From the growth in profits of energy companies and banks to decreases in other industries, companies’ preliminary financial results in 2017 express the contradictory developments in the economy, according to the reports that companies submitted to the Bucharest Stock Exchange or their own announcements.

From the growth in profits of energy companies and banks to decreases in other industries, companies’ preliminary financial results in 2017 express the contradictory developments in the economy, according to the reports that companies submitted to the Bucharest Stock Exchange or their own announcements.

Romgaz (SNG, + 82% profit in 2017/2016), Nuclearelectrica (SNN, +172%), BRD – SocGen (BRD, + 92%) have registered profits beyond analysts’ expectations and OMV Petrom (SNP + 140%), DIGI Communications (DIGI, + 433%) or Bursa de Valori Bucuresti itself (BVB, + 143%), the company that manages the market with the same name (Bucharest Stock Exchange), had remarkable results.

Energy of profits

Energy companies owe their profits largely to the price increase in energy, and banks both to the clean-up of balance sheets and the lending re-launch, even though it was especially about lending to households, according to the BNR reports.

Energy and banking sectors also register the biggest profits.

The deeper statistics go in the rest of the economy, the less spectacular profit increases become, or profits are often lower than in 2016. Or even there are net losses recorded.

*

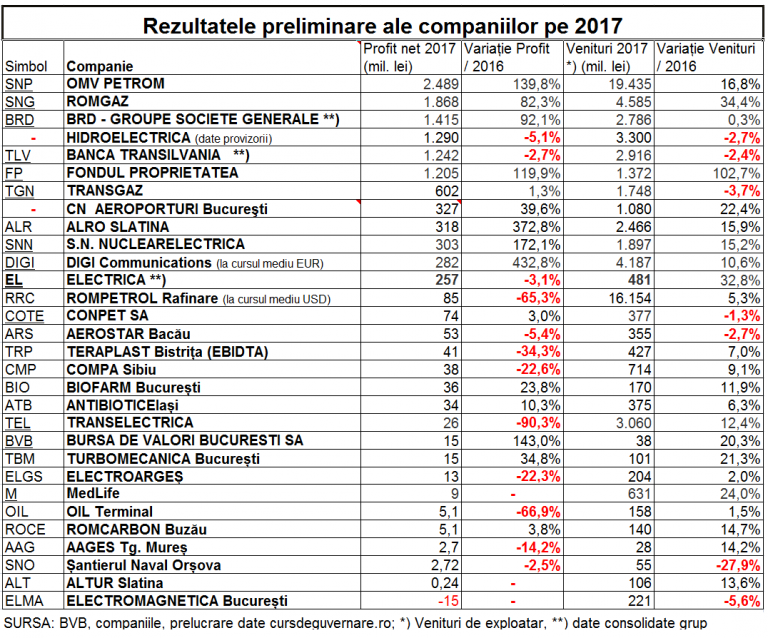

- Preliminary results of companies in 2017

- Symbol Company Net profit in 2017 Profit change/2016 revenues in 2017 (million RON) revenues change/2016

*

OMV Petrom (SNP) also took advantage of the price increase in electricity, not just in oil.

„In Q4/2017 we benefited from an increased demand for electricity and fuels as well as higher commodity prices,” says Mariana Gheorghe, the CEO of the company in the report sent to the BSE.

In fact, SNP’s operating profit for the whole 2017 doubled, to RON 3.3 billion, due to „better” prices achieved in the Upstream segment, the „solid margins for electricity” in the Downstream Gas segment and the revenues from „the insurance of Brazi power plant” and „better” margins of Downstream Oil – according to the report mentioned.

In fact, SNP’s operating profit for the whole 2017 doubled, to RON 3.3 billion, due to „better” prices achieved in the Upstream segment, the „solid margins for electricity” in the Downstream Gas segment and the revenues from „the insurance of Brazi power plant” and „better” margins of Downstream Oil – according to the report mentioned.

SNP recorded a net profit of almost RON2.49 billion in 2017, up almost 140%, from revenues up by almost 17% to more than RON 19.4 billion.

Romgaz (SNG) reported a „well above expectations” profit, up by more than 82% to RON 1.87 billion, the largest profit in the company’s history, according to analysts of Prime Transaction investment firm.

