Romania is clearly distinguishing itself within the EU in terms of current account deficit evolution, with the second highest current account deficit in 2017 and a steady upward trend since 2014, according to data updated by Eurostat in mid-January 2019.

Romania is clearly distinguishing itself within the EU in terms of current account deficit evolution, with the second highest current account deficit in 2017 and a steady upward trend since 2014, according to data updated by Eurostat in mid-January 2019.

Under these circumstances, the problem that arises is about the reasons we have to be different than countries from our region and our development league that we are completely in the opposite direction. Both to them and big European economies. Moreover, we afford to go out of the balancing zone strongly recommended through the scoreboard with 14 macroeconomic stability indicators monitored at the EU level.

Perhaps we could have accepted a temporary deficit if the money would have gone to „schools, hospitals and roads”, but it is not the case, the money went and will go even more steadily on consumption. That will put pressure on the EUR/RON exchange rate in a free market that quotes including the capacity of a country to make useful decisions for the economic environment.

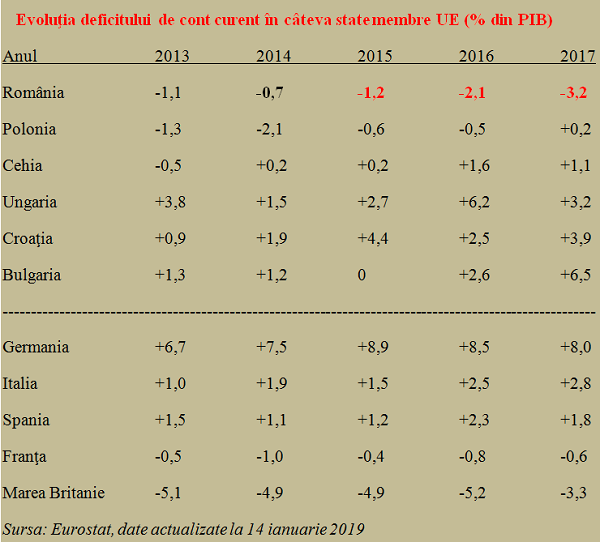

To see how we position ourselves relative to other member states, we present the following table:

*

- Evolution of current account deficit in some EU member states

- Year

- Romania

- Poland

- The Czech Republic

- Hungary

- Croatia

- Bulgaria

- —

- Germany

- Italy

- Spain

- France

- UK

*

Methodological note

The current account deficit refers to the situation of a country in which the value of goods and services imported exceeds the value of goods and services exported, after cumulating, on both flows, with the inflows and outflows from „primary” incomes (labour revenues, revenues from investment in financial assets – direct investment, portfolio and other investments – and other primary income – taxes, subsidies) and „secondary” revenues (private current transfers and transfers of public administration. Basically, it is about the money result of foreign transactions.

Remarks:

- Getting out of the crisis in 2014 and returning to the level of the economy from 2008 was made simultaneously with the decrease in the current account deficit to only -0.7%, which placed Romania among the states from the former eastern bloc. Unfortunately, the advance obtained on the way of recommendations for financial balancing compared to other states was wasted later.

- The systematic deterioration of the current account balance took place in counter-current compared to ALL ex-socialist states presented in the table that joined the EU. They have all reached the positive range in 2017, with values ranging from + 0.2% of GDP in Poland, the closest economy to us by structure and size, and + 6.5% in Bulgaria, which has expressed its intention to adopt the European single currency as soon as possible.

- According to official data published after first 11 months of 2018, Romania’s current account deficit has already reached -4.3% of GDP, which means that the negative trend is to be maintained in the last year and the most likely value at the year-end is somewhere around -4.7% – 4.8% of GDP.

- Even though they do not have the economic strength and competitiveness of Germany (which went out by the upper end of the balancing zone recommended (-4% – + 6% of GDP) for the current account deficit, the other big economies of the EU, excepting the UK, had surpluses or less significant deficits (despite the Latin socio-cultural model, see Italy, Spain and France).

- Otherwise, even the UK has taken measures to curb the current account deficit, especially after the pound has declined over the last three years from EUR 1.37 to EUR 1.13. Or, unlike us, the British still have in their balance of payments a financial account and a capital account that are able to mitigate the effect of the current account deficit.