Member states are trying to reach a consensus by October about the European Commission’s proposals to amend the European Directive on posted workers.

Member states are trying to reach a consensus by October about the European Commission’s proposals to amend the European Directive on posted workers.

Although it is a new subject dividing the European Union (Western Europe and the former communist states have divergent positions), it has a minor impact on the labour market, according to an analysis of the Bruegel think tank in Brussels.

The reform became known to the EU citizens only after the French president, Emmanuel Macron, made a tour in the eastern bloc this summer, including Bucharest, to try to secure the reform of the system for posted workers.

Central and Eastern European states reject the amendments, though. The only concession that they are willing to accept would be to support the proposals if shaped in an attenuated form, but with a condition – that carriers would not fall under this directive.

Current situation, which Western states want to change

Posted workers are employed in a country (country of origin) and sent to work for different periods in another country. They pay taxes in the country of origin and generally are subject to the labour law in their country of origin.

The employer is not required to pay the posted worker more than the minimum wage established by the host country.

The host country’s legal regime also applies to working time, minimum rest time, paid leave, minimum wage, workplace, health, as well as work protection, safety and hygiene measures.

Example: A firm in Romania gets a contract for building a construction in Paris. Employees will pay taxes and contributions, and their salaries are, even though higher than in Romania, well below those of local workers.

The current provisions date back to 1996 when the pay gap within the EU was not so high. Meanwhile, poorer countries have also become members, such as Romania and Bulgaria, and old member states, such as Spain, have faced big labour market problems.

In these 21 years, the economic and labour market situation in the European Union has considerably changed, and the Commission has found that some firms have benefited from the widening wage gaps and have used the system as a way to benefit from these gaps.

How European Commission wants this directive to be

Remuneration

The current Directive only stipulates that posted workers are entitled to the minimum wage in the host country. The new proposal provides for the application of the same rules on remuneration in the host member state as laid down by law or by collective agreements of general application.

That does not mean equal pay.

Remuneration does not only include the minimum wage but also other elements such as bonuses (for holidays, for example), allowances or wage increases based on seniority.

Member states will have the obligation to transparently state the various elements that form the remuneration on their territory. If they are laid down by law or collective agreements of general application, these elements will have to be considered in determining the salaries of posted workers.

Example:

A worker posted to the construction sector in Belgium must be granted, in addition to the minimum wage for his category (which varies from EUR 13.379 / hour to EUR 19.319), a number of remuneration elements laid down in the collective agreement of general application for the construction sector:

- compensation for adverse weather conditions;

- mobility allowance;

- additional payment for executing special works;

- allowances for tool depreciation, etc.

Long-term posting

The Commission also proposes that workers posted for more than two years (long-term posting) should at least be under the labour protection compulsory rules from the host member state.

This measure will apply right from the first day if it can be anticipated that workers will be posted for more than 24 months. In all other cases, the measure will apply as soon as the posting duration exceeds 24 months.

Example:

Workers posted to Germany for more than two years will benefit from the rules in that country on the protection against abusive dismissal, even though the labour law in their country of origin does not provide for such protection.

Collective agreements of general application

The Commission proposes that the rules laid down in collective agreements of a general application become mandatory for posted workers in all economic sectors.

Subcontracting chains

Within the subcontracting chains, member states will have the option of applying in the case of posted workers the same pay rules that are compulsory for the main contractor, even if these rules result from collective agreements with no general application.

Position of member states

Austria, Belgium, France, Germany, Luxembourg, the Netherlands and Sweden (host countries with large numbers of posted workers from poorer countries)

They want for the principle of „equal pay for the same work” to be accepted and invoke two arguments:

- significant wage gaps distort the conditions of fair competition between businesses, thus undermining the good functioning of the single market

- social dumping caused by posted workers who are much cheaper than local workers (posted workers earn up to 50% less than local workers in certain sectors and member states).

Bulgaria, the Czech Republic, Estonia, Hungary, Lithuania, Latvia, Poland, Slovakia and Romania (suppliers of cheap posted workers) are against reforming the system and ask at least a compromise, to exclude the transport sector.

Poland is the most interested in getting these exemptions, as 30,000 companies would be affected, with a total of 300,000 drivers.

Romania: situation and position

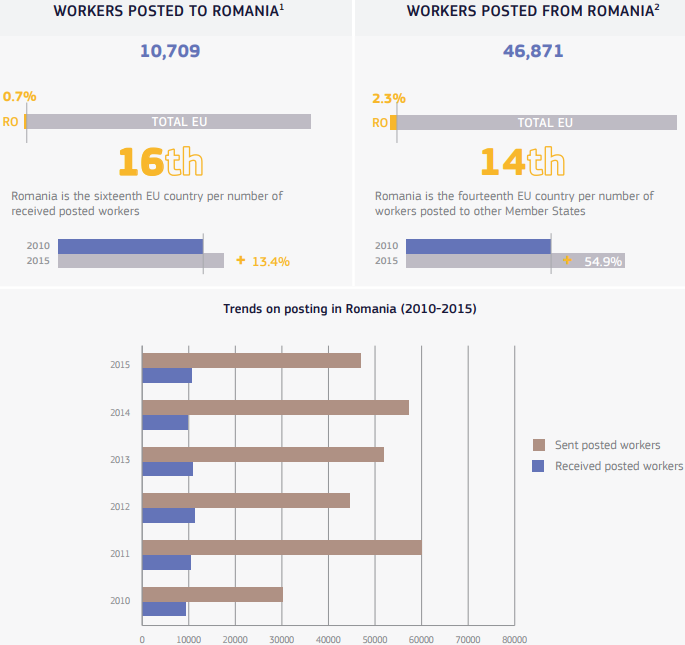

Romanian companies had 46,871 workers posted in different EU states in 2015, according to the European Commission data.

