The net national average income for 2016 was 2,046 lei (equivalent to 456 euros) per month, according to the data processed by INS.

The net national average income for 2016 was 2,046 lei (equivalent to 456 euros) per month, according to the data processed by INS.

This key indicator for the economy grew by 10.1% compared to the previous year, the highest increase in the EU. The analysis of the INS data also shows the monthly cost related to the payment of the salary, respectively 3,493 lei (778 euro) per employee.

Thus, for 100 lei paid by following the law, an employer had to allocate 170.72 lei on the salary costs, which means that the state has charged the work by a total effective rate of 41.4%. These figures are slightly lower than in the previous year, when the cost for 100 lei, net amount, was 171.50 lei and the cumulative taxation of the work 41.7%.

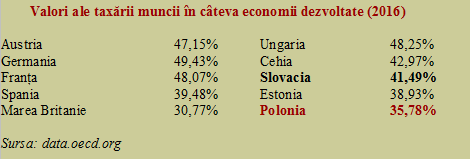

This is a similar level to Slovakia and above the average of 36% within the OECD (which comprises the most developed economies in the world) but below major European economies such as Germany, France and Italy, where this indicator (tax-wedge in English) is over 45%. Closer to us, Hungary went with them, while Poland (which it might be useful for us to take as a model) was close to the average of the developed countries.

*

- Levels of work taxation in some developed economies (2016)

*

The average number of employees increased last year from 4,611.4 thousand persons to 4,759.4 thousand persons (+ 3.2%) and was 5,223.8 thousand persons on December 31, 2016. If related to the economic growth, estimated at 4.8% (in the provisional version), it results that two-thirds of the GDP growth came from the expansion of the economic activity and only one-third from improving the productivity.

Top of Romanian salaries by industry

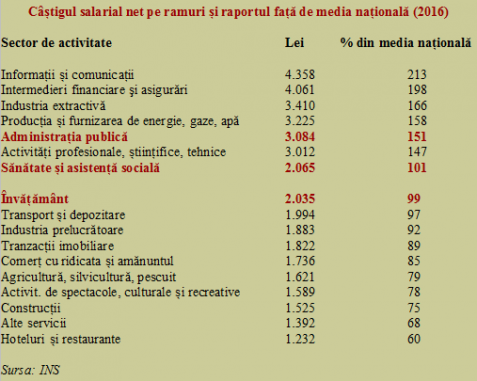

As regards the ratios between the amounts representing payments for various activities of the national economy, the situation is presented in the table below. The IT sector has taken over the „yellow t-shirt” from the financial sector and the public administration provides incomes more than 50% higher than the average of the economy, to which health and education sectors are (unfortunately) very close.

*

- Net salary income by sectors and the relation to the national average

- Sector Lei % national average

- IT&C

- Financial intermediation and insurance

- Extractive industry

- Production and distribution of energy, natural gas, and water

- Public administration

- Professional, scientific and technical activities

- Health and social assistance

- Education

- Transportation and storage

- Manufacturing industry

- Real estate

- Retail and wholesale trade

- Agriculture, forestry, fish farming

- Shows, cultural and leisure activities

- Construction

- Other services

- Hotels and restaurants

*

In the structure by regions of development, a net difference can be observed between the capital city region, where the share of employed people in commercial services approaches 62%, and all other areas of the country, where it varies between 35% and 41%. The explanation comes from the much lower salary in the latter, which does not allow the job creation and the service development due to lack of a solvable demand.

Also noteworthy is that the share of public sector employees in the Bucharest area (below 16%) is much lower than in other areas that are close to 20%, with three revealing exceptions.

In the Western Region, the most developed after the capital city, the share of public sector employees is only 16.6%, well below the poorest regions, Southwest (24.0%) and North East (26.4%), where the state is one of the main employers and price forming player on the labour market.

Finally, it should be noted that more than three quarters of employees have been active in the private sector last year. Its share in the economy was 75.7% and the increase in their number was 4.5% compared to the previous year, which leads to an increase of about 155 thousand jobs, over the increase in the whole economy. That is the whole increase in the number of jobs came from the private sector.