Government debt service for 2019 will surely exceed the 2018 level, according to the projection made by the Ministry of Finance based on the debt already contracted and the exchange rates on 31.03.2018.

It would be RON 53,635.5 million compared to RON 53,580.5 million this year and compared to less than RON 50 billion in 2017.

The level of capital ratios (the amounts to be reimbursed during the year) will increase from RON 42,456.3 million to RON 43,599.0 million, while the money paid on interests and fees related to the debt appears to decrease from RON 11,124.2 million to RON 10,036.5 million (to which, of course, extra amounts will be added in the coming months).

*

- Public debt service – projection on 2016 – 2019

- Year

- Public debt service

- Capital rates

- Interests and fees

- Domestic public debt service

- Capital rates

- Interests and fees

- Foreign public debt service

- Capital rates

- Interests and fees

*

In fact, the projection is made by the Ministry of Finance by 2024, but the amounts presented are even less relevant as the term is farther and it is not known how contracting new loans will evolve, which will be their exact way of structuring between the domestic and foreign market, plus the uncertainties related to the exchange rate (where the National Commission for Strategy and Prognosis sees, arguably, a decline to 4.58 lei/euro by 2024).

It is important to note that in 2017 we benefited from a local minimum in payment obligations in the public debt account and interest and fees rates were maintained below RON 10 billion. Which will not happen again in 2018 and 2019 and will put pressure on public finances.

At the same time, there is a significant increase in interest and fees taking shape after they stagnated in 2017 to 2016 levels.

At the local level, the problem is located at their level, and at the external level, significantly higher capital rates will have to be „rolled over” this year (over 70% higher than in the previous year).

We recall that „rolling over” implies contracting loans equivalent to the outstanding amounts in order to pay them and, basically, moving the repayment term in the future, but at a new market interest, the one valid at the moment when the new loan was contracted.

That is why it would be essential for the payments that Romania will assume for the next years that this interest (which depends on the perception of the capital markets) is as small as possible, anyway below the level applied when we contracted the previous loans, which now must be „rolled over”. Otherwise, the payment burden is likely to increase, even in the absence of an increase in the credit stock (which is not the case today).

- Evolution of public debt according to the EU methodology

- Year

- Total

- GDP

- % of GDP

- * calculated according to the EU methodology, by the ratio between the debt and the last four quarterly GDP values available

*

As we can see in the table, the public debt trend is increasing in absolute terms but decreasing as a share of GDP.

It is important for the increase in the debt stock to maintain well below the economic growth rate in order to offset even the systematic increase (for reasons that are not necessarily imputable to us, but it would not hurt for us to be cautious) of the interest at which we can borrow money from the capital markets.

Interestingly, according to data published by Eurostat for 2017, on the structure of public debt of all EU member states, contrary to the vast majority of tables and graphs that appear regularly, Romania is almost exactly in the middle of the list by the way the debt is structured between residents and non- residents (approximately equal) and is a neighbour in this ranking with the Czech Republic, Germany and France.

*

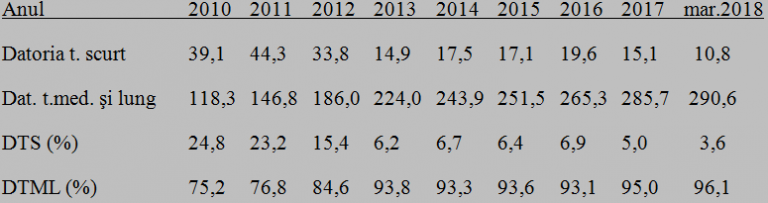

- Year

- Short-term debt

- Long and mid-term debt

- DTS (%)

- DTLM (%)

*

At the same time, the evolution in debt structuring by maturities shows an accentuated increase in the share of medium- and long-term debt.

Which is a good thing for the allocation of the pressure on the budget over time, but at the same time implies a greater responsibility for the decisions taken, with consequences that will manifest for a long time.

*

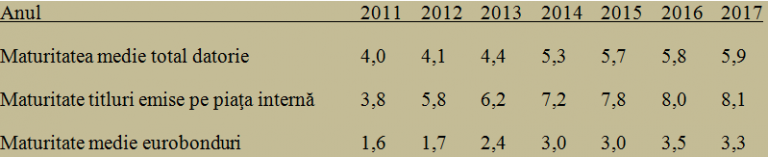

- Year

- Average maturity of total debt

- Maturity of bonds issued in local market

- Average maturity of Eurobonds

*

For now, as we benefited both from the economic growth and an extension of payment deadlines, we have positioned around 1.2% of GDP in recent years, money that we need to have in the budget just for interest and fees on public debt.

But the situation may change relatively quickly, precisely because we will not be able to preserve indefinitely this fast pace of maturities’ increase.

It can already be noticed the capping of the average term of the securities issued on the domestic market and even a slight decrease in the maturity of Eurobonds. That is why we should be very careful with the new loans and especially how we use the money because the price paid later should justify the decision to borrow.