The progress in the development of Romanian infrastructure networks of utilities and roads is too slow compared to the needs and our neighbours’ progress, as shown only by the maps of these networks and cross-border interconnections.

The progress in the development of Romanian infrastructure networks of utilities and roads is too slow compared to the needs and our neighbours’ progress, as shown only by the maps of these networks and cross-border interconnections.

Major projects of gas pipelines have been delayed, and the completion of the 400 kV ring of electricity transmission lines is delayed. As for highways, delays and prevarications have become a commonplace.

Gas hub illusion

Romania is about to lose the few chances it had to become a regional centre for natural gas distribution and trading, after the completion of Phase 1 of the Romanian sector of the pan-European gas pipeline from Bulgaria to Austria (BRUA) has been postponed until the end of this year.

*

- New regional gas pipelines

- Turkstream – operational

- Transanatolian – operational

- TransAdriatic –to be completed

- BRUA – in Romania to be completed in 2020

- IoanianAdriatic – design phase

- Est Med – agreement signed

- Volumes in billions cubic meters

- Ukraine – capacity of

- Hungary – capacity of

- Republic of Moldova – capacity of

- Bulgaria – capacity of

*

In the meantime, natural gas has started flowing from the Caspian Sea via the transnational gas pipeline (TANAP) to Bulgaria and will reach Italy via the transadriatic pipeline (TAP), as will Russian gas distributed through TurkStream.

In this context, the major negative differences in terms of volumes that BRUA registers compared to the other gas pipelines are relevant: at most 4.4 billion cubic meters through BRUA Phase2, compared to 30 billion through TurkStream and 10 billion cubic meters through TAP.

And for now, plans of the Romanian system operator Transgaz (TGN) for the next few years only provide for an increase of about 3 billion cubic meters, rather without Romanian deposits in the Black Sea. The pipeline for sampling them would be ready by 2021, two years later.

Of the total major investments of over EUR 1.9 billion proposed for the period 2013 – 2023, Transgaz completed only 144 million, with the broad backing of the governments that left it without its own financing by imposing the transfer of almost all profit to dividends.

Gaps in electric buses infrastructure

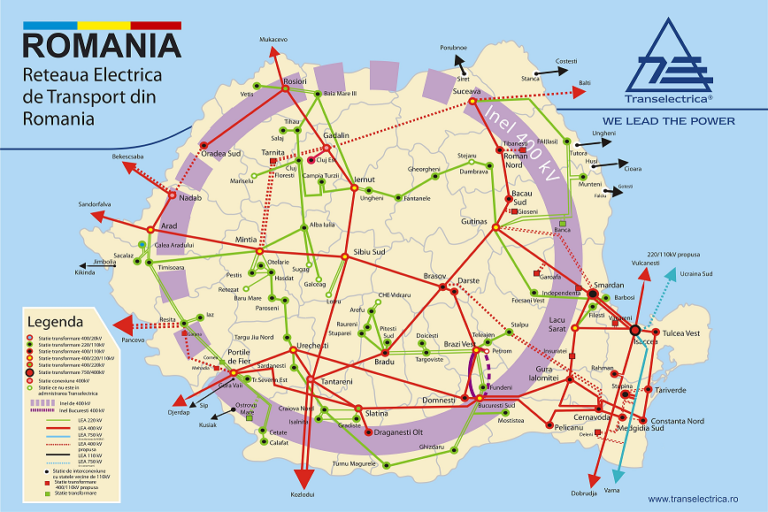

The large transport infrastructure of the national energy system (SEN) would not meet the import needs according to the pessimistic but realistic scenario in which large coal-fired power producers will not be able to ensure the gas transition in time, according to a study by Transelectrica system operator (TEL).

*

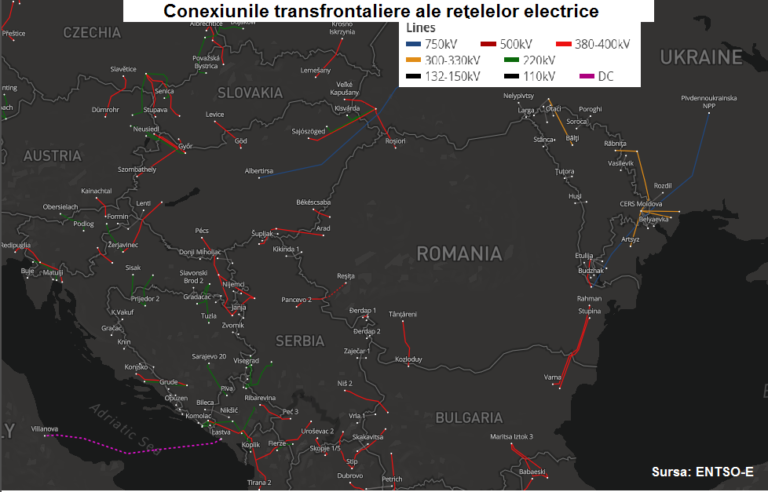

- Cross border connexions of electric grids

*

In the region, Romania is not much worse than Hungary in terms of cross-border interconnections. However, Romania’s economy is 50% larger than Hungary, but both have just as many 400 kV cross-border interconnections.

Romania still has to cover large segments of the 400 kV ring, which follows the contour of the country.

*

- Romania

- Romanian electricity transport grid

*

Like Transgaz (TGN), Transelectrica suffered from the same policy of profit stealing through dividends for covering the holes governments made in the budget.

One single external connection on the highway

Romania is only connected to Hungary through a highway and through in point only, but things are even worse inside.

*

- Romania, neighbours and highways

*

No highway crosses the Carpathians, which have become a barrier to the unitary development of the country.

For compliance, it is worth repeating that not even the pressure from large car manufacturers Renault and Ford has been compelling enough for Romanian governments.

There are no highways crossing to the rest of Europe to facilitate the exports of car factories from Pitesti and Craiova.