Carefully supervised by Liviu Dragnea, Darius Valcov, the PSD’s expert in writing and observing the government roadmap, has fulfilled his mission again and delivered in time a new government program.

Carefully supervised by Liviu Dragnea, Darius Valcov, the PSD’s expert in writing and observing the government roadmap, has fulfilled his mission again and delivered in time a new government program.

The Tudose government program is a revised and amended edition of the program with which Sorin Grindeanu has been appointed at Palatul Victoriei six months ago.

The details of the Mihai Tudose government plan, endorsed by PSD and ALDE, and the people who will have to achieve the vision, below:

Macroeconomic policies: maximum public debt threshold proposed – 60% of GDP

Ionut Misa is officially asked to build an economic model consisting of measures „successfully implemented in countries such as Poland, Denmark, France, Germany, the United Kingdom or the US„.

Ionut Misa is officially asked to build an economic model consisting of measures „successfully implemented in countries such as Poland, Denmark, France, Germany, the United Kingdom or the US„.

The details of this chapter are not very accurate: „Just because we understand that the language of an economic program is not easily accessible to all who want to check it, we have decided for the presentation of our economic program to be different and easy to understand and go through. Our references will, therefore, be a sum of principles, not chapters.”

From the Ministry of Finance, it is expected the drafting of the Legislative Code called „The Economic Code of Romania„. It will contain the Tax Code, the Tax Procedure Code, the Companies Establishment Law, the Tax Evasion Law and all the other economic laws.

Deadline for submission to the Parliament: September 2017. Deadline for adoption: no later than 1 July 2018.

As a rule, the government program states:

The compliance with the Maastricht Treaty criteria: a budget deficit below 3% of GDP and a public debt of less than 60% of GDP (to be noted: the public debt is about 40% of GDP now).

Companies will be taxed on turnover, not on profit. The idea of introducing the household tax is preserved

The Government wants to replace the current tax on profit with a tax on company revenue.

„We will introduce the revenue taxation for all companies in Romania (tax on turnover) as of January 1, 2018. It will replace the corporate tax and have 2 or 3 tax rates,” the government program says.

The measure is a new one introduced by PSD with the intent to increase the state revenues from business taxation. In addition, managing this type of tax would significantly ease the work of the tax authority and would make tax optimization practices unnecessary.

The reverse of the medal: this tax formula badly affects the companies that have a high volume of transactions and low margins.

The so-called household tax is maintained: the Tudose government maintains the philosophy of taxing the taxpayers’ income, and the implementation of the global income tax for natural persons is scheduled to be implemented starting in 2018 with the completion and submission of the patrimony declaration.

VAT decreases, but later. Solidarity contribution and vice tax introduced

Starting January 1, 2018, the number of taxes, charges and commissions in Romania would not be higher than 50:

- For the population, there will be no more than 10 taxes, including CASS, CAS, the income tax, the tax on land, the tax on immovable property, the car tax, the solidarity contribution (new tax, no further details), the vignette

- For businesses, the number of fiscal and non-fiscal charges will be up of maximum 40

The government program also mentions an extra tax on products whose consumption has a major negative impact on the population health. The only detail: it will be imposed as of 1 January 2018.

Deadline for submitting the tax nomenclature: 1 September 2017.

Other measures:

- VAT rate change from 19% to 18% as of January 1, 2019 (also promised by Grindeanu government but with a 1-year postponement)

- The facility to pay all taxes online as of 1 January 2019

- An integrated information system for the entire public administration in Romania, the timeline and the way of implementation presented by 1 January 2018

- Reducing the number of forms to be filed by taxpayers: one form per year for those who obtain incomes from independent activities and 5 forms per year for SMEs as of 1 January 2018

Regarding the VAT, the program also contains the following general information: „As of 1 September 2017, we will also introduce an improved mechanism of tax collection (split payment) based on the model used by Italy, which almost reduces all the evasion of the VAT that is declared and not paid at present.”

One last good news: Law 31/1990 will be amended so that a person can no longer establish a company within a number of years after two insolvencies.

Mission of Sovereign Investment Fund: why take Europe’s money, we are fine with Romania’s money

Nor in the new government program is it very clear who will manage the FSDI’s activity. We know, though, that the project has been prepared by the person who was the minister of economy and will be prime minister tomorrow. We know the project is ready since May 15, but Sorin Grindeanu has presumably sabotaged it, according to Liviu Dragnea’s accusations.

What would be done with this money: everything, especially things that could have been done with European funds: hospitals and highways.

According to the government program:

The fund will mainly include the profitable state-owned companies, the value of which will exceed EUR 10 billion (this version does not mention either the companies transferred to the FSDI portfolio)

- „The largest investments of FSDI over the next 4 years will be in the healthcare field, by building a republican hospital and 8 regional hospitals. The total financing from FSDI is estimated at EUR 3.5 billion.”

To be mentioned: Commissioner Corina Cretu warned in the last 2 years that Romania does not access the funds available under the Regional Operational Program 2014-2020, which provides EUR 326 million for the development of health infrastructure and services.

