (belated) discussion of whether or not there is money for a 40% increase in pensions or 100% increase in children allowances is ABSURD, as long as Romania has a budget deficit. deficit means that we are within the negative range in terms of expenses versus revenues, which is why we also borrow (see also the EUR 3 billion mega loan recently contracted on the long and very long term). From which we can see as clearly as possible that there is no money. We only have if others give us, for high interest rates.

In slightly more prosaic terms, we borrow to regularly go to the fast-food sponsored with money from the future by the politico-electoral machinery. Or, deficits are not for short-term consumption but long-term investments.

In which case refunding the money and paying related interests (which, in 30 years and at a level of 3.5% per year, more than double the amount to be paid, also from taxes) would have been like a bank instalment needed in order to have a roof over our heads. Not as a massive, silent price increase, over time, in some goods and services that we rushed to buy without having money in our pocket and any concern for the consequences.