The trade deficit in the first two months of 2017 was EUR 1.259 million, 27% higher than the same period of the previous year, according to the INS data.

The trade deficit in the first two months of 2017 was EUR 1.259 million, 27% higher than the same period of the previous year, according to the INS data.

The exports increased at a good pace (+ 9.2%, to EUR 9,749.9 million), but have been outweighed by the imports that advanced by 10.9%, to 11,008.9 million.

The import coverage ratio by exports still maintained a reasonable level (92.4%, same as at the end of January). That is more than the overall evolution registered in 2015 and 2016, which saves some hopes for a return in the coming months to better trade deficit values.

*

- Evolution of import coverage ratio by exports between 2009-2017

- Year

- Coverage ratio FOB/FOB

- * After two months

*

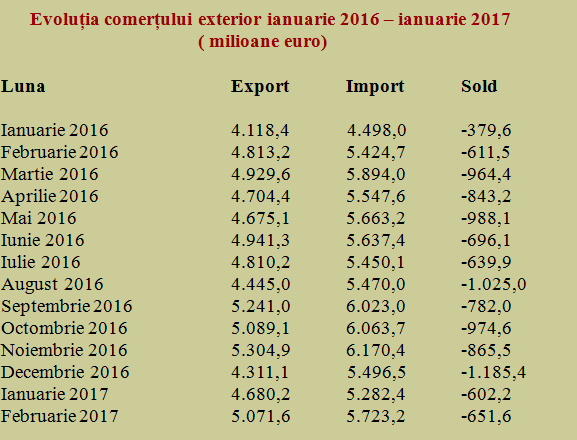

State of play of the foreign trade evolution between January 2016 – February 2017 is as follows:

*

- Development of foreign trade between January 2016 – February 2017 (million euros)

- Month export Import Balance

- January 2016

- February 2016

- March 2016

- April 2016

- May 2016

- June 2016

- July 2016

- August 2016

- September 2016

- October 2016

- November 2016

- December 2016

- January 2017

- February 2017

*

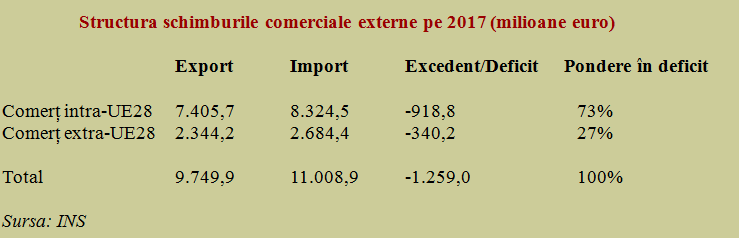

Trade exchanges with the EU countries were nearly seven and a half billion euros in exports (accounting for 76% of total exports) and a little more than EUR 8.3 billion in imports (75.6% of total imports, an increasing share compared to the previous month).

In terms of extra-Community trade, exports amounted to EUR 2.34 billion (24% of total exports) and imports EUR 2.68 billion (24.4% of total imports).

*

- Foreign trade structure in 2017 (million euros)

- Export Import surplus/deficit share of deficit

- Intra-EU 28 trade

- Extra-EU 28 trade

*

To note as an important evolution of Romania’s foreign trade deficit structure, the share of intra-EU trade in the total deficit dropped from about 90% last year to just 73% in the first two months of 2017, while the deficits increased on the extra-Community trade segment, from about 10% last year to 27% in the first six months of this year.

We emphasize that only two years ago, in February 2015, Romania (still) registered surpluses in the extra-Community trade. That suggests the necessity to better adapt the production to the emerging markets and the urgent need to find new markets outside the EU.

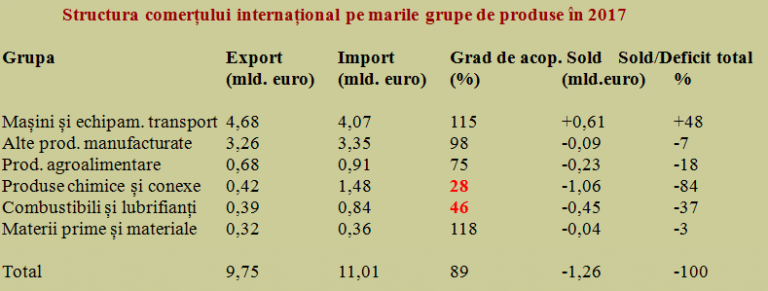

How foreign trade balance appears, by its structure

In terms of structure, Romania obtained a positive sector result only on the segment of machinery and transport equipment (+ EUR 0.31 billion), with trade values close to the segment of other manufactured products. Unfortunately, these results have been annulled and reversed in the chemicals and fuels sectors, where the import coverage ratios by exports reached damage levels (29%, respectively 43%).

*

- Structure of foreign trade by main groups of goods between in 2017

- Group export (bn euro) Import (bn euro) Coverage ratio (%) Balance (bn euro) Balance/total deficit

- Machinery and transport equipment

- Other manufactured products

- Agri-food products

- Chemicals and related products

- Fuels and lubricants

- Raw materials and consumables

- Total

*

Foreign trade of chemicals, a sector affected by the closure of production capacities, have been seriously deficient and generated five-sixths of the total trade deficit. Also, in the fuel and lubricants segment, we have not even covered half of the imports by exports, despite the natural resources at our disposal.

Furthermore, trade ratios have deteriorated compared to the last year in the segment of food, beverages and tobacco products (another group where we should have made use of the advantages of resources), which had only 75% coverage and generated about a fifth of the overall trade deficit.

Altogether, Romanian decision makers should have come up with solutions to reduce the chronic deficits in the petrochemicals segment and remove the bizarre minus registered in the food products segment, rather than provide wage increases from volatile sources. Also, to encourage the development of the industrial production, on the infrastructure side, the segment that supports the national currency, by the amounts of the foreign currency received.