- „Another EUR 3 billion will target the construction of highways and fast railways, with the priority given to highways that cannot be completed or launched with European funds by 2020”.

„There are five highways that meet these criteria, one of which, Pitesti-Craiova, is scheduled to be completed with European funds by 2021. The other four, if not financed from the budget, will be launched with this financing: a highway to cross the mountains between Transylvania and Moldova (Tirgu Mures – Iasi), a second highway through the South of Romania, to connect Transylvania to Oltenia and Tara Romaneasca (Timisoara – Bucharest), a 3rd one to cross the mountains from Prahova Valley (Comarnic – Brasov) and a 4th one to connect Moldova to Tara Romaneasca (Iasi – Bucharest).”

To be mentioned: The European Commission has been asking Romania for 3 years to complete the Transportation Masterplan to be able to access the available funds from the 2014-2020 budget. At the middle of the financial year, the Romanian authorities still get money for projects from the previous financial year.

European funds – we plan from the start to give up 27.5% of EU money

Rovana Plumb is asked to „simplify the forms and documents that must be submitted for accessing the European funds, as well as decrease the waiting times for finding out the result, down to one week or even one day in some cases.”

Rovana Plumb is asked to „simplify the forms and documents that must be submitted for accessing the European funds, as well as decrease the waiting times for finding out the result, down to one week or even one day in some cases.”

„With the future government, we plan to attract over 72.5% of the funds available for the 2014-2020 period. The difference up to 100% will be absorbed in the period 2021-2023. Reaching this level, similar to that achieved in the previous government, will mean that more than 92 billion lei will enter Romania’s economy through investment from the European funds in the next 4 years.”

The problem of those who compiled the data about the European funds is that what happened at the end of the previous European financial year – the two-year extension of the period for completing the projects – was an exception.

And the repeated signals from the European Commission show that those who have not learned their lesson will not benefit from the leniency of that n+ 2 from the previous financial year.

ANAF will also keep records of working population. Including pictures

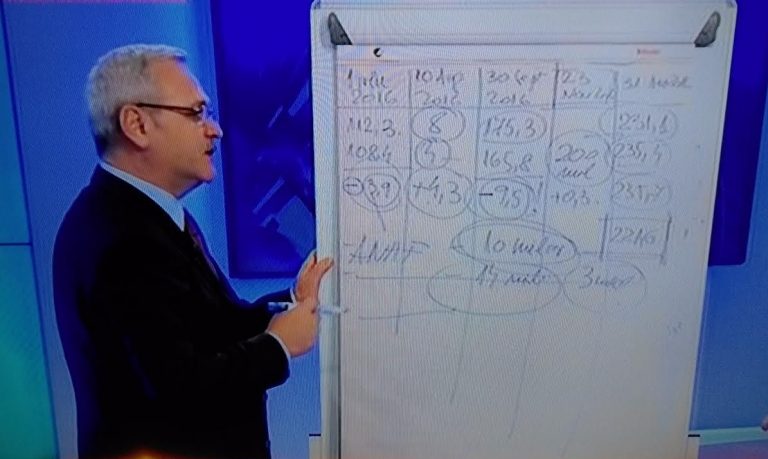

The plans for increasing the efficiency of ANAF’s activity are:

– We propose the introduction of performance contracts for ANAF with quarterly targets and related corrective measures for the slippage from the target set as well as a program to reduce the undeclared work.

– The drastic increase of fines/penalties for evasion and undeclared work.

– Labour inspectors will have the right to stop the activity of firms that use undeclared work. Authorities will make an online database with all employed workers (IDs, photos) in the fields with a high incidence of undeclared work; employers will be forced to update their information with the employment/dismissal of staff and notify the authorities that administer the social contributions. (Deadline 1 January 2018).

To increase tax collection, we will empower ANAF to collect as many taxes as possible, including taxes from AFM, as of 1 January 2018.

Ministry of Economy makes its own Fund

Besides the FSDI, in the first quarter of 2018, at the latest, a National Development Fund (FND) will be established, which will include companies where the state holds shares and which are currently managed by AVAS and state-owned companies that will cannot be included in the FSDI because of the European ban stipulating that in some cases, production and distribution companies cannot be administered by the same entity to avoid the monopoly behaviour.

Besides the FSDI, in the first quarter of 2018, at the latest, a National Development Fund (FND) will be established, which will include companies where the state holds shares and which are currently managed by AVAS and state-owned companies that will cannot be included in the FSDI because of the European ban stipulating that in some cases, production and distribution companies cannot be administered by the same entity to avoid the monopoly behaviour.

Because of these regulations, Transelectrica and Transgaz will be managed and owned by the FND, while Hidroelectrica or Romgaz by the FSDI.

AVAS is eliminated

The companies in precarious financial situations (insolvency, debts, etc.), such as CN Hunedoara, Oltchim SA or CE Oltenia will not be closed. They will enter a reorganization process based on the Hidroelectrica model.

Under the coordination of the Ministry of Economy and Commerce, an Inter-ministerial Committee will be established to improve the efficiency of Romania’s economic representations abroad.