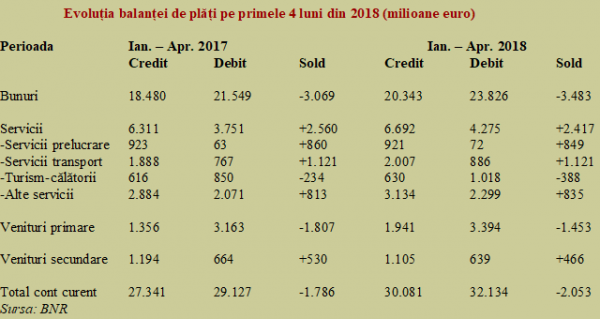

The current account of the balance of payments registered a deficit of EUR 2,053 million in the first four months of this year, about 15% over the same period of the previous year.

The current account of the balance of payments registered a deficit of EUR 2,053 million in the first four months of this year, about 15% over the same period of the previous year.

The percentage was in decline compared to previous months, after the decrease in the growth rate of goods segment to just 14%, significantly below the values recorded in the previous months.

Unfortunately, the additional contribution by the service segment fell by 5% in the first third of 2018 compared to the first third of 2017, to just EUR 2.417 million, which is why it managed to cover only less than 70% of those -3.483 million recorded on the goods side.

The positive balance of transport services remained at the same level (EUR +1,121 million), while the contribution made by services of processing goods owned by third parties decreased marginally (EUR 849 million compared to EUR 860 million).

Against the background of slightly rising receipts and a significant increase in payments (+ 2% on credit versus + 20% on debit, during the first four months of the year compared to the same period in 2017), the chronic negative balance in tourism increased by 66% compared to the previous year, from EUR -234 million to EUR -388 million.

The deficit recorded by primary income at the beginning of the last year (from work, direct, portfolio investment or other investment, and other primary income such as taxes or subsidies) decreased by more than 20% (from EUR-1.807 million to only EUR -1.453 million) but the trend is not favourable (the decline was -40% at the end of the previous month).

On the secondary earnings segment, where we find the amounts transferred by those working abroad, the positive balance dropped by 12%. Both the amounts sent to the country (from EUR 1,194 million to EUR 1,105 million) and those that went out of the country (from EUR 664 million to EUR 639 million) have been decreasing.

*

- Evolution of balance of payments in the first four months of 2018 (million euro)

- Period Jan-Apr 2017 Jan-Apr 2018

- Credit Debit Balance Credit Debit Balance

- Goods

- Services

- Processing services

- Transport services

- Tourism – travel

- Other services

- Primary incomes

- Secondary incomes

- Total current account

*

Foreign investments

The balance of non-residents’ long-term deposits slightly increased in April 2018 and maintained above the level registered at the end of last year (EUR 2,642 million at 30.04.2018 compared to EUR 2,597 million at 31.12.2017). Foreign debt service corresponding to them was EUR 690 million.

Direct investment by non-residents increased between January and April this year by 25% over the same period in 2017 (EUR 1,493 million compared to EUR 1,198 million). Equity contributions (including the net estimated reinvested profit) amounted to EUR 1,945 million and intra-group loans had a negative value of EUR 452 million, nearly double the value from the previous month (overall, local subsidiaries total credited their parent companies).

The total external debt rose by 1.7% in the first four months of 2018 compared to the level recorded at the end of 2017 (down by half a percentage point compared to the previous month) and reached EUR 95,070 million. External debt payments have exceeded EUR 20 billion.

*

- Evolution of foreign debt balance by components (2013-2018)

- Year

- DETML

- Short-term foreign debt

- Total foreign debt

*

It is noteworthy the marked difference in the growth rate between the two foreign debt components, with a significant increase in short-term debt (+ 10%) and a decline in obligations committed on long-term (-1.3%). Overall, the extra accumulated debt for the first four months increased by about EUR 1.6 billion.

The medium and long-term external debt service rate was 19.9%, up compared to the end of the previous month (14.4%) but below the level of 23.9% registered in 2017, which in its turn was significantly below the level of 30% recorded in 2016. The goods and services import coverage ratio fell slightly to 5.3 months, down from the end of last year (5.4 months).

The short-term foreign debt coverage ratio, calculated at the residual value (including the capital rates on long-term foreign debt, with maturities in the next 12 months), by the foreign reserves at the BNR, continued to decrease as shown in the table below:

- Evolution of short-term foreign debt coverage ratio, calculated at the residual value

- Month Dec 2015 Dec 2016 Dec 2017 Apr 2018

- Coverage ratio

*