Financial consultancy company McKinsey Global Institute showed in a study from 2023 that the increase of assets prices in the United States of America in the last two decades created approximately 160 trillion dollars of “wealth on paper”. During the same period, economic growth was slow and every investment of 1 dollar generated a debt of 1.9 dollars.

The phenomenon became more pronounced, and in 2023 the American state borrowed 1.69 dollars against every dollar from the GDP.

Surely, the USA has already launched the already famous – and the much debated by Europeans – project called the ”Inflation Reduction Act”, that stipulates injecting 2,000 billion into the economy and society over the following years.

We have also compared these indices for Romania, and the results indicate a similar phenomenon of decreasing public loan yields, in terms of GDP formation as well as carried out investments – an analysis which included, mind you, non-returnable funds from the European Union:

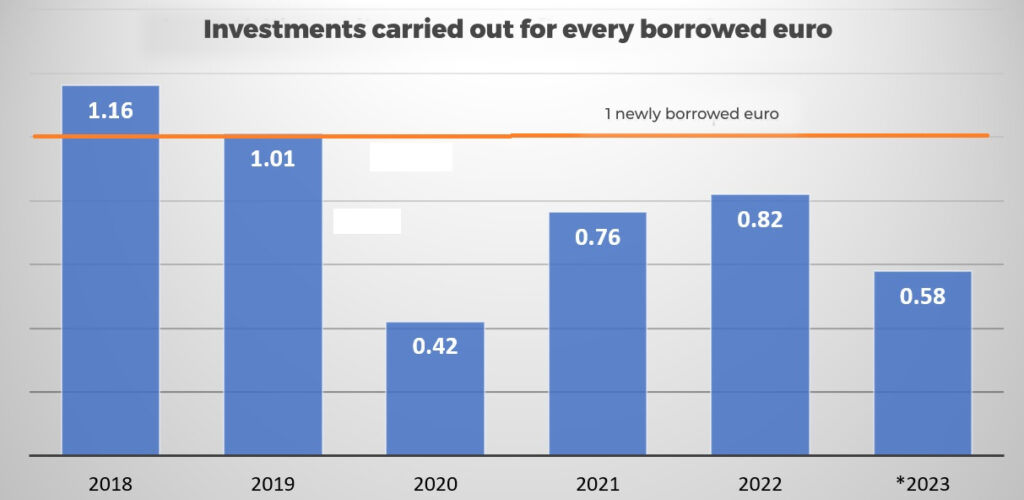

If in 2019, investments of 1.16 euros corresponded to every borrowed euro – in 2022, for every newly-borrowed euro only 0.8 euros were seen in investments. And things are still more inefficient in 2023.

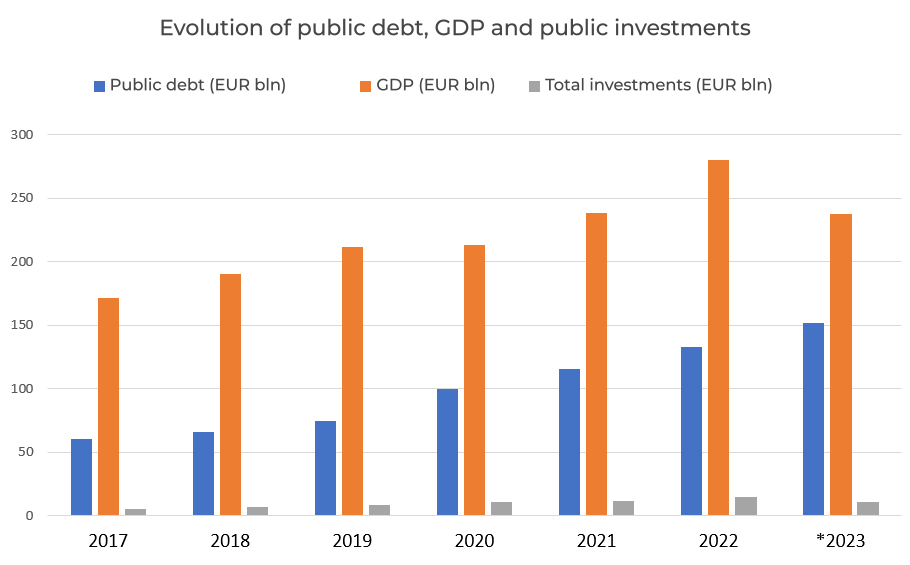

Below, the debt – GDP – Public investments evolution (including only the first 3 quarters of 2023), represented by the debt balance (meaning the total debt at a given moment):

The trend reversed by the Covid crisis hasn’t recovered yet: not every borrowed euro is pinned in investments

In Romania, between 2018 and 2022, the government debt (in nominal terms) has doubled, from EUR 66 billion to EUR 133. 86 billion, while GDP has gone up only 1.5 times.

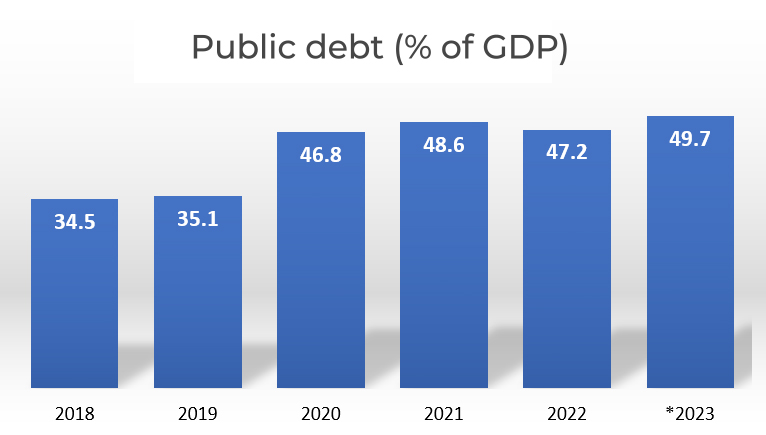

In other words, national wealth has gone up 1.5 euros for every 2 euros borrowed.

Things are even worse with regards to investments: before 2019, the public investment/new debt ratio was above unity. For example, in 2018, every borrowed euro corresponded to 1.16 euros invested.

Source: The Ministry of Finance and NIS *11 months

The year 2020 is atypical, marked by blockages generated by the Covid pandemic and state costs for managing the social and health crises, but the inversion of the ratio continues even today.

Loans taken out by the government are largely spent to cover holes in the budget and very little goes towards investments, and this occurs despite the fact that non-returnable funds from the European Union are significantly increasing during this period.

After the first nine months of 2023, 1 borrowed euro corresponded to 0.58 euros invested. A slightly better situation was registered in 2022, when 0.82 euros were invested for every borrowed euro.

*11 months

Public debt increases in relation to GDP, reducing the margin of action of the government, which must quickly find financing solutions for the budget deficit outside loans, which implies the need to increase state revenues.

***