Most of them worked in construction (40.7%), manufacturing industry (38.3%), business services (7.3%) and transport (5.5%).

Most of them worked in construction (40.7%), manufacturing industry (38.3%), business services (7.3%) and transport (5.5%).

Current situation in EU

In 2015 there were 2.05 million posted workers in the EU, following an accelerated growth by 41.3% compared to 2010.

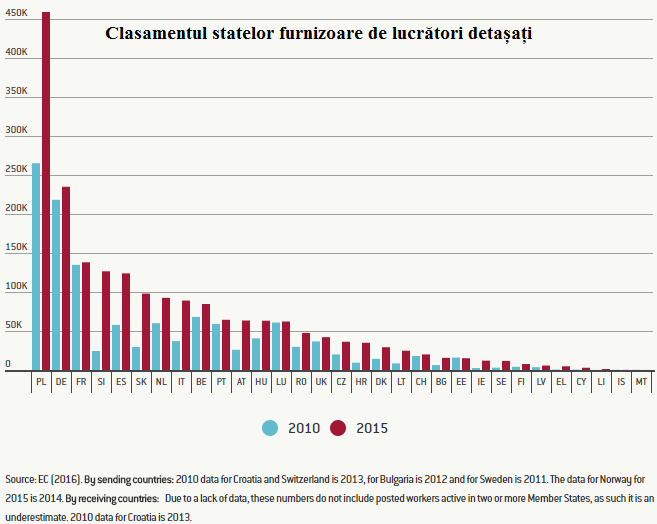

Host countries with the largest number of posted workers are Germany (28% of the total – 420,000 people), France (11,9%) and Belgium (10,5%):

*

- Ranking of countries that host posted workers

- Source: Bruegel.org

*

Poland (22.8% – over 450.000 people), Germany (11.7%) and France (6.9%) stand out in the ranking of countries supplying posted workers.

*

- Ranking of countries supplying posted workers

- Source: Bruegel.org

*

In relation to local employment, though, Luxembourg (with 9% of the total number of posted workers), Belgium (3.8%) and Austria (2.5%) are the countries where posted workers register the highest percentages.

Why impact on labour market will be low

According to an analysis of the Bruegel think tank, the impact on the labour market will be modest.

Main arguments:

Seconded workers represent only 0.9% of all employees in the EU 28, which means only 0.2% in full-time equivalents. The average period during which workers are posted and provide services in another country is less than four months. On average, a worker is posted 1.9 times a year. The two million workers posted per year represent a small part of the overall mobility registered in the EU, where there are 11.3 million long-term migrant Europeans in another member state.

Estimates show that the shorter the periods of posting are, the lower the impact is. In Germany, 4.5% of construction workers are posted workers but the impact is lower as 90% of them are seconded for periods of up to six months.

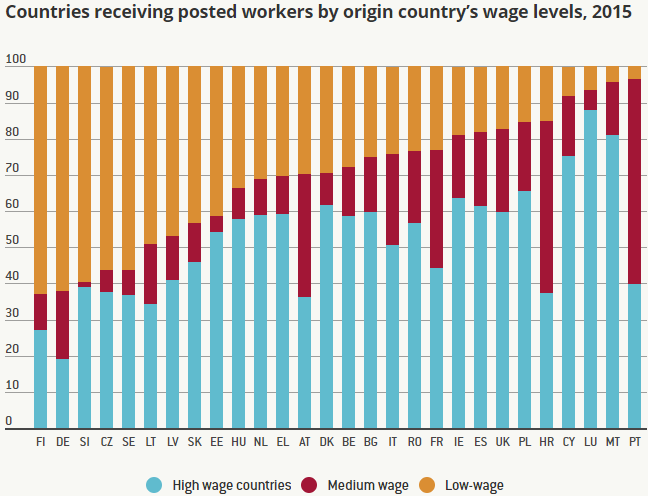

Also, the Bruegel think tank notes, it is a false assumption that posted workers come mostly from countries with low wages. In fact, according to the analysis, postings from a low-wage country to one with high wages account for a third in total, the same as the number of posted workers from a country with high salaries to another country with high salaries.

The most suggestive example is France, which wants a tougher wording of the directive than the version proposed by the EC and where only 23% of posted workers come from low-wage countries, while 44% of the posted workers it hosts come from countries with a high pay. The same is in Belgium – 58% are citizens of countries with high incomes: