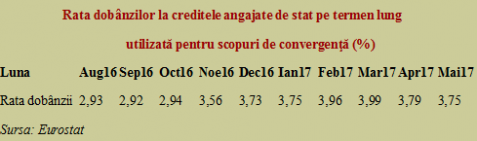

The average for the first five months of 2017 of the long-term government loans was 3.85%, while for the last five months of 2016 it was 3.22%, significantly lower.

The average for the first five months of 2017 of the long-term government loans was 3.85%, while for the last five months of 2016 it was 3.22%, significantly lower.

The matter is NOT just about bigger or smaller decimals since for a public debt of 37.6% of GDP at the end of 2016, applying this interest rate means annual payment obligations of 1.21% of GDP.

*

- Interest rate for long-term government loans applied for convergence reasons

- Month

- Interest rate

- Source: Eurostat

*

At the beginning of 2017, by a similar calculation applied at the level of 38% of GDP, it is obtained 1.46% of GDP. A quarter of a percentage point of GDP would be, if we were to use the spring forecast of the National Commission of Prognosis, about EUR 450 million IN ADDITION to what we would have paid anyway with the interest rates applied in the previous period.

We used this calculation method because debts are generally „rolled”. That is, new loans are contracted for the same amount as the one to be paid, but for most of them at the value of long-term interest rates, as the tendency is to increase maturities, with the aim of lessening the pressure on public finances resulted from short-term payment obligations (less than one year).

Moreover, the state has also to compensate, in this respect, the trends from the private sector, because the debts cumulate for the whole country.

Problem (big): Short-term debt increased between January/April 2017 faster than long-term debt

There is a situation that is not quite desirable, as the one found in the BNR’s release on the balance of payments. Where, beyond the overall external debt growth, we find a faster increase in the short-term debt than in the long run.

In addition, after the election fairy play with a winning fanciful electoral program that leaves to the next generations the bill for the unbalances created by the current unreasonable excess of consumption, the latest political events are likely to send us back above the level of 4% in terms of long-term interest rates, which we had avoided „by a whisker” in March.

*

SITUATION WITH FIGURES

Balance of payments and external debt – April 2017/BNR release

„Between January and April 2017, the total foreign debt increased by EUR 1,709 million. In structure:

The long-term foreign debt amounted to EUR 70,202 million on April 30, 2017 (74.6 percent of total foreign debt), up 1.8 percent compared to December 31, 2016;

The short-term foreign debt reached EUR 23,884 million on April 30, 2017 (25.4 percent of total foreign debt), up 2.1 percent versus December 31, 2016.”

*

In fact, at a time of economic growth of 5.7%, as the one advanced as an estimate for the first quarter of this year, instead of wasting the money and increasing the public deficit, Romania should have used a part of the extra revenue from the budget (if had not reduced taxation) to cut the already accumulated debt.

Not as a percentage of GDP, as it is usual in the official communications, but in absolute terms. That is to stop paying at least a part of the billions of euros of debts in the form of interests and fees that thins down the public budget. Which does not allow for more substantial wage increases and leave us with little investment.

All in all, when the Eurostat official data for June 2017 on the interest rate evolution (which had hardly curbed for Romania) will be released, we shall know which is the bill for the televised circus with the dismissal of its own government. Very likely, of tens of millions of euros.

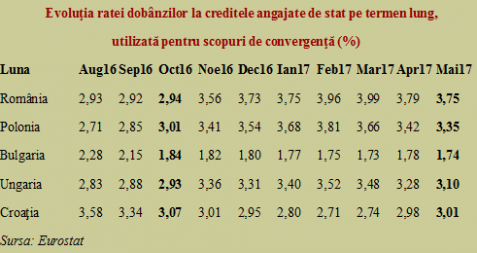

And to make clear how we get to pay more than others, and how we insist at any cost to pour petrol onto the fire, we present the evolution of interest rates in a few EU countries that are close to us geographically and in terms of development:

*

- Evolution of interest rate on long-term government loans, used for convergence reasons (%)

- Month

*

Given that the economy has performed and recorded the highest GDP growth rate within the EU, it is worth mentioning the relative deterioration of the interest rate indicator for Romania. From where we were below the level of Poland and Croatia, practically on the same level as Hungary, we clearly stood out at the top of European interest payers, where only Greeks are ahead of us for the reasons we know. It is noteworthy that we went up in terms of interest rate and our Bulgarian neighbours went down.

Neither the Hungarians nor the Poles excel in democracy, but at least they are more politically stable and more concerned about the sustainability of their country’s evolution.

In our case, if we saw that politics cannot help the economic development, maybe it would be enough, similarly to a principle in medicine, to first be careful not to do any harm.