If the PSD-ALDE alliance does not reconsider the measure of transferring all social contributions to the employees, Romania will be the first EU country where employers will no longer contribute to financing the social security system.

If the PSD-ALDE alliance does not reconsider the measure of transferring all social contributions to the employees, Romania will be the first EU country where employers will no longer contribute to financing the social security system.

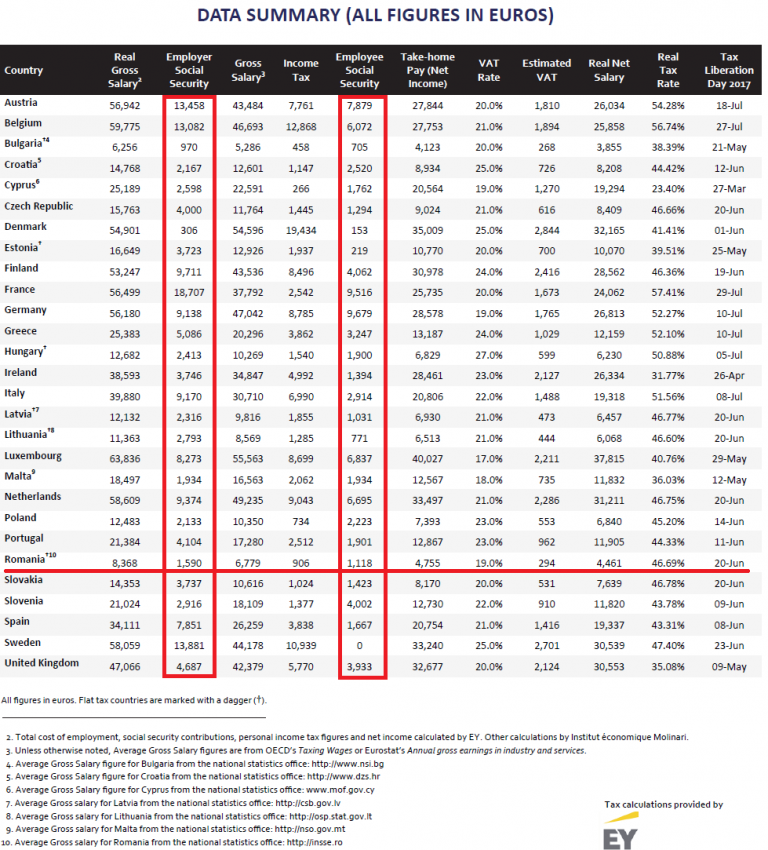

In the table below, it is noted that all EU member states have divided this burden between the employer and the employee, and in most cases, the contributions paid by the employers are higher:

The table has been drafted by the Molinari Economic Institute (Paris), which calculates Free Day, the symbolic date when it is believed that employees start to work for them, the first period representing the work for paying taxes to the state.

The table has been drafted by the Molinari Economic Institute (Paris), which calculates Free Day, the symbolic date when it is believed that employees start to work for them, the first period representing the work for paying taxes to the state.

According to an analysis of the National Social Bloc, out of 120 countries where a social security system is developed, none left the payment of social contributions exclusively to the employee, as the new bills provide in Romania.

Trade unions allege that this „social experiment”, unique in Europe, eliminates the principle of social solidarity and responsibility on which social security systems are built, to which both employers and employees contribute.

On Wednesday, at the end of the meeting between the authorities and the representatives of the 6,000 union members protesting in Victoriei Square, Prime Minister Mihai Tudose explained that it is very difficult to give up at this moment the transfer of contributions:

„It was a package, the Law on unitary pay, with this tax transfer, with the tax relief, these formed a package. Now, a part of this legislative package (Law 153 on unitary pay in public sector – editor’s note) has now entered into force. To the extent that, along with the support of union confederations as well, we shall find another solution, we shall apply that solution,” said Mihai Tudose.

If the transfer of contributions is made, starting in 2018, the implementation of the unitary pay law will have a budget impact of RON 32 billion by 2020 and RON 42 billion by 2022, according to Government’s calculations.

If the transfer is dropped, the impact will rise to RON 63 billion by 2022, which would endanger the deficit. For the time being, the Government has no solution to finance the difference of RON 21 billion from other sources but the Prime Minister has promised the union members that he will consider the possibility of compensating these additional losses to the budget.

How payments of social contributions are currently made

At present, social contributions for normal work conditions amount to 39.25% of the gross salary and are paid as follows:

Pension contributions – 26.3%, for normal working conditions

- 5%, the employee’s individual contribution

- 8%, the contribution paid by the employer

Health insurance contributions – 10.7%

- 5% the employee’s individual contribution

- 2% the employer’s contribution

Contributions to unemployment fund – 1%

- 5% the employee’s individual contribution

- 0,5% the employer’s contribution

Contribution to the Guarantee Fund for debt salaries – 0.25%

- is paid by the employer

Contribution to holidays and health insurance allowances – 0.85% (paid by the employer)

Insurance contribution for occupational accidents and diseases – 0,15% (paid by the employer)

Overall, calculations show that, of the gross salary, an employee (either from the public or the private sector) will pay additional contributions of 22.5% instead of 15.75%. That means, for the increase to also be seen in the net salary, it should be higher than the amount representing the contributions transferred to the employee.

If another component of the package to which Prime Minister Mihai Tudose refers, total contributions of 39.25% will be reduced as of January 1, 2018, to 35% of the gross salary.

Also, the income tax will decrease from 16 to 10% (the fourth component of the legislative package).