Romgaz (SNG) reported a „well above expectations” profit, up by more than 82% to RON 1.87 billion, the largest profit in the company’s history, according to analysts of Prime Transaction investment firm.

The increase in SNG’s turnover, of more than 34% to more than RON 4.58 billion, was obtained by higher gas sales, invoiced gas storage services as well as the 14.5% increase in the electricity production.

The (almost) tripled net profit of Nuclearelectrica (SNN), to RON 303 million, from revenues increased by more than 15% to more than RON 1.89 billion, also exceeded analysts’ estimates.

The (almost) tripled net profit of Nuclearelectrica (SNN), to RON 303 million, from revenues increased by more than 15% to more than RON 1.89 billion, also exceeded analysts’ estimates.

The increase in SNN’s profitability has come not only from higher revenues from the sale of electricity but also from the decrease of financial losses.

The marginal growth by 1.3% in the profit of Transgaz (TGN), which administrates the monopoly of Romania’s natural gas pipelines, to RON 602 million, from revenues decreasing by 3.7% to almost RON 1.75 billion, was not surprising.

The marginal growth by 1.3% in the profit of Transgaz (TGN), which administrates the monopoly of Romania’s natural gas pipelines, to RON 602 million, from revenues decreasing by 3.7% to almost RON 1.75 billion, was not surprising.

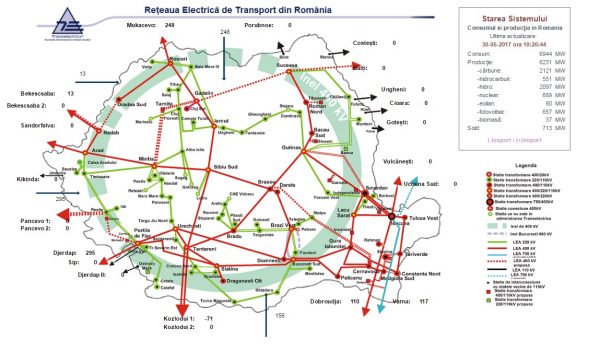

Transgaz (TGN) depends to a large extent on regulated prices, decided by the Romanian Energy Regulatory Authority (ANRE), the same as Transelectrica – the operator of the electricity grids.

So, it was not a surprise even the decrease of Transelectrica (TEL) profit by over 90%, to only RON 26 million. Although revenues have increased by more than 12%, the company is in the process of restructuring the business model, which now counts on lower tariffs than in the past.

So, it was not a surprise even the decrease of Transelectrica (TEL) profit by over 90%, to only RON 26 million. Although revenues have increased by more than 12%, the company is in the process of restructuring the business model, which now counts on lower tariffs than in the past.

In its turn, Hidroelectrica seems to stagnate for now, according to management’s estimates. Conpet Ploiesti (COTE) also has a modest increase compared to other companies, especially because it depends on a single major customer, OMV Petrom.

Alto Slatina’s performance (ALR) is also related to energy, even though the strategy of increasing sales of products more than the sales of primary aluminium was decisive. ALR recorded a net profit more than four times higher in 2017, up to RON 318 million, from revenues higher by 16%, which reached almost RON 2.47 billion.

Alto Slatina’s performance (ALR) is also related to energy, even though the strategy of increasing sales of products more than the sales of primary aluminium was decisive. ALR recorded a net profit more than four times higher in 2017, up to RON 318 million, from revenues higher by 16%, which reached almost RON 2.47 billion.

Alro has though a special situation because it also produces energy, of which the rest of the companies cannot take advantage.

Quality of economic growth

Statistics are contradictory in the rest of the economic sectors, but not less relevant to the quality of Romania’s economic growth.

Three of the auto parts manufacturers have recorded a poor performance or even a counter performance, although the vehicle production is one of the main drivers of the 8.2% industrial growth in 2017.

The net profit of Compa Sibiu (CMP) dropped by more than 22%, to RON 38 million, although revenues increased by over 9% to RON 714 million.

The net profit of Compa Sibiu (CMP) dropped by more than 22%, to RON 38 million, although revenues increased by over 9% to RON 714 million.

The level of turnover does not position the company among the small ones, however, its strength is reduced in a highly competitive market, and the chaos in the tax policy has not helped.

