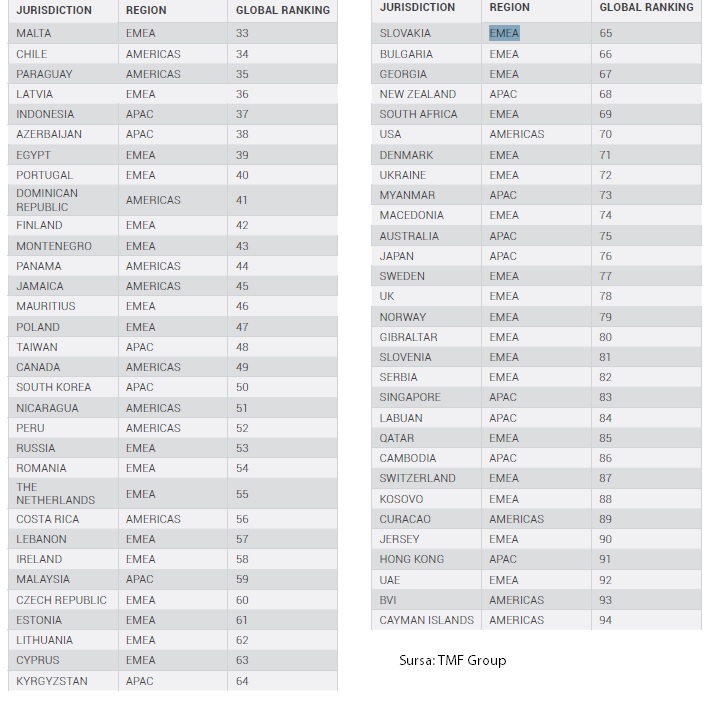

Romania ranks 54th in a global ranking of the complexity of financial and accounting regulations faced by foreign companies in another country.

Romania ranks 54th in a global ranking of the complexity of financial and accounting regulations faced by foreign companies in another country.

The last position (94) represents the lightest environment and is held by the Cayman Islands, according to a survey by the TMF Group consultancy firm, which operates in 80 countries around the world.

The TMF Group report is the result of surveying the representatives of companies from the countries covered, who have been asked to assess the difficulty that a foreign company faces in complying with local regulations based on four criteria concerning:

- cross-border transactions and corporate representation of companies at the local level;

- local tax regulations and reporting according to them;

- accounting regulations and the level of reporting technology;

- the structure of taxes and their impact, the need to adapt the business to regulations and related non-compliance risks.

Thus, Turkey ranks 1st, as having the most difficult accounting and tax regulatory environment, because (among others) reports should be made on paper, in Turkish language and currency.

Businesses are difficult in Italy, which ranks third by the complexity of financial compliance, because the taxation is organized on three levels, national, regional and municipal, and in Greece (4th), especially because the very many taxes are paid to several entities.

Romania, on tax difficulties map

More complicated than the Romanian tax and accounting system are those in Croatia (20), Latvia (36), Portugal (40), Poland (47) and Russia (53), according to the TMF Group’s 2017 financial complexity index.

Right behind Romania, the difficulty of tax and accounting compliance decreases in the Netherlands (54) and, of the countries with which Romania competes for foreign investments, in the Czech Republic (60), Lithuania (62), Slovakia (65), Bulgaria (66) and Serbia (82).

The five least complex jurisdictions have „simplified reporting requirements and tax rates favourable to encourage investment: Jersey (90th), Hong Kong (91), United Arab Emirates (92), British Virgin Islands (93) and Cayman Islands (94)”.

Among the most difficult environments are also China (7th position) and Belgium (8), Mexico (15), Israel (17) and Spain (18), Austria (21) and Luxembourg (24).

To establish the ranking, the TMF Group’s internal accounting and tax experts used four complexity parameters, based on the accounting and tax rules and regulations from the 94 jurisdictions and the related non-compliance risks.

To establish the ranking, the TMF Group’s internal accounting and tax experts used four complexity parameters, based on the accounting and tax rules and regulations from the 94 jurisdictions and the related non-compliance risks.

Trends

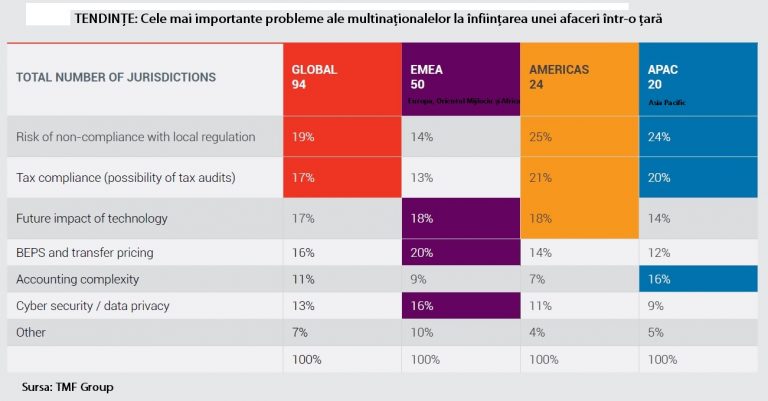

TMF Group experts from all over the world have been questioned about the most important future issues raised by the complexity of the tax and legal environment and most of the answers have referred to the foreign companies’ risk of non-compliance with local regulations.

Tax compliance and the need for tax audits is the second priority, followed by the reporting technology and relations with the authorities.

Tax consultants are increasingly worried, in order, about the implications of the base erosion and profit shifting (BEPS), the complexity of accounting regulations and cyber security.

Tax consultants are increasingly worried, in order, about the implications of the base erosion and profit shifting (BEPS), the complexity of accounting regulations and cyber security.