The general consolidated budget ended the first month of 2019 with a surplus of RON 717 million or 0.07% of the estimated GDP for the current year, according to data published by the Ministry of Finance.

The general consolidated budget ended the first month of 2019 with a surplus of RON 717 million or 0.07% of the estimated GDP for the current year, according to data published by the Ministry of Finance.

The result reported is three times weaker than the same month of 2018 and five times lower than in the same month in 2017, when the balances were + 0.35% of GDP, respectively + 0.21% of GDP (however, the low reference basis makes these ratios less relevant).

The explanation for traditional surpluses registered at the beginning of the year stays in the existence of quarterly payment receipts, along with the monthly spending. Moreover, it should be noted that this happened even in the context that the current year’s budget had not been adopted and the operation was based on the default option of preserving 1/12 proportions (in nominal values) of the 2018 budget.

*

- One month 2017 (million RON) One month 2018 (million RON) One month 2019 (million RON)

- Total revenues

- Total spending

- Surplus/deficit

*

To keep in mind, though much higher than the economic growth, the revenue growth rate was significantly lower than the expenditure growth rate (+ 15.1% in revenues versus 22.7% in expenditure, both in nominal terms). This is also the explanation for the significant reduction of the surplus, by more than one billion lei compared to the same month of the previous year.

Although it increased in percentage terms by 24.2%, the corporate tax remained at an extremely low share, with slightly less than RON 280 million. That is, approximately seven times less than the salary and income tax of almost RON 2 billion (otherwise, on a downturn trend by no less than 37.6% following the tax rate decrease from 16% to 10%).

We recall that this decrease has been introduced to compensate for the transfer of payment obligations from the employer to the employee and the effect registered in January 2019 on the increase in insurance contributions was spectacular (+ 32.3% compared to the same month of 2018, but, in time, once the amounts obtained under the same conditions are compared, these major variations will disappear).

In terms of indirect tax revenues, we can see a remarkable increase in VAT payment receipts (+ 23.1%, from RON 5.6 billion to almost RON 7 billion), as well as in excise taxes (+ 38% from RON 2.1 billion to RON 2.9 billion). They were also the major source for feeding the public budget, with an increasing cumulative share of revenues from 34.6% to 38.2%.

While local budgets started the year with a positive result, with revenue coverage of expenditures of 127%, the social insurance budget and the public health insurance fund were clearly deficient, both with a coverage rate of only 81%. The unemployment budget has maintained the traditional exaggerated surplus (coverage of 237%!).

*

- Budgets revenues expenditure balance coverage ratio

- – local budgets

- – social insurance budget

- – public health insurance fund

- – unemployment budget

*

It should be noted that it would be useful to have clarifications in the Note on the general consolidated budget implementation about the amount of RON 2,486 million (0.24% of estimated GDP), mentioned in the negative balance of financial operations in the first month of 2019, compared to a positive balance of RON 127.8 million presented in January 2018 data.

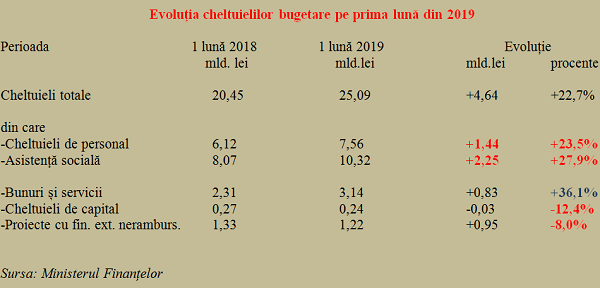

Salaries and social protection have increased above the overall average

A selection of expenditures in the first month of the year shows increases above the overall average in the most important public spending components. This is a 23.5% increase in wages for the public sector and an even higher increase (+ 27.9%) in the social assistance, mainly driven by pension increases applied at the middle of last year and the increase in the minimum guaranteed income.

If we refer to the advance of the amount of RON 1.2 billion for paying 50% of February pension costs that are distributed through the Romanian Post, we find approximately the difference in balance between January 2018 and January 2019. Practically, we would have otherwise had the same deficit in nominal terms and even a little lower, if we relate to GDP. What is interesting, though, is the coincidence with the same amount of RON 1.2 billion received from the EU for payments made.

*

- Evolution of budget expenditure in the first month of 2019

- Period one month 2018 (billion RON) One month 2019 (billion RON) evolution (billion RON percentage)

- Total expenditure

- Of which

- – personnel expenditure

- – social assistance

- – goods and services

- – projects with foreign non-reimbursable financing

*

It is worth to welcome the advance to better rates in the expenditure on goods and services, but unfortunately, in terms of capital expenditures and projects with non-reimbursable financing, values have been decreasing significantly.

The official release also highlights the result of maintaining investment expenditure in January 2019 at about RON 0.5 billion (0.049% of GDP), the same as in January 2018.