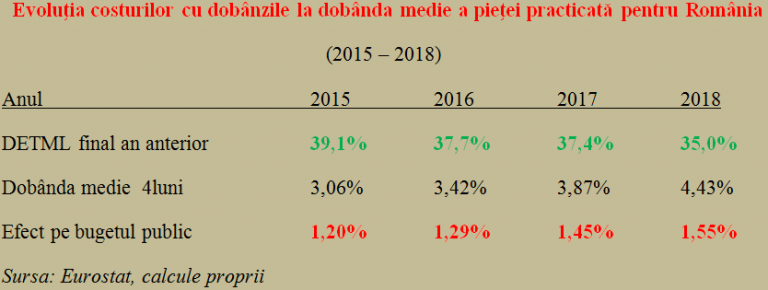

Although medium- and long-term foreign debt (DETML) has declined steadily over the last four years related to GDP, the amount paid for this debt has continued to increase, including as a percentage of GDP.

The budget effort for the first four months of 2018 was RON 1.8 billion (or 56%) higher than in the first four months of 2017.

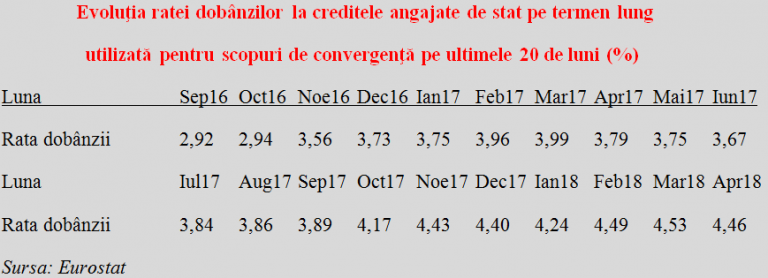

The average interest rate on long-term government loans used for convergence purposes in the first four months of 2018 rose to 4.43%/year, while it was 3.87% in the first four months of 2017, a significantly lower value.

We remind that, for the most part, loans already contracted are not effectively paid but “rolled”, which means new loans with an equivalent value are contracted. But this is done at the market rate valid at that time, and interest will continue to be paid. That means a different interest is paid for the same amount borrowed.

Of course, not the entire foreign debt stock has to be „updated” with the related interest, but the intersection between the debt share of GDP with the average interest rate over a period of time long enough to provide a solid picture of the situation, offers the possibility to draw pertinent conclusions regarding the opportunity decisions in contracting new debts.

*

- Evolution of interest costs for the average market interest in Romania

- Year

- DETML, end of the previous year

- Average interest – 4 months

- Effect on public budget

*

Two years ago we benefited from relatively low interest rates at which we could extend the maturity of already contracted loans or take additional loans.

The only country for which interest rates are rising

Here’s what the evolution of the interest rate on long-term government loans used for convergence purposes shows over the last 20 months:

*

- Evolution of interest rate on long-term government loans used for convergence purposes, over the last 20 months

- Month Sep16 Oct16 Nov16 Dec16 Jan17 Feb17 Mar17 Apr17 May17 Jun17

- Interest rate

- Month

- Interest rate

*

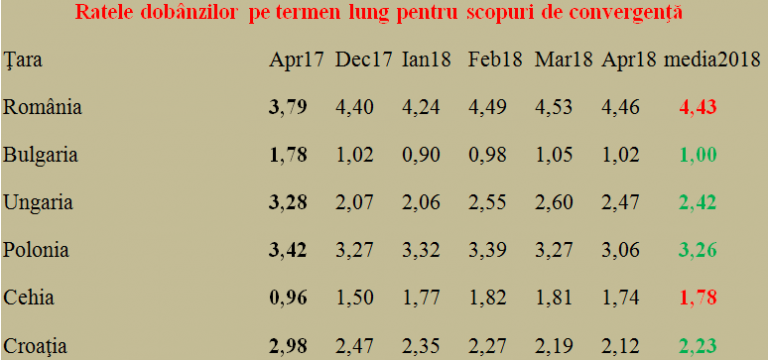

Unfortunately, we are the only country in the former Socialist bloc that has joined the EU where the situation has worsened compared to April 2017, with the exception of the Czech Republic (which at that time benefited from an exceptional interest rate of less than one percentage point and still has the lowest value, except for Bulgaria, which has the currency indexed to the euro).

*

- Interest rates on long term for convergence purposes

- Country Apr17 Dec17 Jan18 Feb18 Mar18 Apr18 2018 average

*

In fact, the Czech Republic has made an even more drastic adjustment than us on the public debt share of GDP, from 42.2% in 2014 to 34.6% in 2017, that is, from a value above ours to a level slightly below us, even though, in the terms presented above, it would pay interest of only 0.61% of GDP.

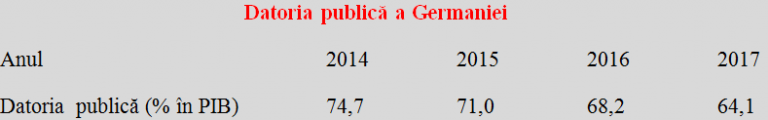

In order to clarify where the inspiration came from, we present how Germany’s foreign debt evolution shows from 2014 onwards, according to official Eurostat data:

*

- Germany’s public debt

- Year

- Public debt (% of GDP)

*

This is to say that the average interest rate on amounts borrowed by the German state was much more advantageous than in the states presented above. Starting from just 0.22% in April 2017, it rose to 0.54% as an average of the first four months of 2018. Moreover, the target of meeting the 60% threshold imposed at Maastricht seems quite clear.

Even countries that could have afforded debt increases as a share of GDP (against a declining trend in interest rates) did not venture into this possibility. Not only those that were above 60%, such as Croatia (from 84% in 2014 to 78% in 2017) or Hungary (from 76.6% to 73.6%) but even the Bulgarian neighbours (from 27.0% to 25.4%). The marginal exception is Poland (which started from 50.3% in 2014 went up to 54.2% in 2016 but then adjusted to 50.6% in 2017).

Therefore, given the developments in international markets, in order to limit a significant increase in interest payment obligations, we should somewhat pay more attention to countries from the region and to those that set the tone in the EU. That is, we should focus more on European non-reimbursable funds and maintain the trend of adjusting the share of foreign debt in GDP.