2017 was an exceptional year for Romanian companies system in terms of profitability and registered a general margin of 8%.

Statistics also show that the profitability margin of foreign-owned companies is close to half the margin declared by domestic companies (3.7% versus 6.7%, the net profit margin in 2017).

When it comes to productivity, statistics are not in favour of the local capital – RON 250,000/employee/year, compared to RON 550,000/employee/year.

Paradoxically, although Romanian firms have become more profitable, the corporate tax decreases as a share of GDP, so the state is less and less reliant on corporate tax revenues.

These data are included in Romanian Private capital study, an analysis prepared by Ziarul Financiar with PIAROM support, which reached its fourth edition.

Profit, profitability, depending on capital nature

According to aggregate data from the ZF/Piarom survey, the 500,000 companies with a turnover different from zero had a turnover of RON 1.359 billion in 2017 and a total net profit of RON 102 billion.

The rising profitability trend in 2017 is due to both an increasing consumption and labour productivity growth, as a result of turnover growth faster than wages.

Romanian business had an exceptional year, as 2017 was the eighth consecutive year of economic growth. The whole system of active companies in Romania produced a positive net result (profit) of RON 72 billion, or EUR 15 billion.

*

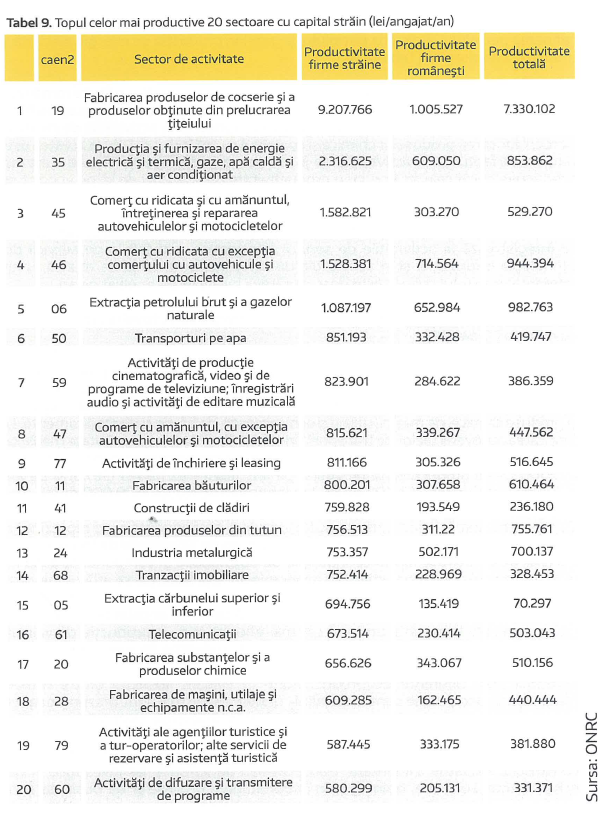

- Chart 3

- Evolution of Romanian private companies’ profit and profitability between 2014 – 2017 (billion RON)

- Net profit, Romanian companies (billion RON) Net losses, Romanian companies (billion RON) Net result Romanian companies (billion RON) Profitability, Romanian companies

*

The difference in terms of profit margin between companies with Romanian private capital and companies with foreign private capital maintained constant in 2017 compared to 2016.

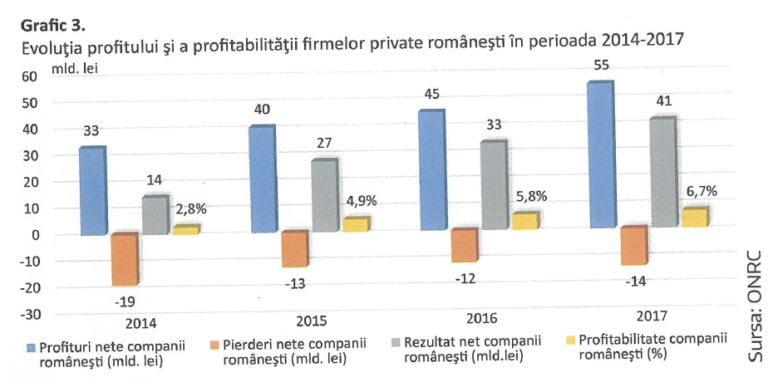

Important mention: During the entire 2014-2017 period (as analysed in the study), foreign companies were either making losses or having a profit margin 2-3 times lower than Romanian firms.

