Relatively recently joined the functional market economies club, although it has multiple pending development (not just economic) issues, Romania looked around and chose a poisonous mix of reduced incomes in terms of GDP share, specific to the Anglo-Saxon area, and expenditures that tend to grow on the European model. Having resulted in recent years in deficits also expanded toward the American model, with the only mention that RON is not a dollar.

Relatively recently joined the functional market economies club, although it has multiple pending development (not just economic) issues, Romania looked around and chose a poisonous mix of reduced incomes in terms of GDP share, specific to the Anglo-Saxon area, and expenditures that tend to grow on the European model. Having resulted in recent years in deficits also expanded toward the American model, with the only mention that RON is not a dollar.

Eurostat data shows very clearly that relatively small, „American” type of taxation and relatively large expenditure, on the „European” model, cannot go hand in hand. The combination does not work because the state budget is heading to an economic slippage even under conditions of sustained growth, as Romania has managed to obtain in recent years.

We recall that the 3% of GDP deficit threshold set by the Maastricht criteria must be understood in accordance with its spirit and not just its letter. That is, it has been set as a precautionary measure in the economic crisis, not sustained growth situations. When formal compliance with it ensures nothing but the collapse of public finances at the first sign of an economic slowdown.

Proportions of an economic model

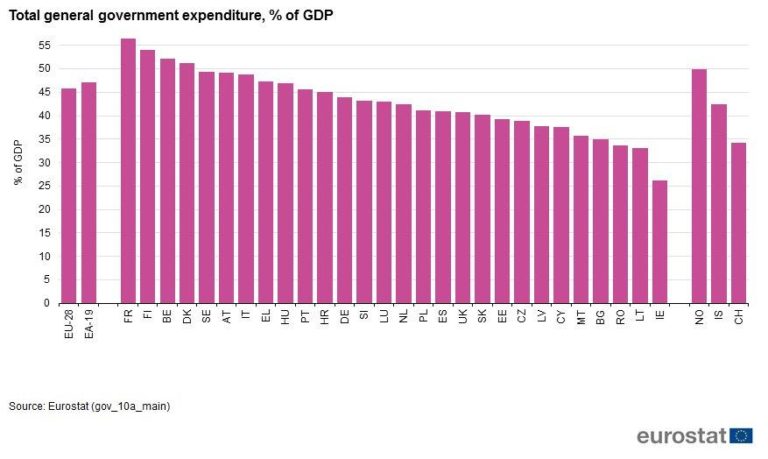

Now let’s say that we are going from the reality of a budget placed both in terms of inflows and financial outflows far below the EU average for reasons of economic development level, a statement confirmed by the position of former Eastern bloc countries also below the EU average which is pulled up by Western countries (but with us ending up at the bottom of the list of new EU members).

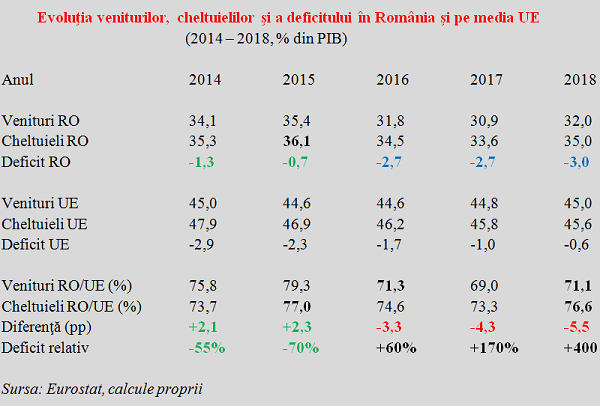

At least then, on the path of convergence with European usages, we should have maintained the more important achievement of a percentage more consistent with the de facto integration target between countries highly performing in terms of revenue rather than the expenditure. Which it did happen after the ending of the economic crisis in 2014 and 2015 and brought us in terms of balancing the budget even at a budget below one-third of the EU level.

*

- Evolution of revenues, expenditure, and deficit in Romania and the EU average

- Year

- RO revenue

- RO expenditure

- RO deficit

- EU revenue

- EU expenditure

- EU deficit

- RO/EU revenue (%)

- RO/EU expenditure (%)

- Change (pp)

- Relative deficit

*

As of 2016, a premature celebration of success followed, and an obvious rupture in the fundamental economic data of the budget, on the principle of “Snow White story with the seven dwarves, four big and four small”. As everyone enjoys fairy tales, especially adults having (only) everyday worries, a major development mismatch with the evolutions in the EU and our region has been obtained.

On the path of returning closer to the reality of belonging to the single market, the gap between revenues and expenditure relative to the EU’s updated requirements has further increased. In fact, Romania started in 2018 to make the maximum spending as a share of GDP reached in 2015, while having budget revenues (suddenly and pointlessly) reduced starting 2016, both flows as compared to the EU average of those years.

This resulted in a budget deficit increase more than four times in terms of GDP share, from 0.7% to 3.0%, with low hopes of returning to the balanced area where our neighbour country and EU accession wave colleague Bulgaria, or our pretended economic model (by size and structure) is placed or Poland (which, what a coincidence! generates the biggest trade deficit for us in bilateral exchanges).

With taxation down, although expenditure should go up

If you only refer to the amounts collected to the budget from taxes and social contributions (excluding the amounts that are unlikely to be collected anymore, as required by Eurostat methodology), in order to see how we stand on the taxation side, without having many years listed, we see how taxation has deteriorated in ten years of EU membership.

*

- Year

- RO revenues

- EU revenues

- RO/EU ratio

*

However, expenditure will inevitably increase toward the EU average, precisely because we are at the bottom of the list in Europe (with 60% of what would be a decent allocation of euro to both health sector, 4.3% of GDP compared to the EU average of 7% and education, with 2.8% compared to 4.6% of GDP) and, moreover, there are many electoral rounds to come, with potential offers for the future (with 11.7% of GDP, social protection was in 2017, according to Eurostat, also at around 60% of the EU average).

In this context, because RON is not a dollar, no one is fighting for our national currency. Far from being an international reserve currency, we cannot afford to have US deficits (the US had a deficit of 3.8% of GDP in 2018 and 5.1% of GDP in the fiscal year 2019, according to us.governmentdebt.us), nor to expect a miraculous attitude change in terms of revenue collection.

Therefore, it is necessary to quickly find a solution of fiscal adequacy but (if we want to continue our development) without suffocating the business environment with unexpected bizarre taxes.

The first step would be to recover the eight percentage points lost between 2015 and 2018 in revenues relative to the EU average (to be read the return to 36% of GDP or 80% of the EU average). Or, maybe we can improve the collection rate?