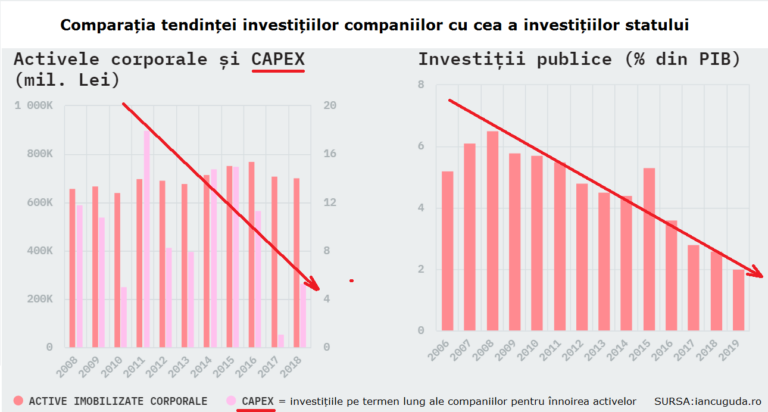

Both public and companies’ long-term investments halved in 2018 compared to 2009.

Both public and companies’ long-term investments halved in 2018 compared to 2009.

This is proof that without state investments, the private sector does not have investment resources and if it has them, it does not have the confidence to invest.

Companies’ long-term investments in assets renewal, amounted to RON 37 billion in 2018, reached only 52% of the level registered in 2009, the most difficult year of the financial crisis that threw the world into recession.

Public investments also halved in 2018 compared to 2009, in terms of the ratio of GDP (2.6% versus 5.8%). This is another type of ratio but no less relevant: even if the nominal GDP has doubled, the state invested in 2018 by RON 4 billion less than in 2009 – less than RON 24.7 billion, in total. In other words: also half.

The reality confirms this way the theory that public investments are the driver of development. It is not just a statistical coincidence extracted from the analyses of Iancu Guda, the president of the Romanian Financial-Banking Analysts Association (AAFBR).

*

- Comparison between companies’ investment and state investment trends

- Tangible assets and CAPEX (million RON) Public investment (% of GDP)

- Non-current tangible assets CAPEX – companies’ long term investment in asset renewal

*

If the state does not invest, most often companies do not have enough resources for relevant investments (the overwhelming majority do not have access to bank loans).

The lack of confidence in the business environment created by state policies also discourages even the companies with development potential in the economy – as many as they are.

„More worrying is the fact that almost one-third of these investments (public ones, low anyway – editor’s note) represent modernization costs for the public defence sector, which are not visible in the business environment”, namely in the economy’s competitiveness in the mid-long term, says Iancu Guda.

Companies invest in a subsistence and not renewal

Nearly three-quarters of the increase in the book value of assets (5% of the 8% increase) is the result of positive revaluations of lands and constructions owned by companies, says the AAFBR president’s most recent analysis.

In other words, „companies in Romania have only maintained the level of their tangible assets in the last decade„, Iancu Guda explains in the most recently published analysis.

The average duration of current assets’ use is likely to reach about 15 years, the longest use cycle in the last decade (…), „an extremely long period, given the increased speed of innovation and development of new products/technologies, which reflects a low competitiveness of Romanian companies”, Iancu Guda also says.

No wonder that Romanian economy’s supply has failed to meet the consumption demand excessively stimulated by government policies, and the increase of imports has deteriorated the financial balance of the country.

Neither big, bankable companies invest anymore

The phenomenon is all the more worrying as half of the revenues of all companies in Romania are concentrated within only 1,000 companies. Only another 11,000 companies would have the capacity to finance, from their own sources and especially from loans, according to data of the National Bank (BNR).

But neither companies that are able to invest do that anymore, not at an increasing rate. Gross fixed capital formation (an indicator of total investments in society) decreased in 2018. It did not confirm the increase from 2017, according to BNR data.

- *

- Investment

- Real annual change Real change compared to Q1 2015

- Gross fixed capital formation

- Equipment, including transport means

- Construction of residential buildings

- Engineering construction

- Construction of non-residential buildings

*

- Reasoning factors explaining GDP dynamic

- Final total effective consumption Net export of goods and services

- Stock variation Gross fixed capital formation

- Real annual GDP change

*

The latest BNR report on financial stability states: „Reversing the contribution of gross fixed capital formation to the economic growth indicates the need to intensify efforts to create a framework suitable for stimulating investments in the private sector and to improve the quality of public investments with an impact on long-term development, in order to ensure a sustainable economic growth”.

BNR report’s scholar like expression actually expresses the concern about the inability of government policies to encourage the country’s healthy development. Because the lack of investments means underdevelopment – even students know that.

Causes

They are the same insistently repeated by analysts in various terms over the last three years. The AAFBR president also reformulates them:

- political instability (3 changes of governments and dozens of reshuffles);

- discontinuity of structural reforms;

- workforce tension increase and an unpredictable context of work remuneration;

- tax evasion (unfair competition).

The analyst does not forget the disproportion between the populist stimulation of consumption, the stimulation of investments and development:

- „Developed countries are characterized by constant investments in industry and production activities, which generate a high added value that covers domestic consumption and encourages export growth.

- Poorer or developing countries are marked by investments in services, distribution and consumption sectors, as the economic growth is based on consumption fuelled by imports.

- In their case, both public and private investments are insufficient for increasing domestic production to the level of consumption (oversized due to populist measures) and supporting exports (outperformed by a faster import advance).”