*

- Evolution of foreign private companies’ profit and profitability between 2014 – 2017(billion RON)

- Net profit, foreign companies (billion RON) Net losses, foreign companies (billion RON) Net result, foreign companies (billion RON) Profitability, foreign companies

*

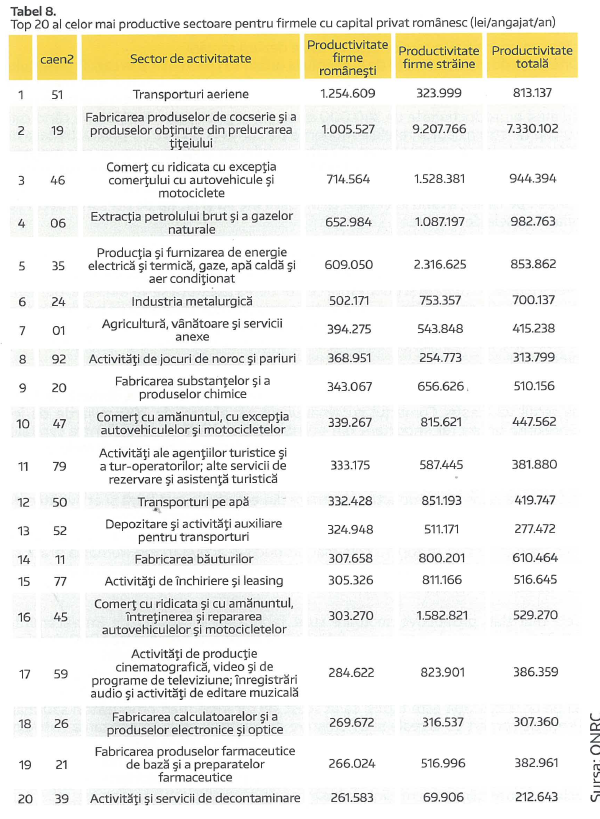

Productivity, contrary to profitability

Aggregated data shows that the productivity of both domestic and foreign capital companies increased by 9% in 2017 compared to 2016. 26 sectors in the Romanian economy report productivity above the average of RON 336,000 /employee/year obtained at the level of the whole economy and the most productive sectors are oil refining, oil and gas extraction, and wholesale trade.

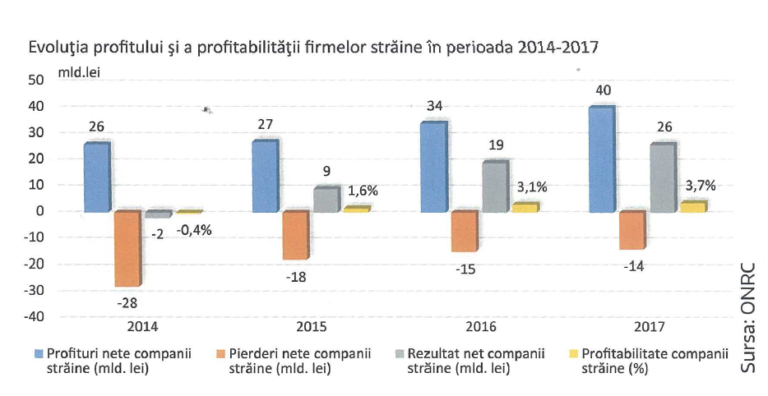

- Chart 8

- Top 20 most productive sectors for Romanian owned companies RON/employee/year

- Air transportation

- Manufacture of coke and refined petroleum products

- Wholesale trade, except motor vehicles and motorcycles

- Crude oil and natural gas extraction

- Electricity, gas, steam and air conditioning supply

- Metallurgical industry

- Agriculture, hunting and related services

- Gambling and betting activities

- Manufacturing of chemical substances and products

- Retail trade, except motor vehicles and motorcycles

- Travel agency, tour operator and other reservation service and related activities

- Water transport

- Warehousing and support activities for transportation

- Manufacture of beverages

- Renting and leasing activities

- Wholesale and retail trade and repair of motor vehicles and motorcycles

- Motion picture, video and television programme production, sound recording and music publishing activities

- Manufacture of computer, electronic and optical products

- Manufacture of basic pharmaceutical products and pharmaceutical preparations

- Remediation activities and services

*

Air transportation, oil refining and wholesale trade remained the most productive sectors with Romanian private capital in the period 2014-2017, in the context that the average productivity of private companies in Romania increased by 16% during this period.

At the level of the whole economy, the ratio between the productivity of Romanian and foreign-owned companies was 1 to 2, or higher, between 2014 and 2017.

*

- Chart 9

- Top 20 most productive sectors for foreign-owned companies RON/employee/year

- Sector Productivity of foreign-owned companies Productivity of Romanian owned companies Total productivity

- Manufacture of coke and refined petroleum products

- Electricity, gas, steam and air conditioning supply

- Wholesale and retail trade and repair of motor vehicles and motorcycles

- Wholesale trade, except motor vehicles and motorcycles

- Crude oil and natural gas extraction

- Water transport

- Motion picture, video and television programme production, sound recording and music publishing activities

- Retail trade, except motor vehicles and motorcycles

- Renting and leasing activities

- Manufacture of beverages

- Construction of buildings

- Manufacture of tobacco products

- Metallurgical industry

- Real estate transactions

- Coal mining

- Telecommunications

- Manufacturing of chemical substances and products

- Manufacture of machinery and equipment

- Travel agency, tour operator and other reservation service and related activities

- Programs production and broadcasting activities

*

*

*