Analysts’ scenarios on the evolution of the exchange rate are rather prudent for the coming months, but severe for the beginning of the next year and later when the RON/euro rate could even reach 4.85.

Analysts’ scenarios on the evolution of the exchange rate are rather prudent for the coming months, but severe for the beginning of the next year and later when the RON/euro rate could even reach 4.85.

Erste & BCR counts on an estimate of 4.77 RON/euro at the end of the year. Banca Transilvania (BT) expects though an average of 4.79 in 2019, which means an exchange rate of 4.80 at the end of the year.

Moreover, according to BT, the average rate for 2020 is 4.84 RON/euro, which means higher maximum levels over the course of the year.

The average of the expectations of over 200 members of the analysts’ association CFA Romania also reaches a rate of almost 4.85 RON/euro over the next 12 months.

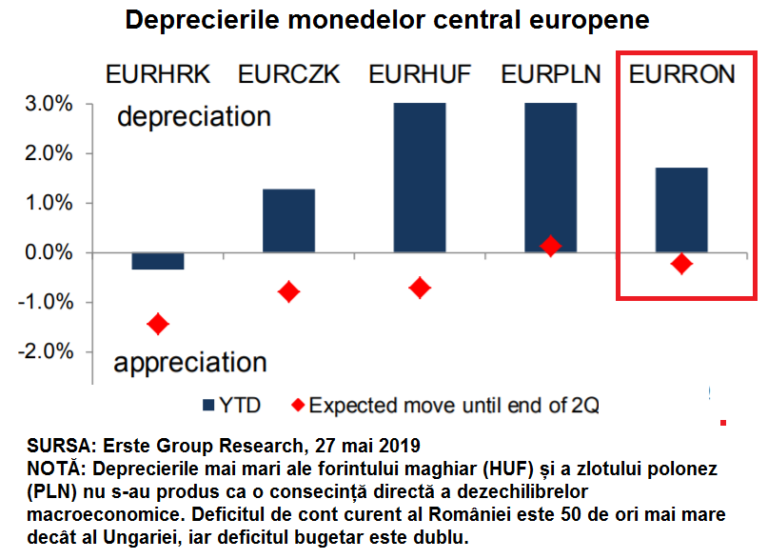

So far, BNR’s conservative currency exchange rate policy has prevented RON from a depreciation with the imbalances, which does not seem to have happened anywhere else in the Central and Eastern Europe.

*

- Depreciation of local currencies in Central Europe

- Note: higher depreciation of the Hungarian forint (HUF) and Polish zloty (PLN) have not occurred as a direct consequence of macroeconomic unbalances. Romania’s current account deficit is 50 times higher than Hungary while the budget deficit is double.

*

Analysts’ independent estimates set a depreciation of down to 4.85 RON/euro next year and some of them, more severe, insist on a foreseeable threshold of 5 RON/euro if external shocks will arise because of the recrudescence of the trade war between large powers.

Big discharging of Romania’s imbalances

The fact that Romania’s largest bank (by assets) expects a jump from 4.79 to 4.84 RON/euro in the average annual rate in 2020 compared to 2019 implies the hypothesis that RON depreciation will be carefully controlled by the central bank this year.

Despite the amplifying imbalances in Romania’s accounts, the political and electoral context of a year considered „errant” by the governor of the central bank will count more in the BT scenario. The electoral year continues with the presidential election, probably in November.

However, analysts expect a gradual depreciation even this year, due to the pressure of the budget deficit, of which (unofficially) a few people still doubt that it will not exceed 3% and especially the record trade deficit (probably over 7% of GDP in 2019) and the pressure of the unsustainable current account deficit (4.8% of GDP, according to estimates of the banking sector).

„One of the valves for offsetting (budget and current account) imbalances is the exchange rate and I will be surprised if that is not used, within an evolution not necessarily drastic even this year, in the coming months. The exchange rate could reach 4.80 RON/euro and even slightly above this threshold,” said Claudiu Cazacu, research director of XTB Romania investment house for cursdeguvernare.ro.

What will BNR do?

Analysts still expect, officially, that the National Bank of Romania (BNR) does not increase the monetary policy rate, rather taking into account the same electoral context.