Altur Slatina (ALT) has a unique production niche in Romania (aluminium automotive parts) but barely managed to make a tiny profit in 2017.

Instead, Electromagnetica Bucuresti (ELMA) has lost RON 15 million, significant for its business level (sales of RON 221 million). The former glory of Romanian telecoms sector managed in the last decade to shift its business, initially helped by the production of automotive parts.

Instead, Electromagnetica Bucuresti (ELMA) has lost RON 15 million, significant for its business level (sales of RON 221 million). The former glory of Romanian telecoms sector managed in the last decade to shift its business, initially helped by the production of automotive parts.

ELMA has become an electricity producer and supplier, it produces metering devices and LEDs but can still be taken, even temporarily, out of a trajectory favourable to accidents.

The company’s report puts a loss on a sanction in dispute of the Competition Council, for which it constituted a provision of 10 million lei.

Smaller companies are extremely vulnerable to the business environment, in the context of a reduced portfolio of customers. At ELMA, for example, „production activity has suffered losses because of the fluctuating orders, mainly due to the postponement of some tenders for the procurement of electricity consumption measurement equipment and some tenders for elements of railway traffic safety.”

Compa (CMP), Electromagnetica (ELMA), and Electroarges Curtea de Arges (ELGS) – a well-known manufacturer of household appliances, are companies constantly in the spotlight of investors on Bucharest Stock Exchange due to their performance and history.

They have the reputation of „miracles” because although they were controlled by employees and their management following the privatization, they managed to survive and produce performance, unlike most of the others, which were only used as land plots for malls.

On the other hand, CMP, ELMA and ELGS are not just symbols of shares listed on the Bucharest Stock Exchange but also symbols of great difficulties facing most of the Romanian companies, viable but without being far-reaching to have a future ensured without worries.

Electroarges (ELGS) also saw its profit reduced by 22%, to only RON 13 million, from sales of RON 204 million, in a relative stagnation.

Banks and new stars

BRD – Groupe Societe Generale (BRD) has continued its healthy path and had the largest profit in the bank’s history.

BRD – Groupe Societe Generale (BRD) has continued its healthy path and had the largest profit in the bank’s history.

BRD Group achieved net earnings almost double in 2017, of more than RON 1.41 billion, from revenues up by only 0.3%, of over RON 2.78 billion.

Banca Transilvania (TLV) did not amaze by a rising net profit, which is „a slight disappointment” to analysts. On the contrary, the profit of more than RON 1.24 billion is lower by 2.7% compared to 2016, and the revenues of over RON 2.91 billion decreased by 2.4%.

Banca Transilvania (TLV) did not amaze by a rising net profit, which is „a slight disappointment” to analysts. On the contrary, the profit of more than RON 1.24 billion is lower by 2.7% compared to 2016, and the revenues of over RON 2.91 billion decreased by 2.4%.

However, the TLV situation is mainly due to the taking over of some historical losses from Volksbank, without which the gross profit in the last quarter would have doubled. The provisioning of the bad loans of the bank acquired had a negative influence on the final results of TLV.

However, the entire banking system seems to have recorded its most profitable year, with a net profit of about RON 5.4 billion, according to some preliminary estimates. BCR’s profit will be reported on February 28, along with the profit of the parent bank.

Performances of new BSE stars are also remarkable

DIGI Communications (DIGI) obtained a net profit more than five times higher, of EUR 61.7 million euros, or RON 282 million (at an average exchange rate), from revenues of over EUR 916 million, up by 8.75% (over RON 4.18 billion, or + 10.6%).

MedLife (M) medical service provider reported revenues of RON 623 million, up 24% and a total net profit of RON 8.8 million, compared to losses of RON1.2 million last year.

Bucharest Stock Exchange itself took advantage of the favourable evolution of the listed companies and especially of one of the best dividend seasons, stimulated especially by the state’s campaign of squeezing out profits from companies whose behaviour decisively influences it.

Bursa de Valori Bucuresti S.A. (BVB), which administrates the market with the same name and includes the Central Depository, which performs the post-trading operations, registered a profit more than double, of RON 15 million, following the increase in the revenues by over 20%, to RON 38 million.