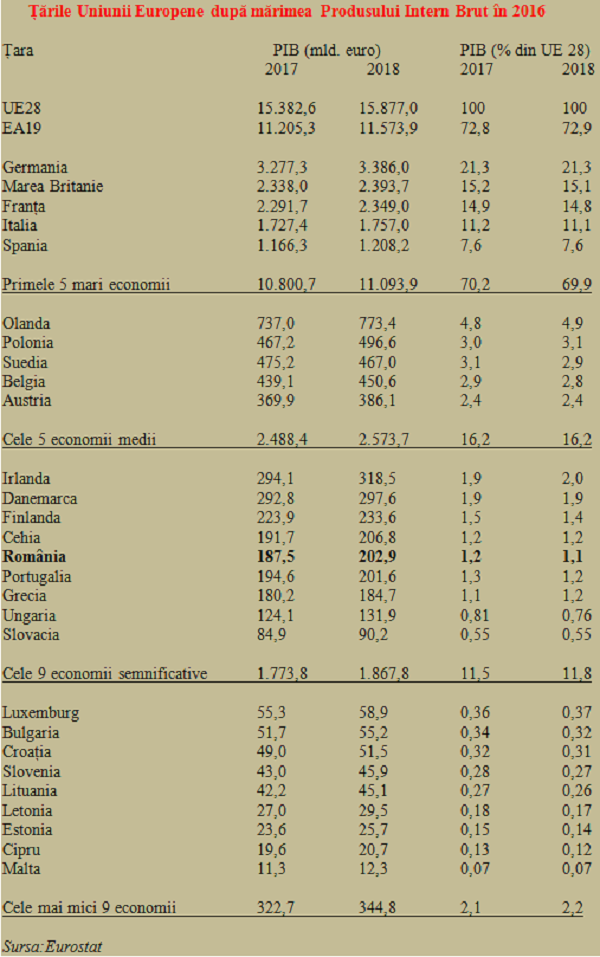

Romania’s economy climbed to 15th position within the European Union, according to data published by Eurostat on 2018 related to GDP expressed in euro (nominal values).

Romania’s economy climbed to 15th position within the European Union, according to data published by Eurostat on 2018 related to GDP expressed in euro (nominal values).

After outpacing Greece in 2017, last year, we also surpassed another economy from the southern part of the continent, Portugal (10.6 million inhabitants), after we exceeded the threshold of EUR 200 billion.

To be noted, our advance expressed in EUR was of 10.8% last year, compared to only 4.1%, the growth in real terms. Which amplified the effect of income increases in RON (+ 30% nominal in Q4 2018 versus Q4 2017) and led to a significant increase in the purchasing power expressed in euro. The direct consequence was the expansion of external deficits and the induction of imbalances in the economy.

Hence there was a correction risk on the GDP value expressed in the single currency based on the evolution of euro/RON exchange rate (which has already moved upwards by more than two percentage points since the beginning of the current year). Which might send us back to the 16th position by the way in which we shall perform compared to Portugal (the latter has the advantage of not having any loss from the exchange rate).

If we look at the Czech Republic, a country with a similar currency regime to ours, the distance between economic results has maintained in 2018 at around four billion euros, although their economic growth was by slightly more than one percentage point below what was estimated for us (3% compared to 4.1%). Based on the current evolution of euro/RON rate, the distance may increase, although we previously seemed to be catching up rapidly (in 2015, the Czech Republic had a GDP of EUR 168.5 billion and Romania EUR 160.3 billion, which means the gap was double).

EU economies’ positioning

In order to get a correct picture of our country from the perspective of the economic power in the EU context, we summarize the shares held by European countries in the EU’s GDP expressed in euro, according to the latest data available (see the table).

At EU level, we can note a strong concentration of the economic power, although the share held by the five largest countries has just dropped below 70% of total GDP.

Germany exceeds one-fifth of the Union’s result and overpasses the UK by more than six percentage points, in terms of EU GDP share (the UK having the GDP expressed in euro significantly influenced by the pound sterling exchange rate) and, very close to islanders is France.

Much behind them, Italy and Spain together do not reach, even by far, the German outcome, but they are the only ones exceeding the threshold of EUR 1,000 billion.

Euroland has a larger share in the EU than the five big economies, namely 72.9%, and sets the overall tone of growth.

74.6% of the GDP growth at the EU level (that is, slightly above the benchmark share) was achieved in the Eurozone (EUR 368.6 billion at a total increase of EUR 494.4 billion last year).

*

- EU countries by GDP dimension in 2016

- Country GDP (billion euro) GDP (% of EU 28)

- EU28

- EA19

- Germany

- UK

- France

- Italy

- Spain

- First five largest economies

- The Netherlands

- Poland

- Sweden

- Belgium

- Austria

- The five average economies

- Ireland

- Denmark

- Finland

- Czech Republic

- Romania

- Portugal

- Greece

- Hungary

- Slovakia

- The nine significant economies

- Luxembourg

- Bulgaria

- Croatia

- Slovenia

- Lithuania

- Latvia

- Estonia

- Cyprus

- Malta

- The nine smallest economies

*

Next, there are five countries that have GDP values above 2% of the EU’s total GDP and almost one-sixth of the economic result.

All of these five countries mean just a little more than the UK or France as a share at the EU level. The Netherlands (EUR 773.4 billion) and Austria (EUR 386.1 billion) demarcate this platoon of medium-sized economies.

It is worth noting the revelation of this group, Poland, which has already climbed to the 7th position. With a GDP about two and a half times bigger than ours (for a population that is double compared to Romania), it outpaced Belgium at the beginning of this decade and last year surpassed Sweden.

However, if we look at the statistical data series, we should note the conjunctural rebound that Polish GDP registered in euro in 2016 (from EUR430 billion in 2015 to just EUR 426.5 billion), a situation to which we should pay attention.

Romania is in the middle of the platoon comprising the nine countries which we have called significant as they represent more than 0.5% of the EU’s GDP.

The only country that we can still surpass in the medium term is the Czech Republic (that is why we could consider it as a reference) and, in the long run, Finland, whose evolution has been somewhat insignificant in recent years.

Finally, there are also the nine countries remained below 0.5% of the EU’s GDP. They represent altogether about 90% of Austria’s level and thus being less significant for the overall results. Also as a reference, Bulgaria and Croatia, plus the three Baltic states, are barely able to represent slightly more than Romania’s economy, as much as it is.