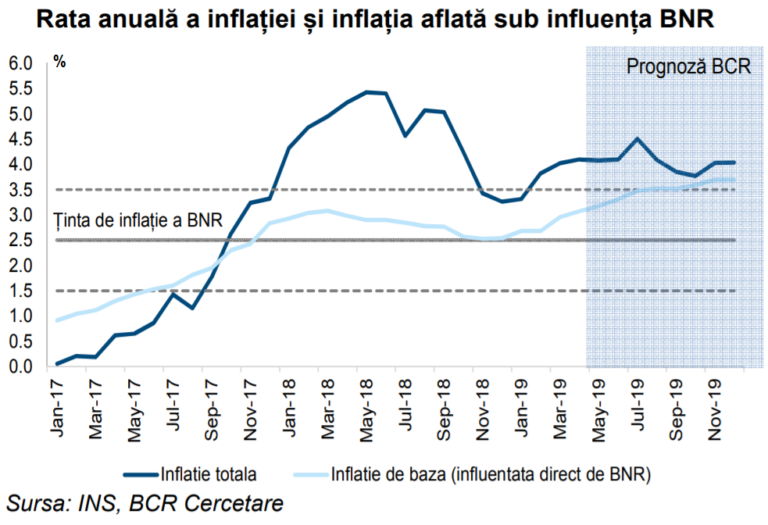

However, April’s inflation rebound (4.11%) has already made the BNR rise end-of-year expectations to 4.2%, and it might consider that it can no longer postpone the increase of interest rate for next year if inflationary pressures increase.

Annual inflation rate and inflation that is under BNR’s influence

However, BCR analysts Dorina Ilasco and Eugen Sinca have hypothesized that „BNR could change the monetary policy rate no sooner than in August,” according to May monthly report of the bank.

Because markets are more on vacation, there are conditions for the relative stability in recent months to maintain at least for the next two months, but inflation related risks, especially those linked to food products prices, will need to be carefully monitored.”

However, if inflation continues to be „significantly above 4%, we should expect increased volatility in both interest rates and exchange rates,” said analysts quoted in BCR’s monthly report from May.

BNR can continue the policy of attracting excess RON liquidity from the money market (which could transfer to euro). BNR Governor Mugur Isarescu even said that the central bank will diversify its „money market intervention instruments to react more quickly”.

„A more severe control of the liquidity is possible to, but it will not exceed the 3.5% threshold in terms of interest” and not for more than two months – Mugur Isarescu said at the middle of May without mentioning though since when.

The BNR has so far attracted the excess liquidity at the monetary policy rate of 2.5%. Lombard last-resort credit facility rate for banks is 3.5% and analysts’ speculation can start from here on.

A variable difficult to introduce into the equation is the potential change in the BNR management, as most of it is at the end of the mandate, but it is unclear how likely that is in the autumn, according to the chart.

Unlikely alternatives

Romania has a clear bill for currency payments. Instead, alternatives to depreciation are uncertain and unlikely this year.

„Capital inflows to Romania should be consistent and who would believe that huge European funds will be attracted in such a short timeframe?! And foreign investments, yes, would be a solution, but this is doubtful, because the economic cycle reached maturity, and global trade relations are rather getting even tenser,” said Claudiu Cazacu.

Nor other options are applicable in the short term and even they were likely, such as capital inflows through public-private partnerships, much desired by the Government. „In reality, though, successful examples of such projects are limited,” says Horia Braun Erdei, Chief Economist of BCR.

„And budget constraints for a significant increase in public investment are too high for us to be able to hope for full compensation of an adjustment in the increase of consumption and exports,” the economist added.

Political competition far from reality

Before the next electoral competitions, „unfortunately, the same as in 2008, Romania does not afford too many incentives for the economy, either on a fiscal or a monetary level.”

„On the contrary, a sincere and useful competition for the society should involve topics related to the management of the adjustment of current imbalances:

- which would be the mix between the monetary and the fiscal part;

- how much to rely on the exchange rate and how much on interest rates within the monetary instruments;

- what expenses should be prioritized and where the cut is possible,

- what taxes should be increased and for how long – within the fiscal instruments”, proposes Horia Braun.

The BCR chief economist admits, though: „Of course I am not so naive to believe that such topics with rather negative connotations would have even little chances to get visibility in the debates and electoral programs.”