The waves caused by the political dispute covered the economic asperities that appear increasingly clearly on the horizon and have now reached the moment of the radical trend change.

The waves caused by the political dispute covered the economic asperities that appear increasingly clearly on the horizon and have now reached the moment of the radical trend change.

The estimate made by the BNR specialists sees an increase in the inflation rate from 0.6% in June 2017 to 3.05% in June 2018, a level which we have not experienced since around 2012.

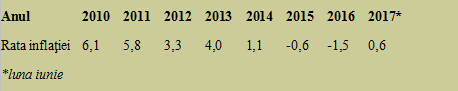

For those who have forgotten how the difficult struggle has evolved with the reduction of the price increase in Romania, we recall the series that led us, against a very favourable international context from the international oil prices perspective, to values close to zero of this key indicator of the economic stability.

*

- Year

- Inflation rate

- * month of June

*

Basically, after cutting the VAT rates, both the standard one and the VAT on food, we are currently operating with prices from three years ago. But this resource of mitigating the officially registered inflation (which is not necessarily correlated with the economic performance, given the influence of repeated interventions from the state administration) has almost exhausted its intervention capacity.

No, five times higher inflation in just one year is not a game!

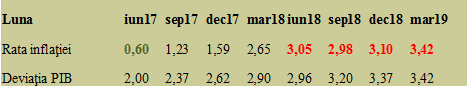

Soon, the effects of the significant increase in revenues via the wages from the state sector and the artificial increase of pensions (which will amplify the already chronic deficit of the state social security budget somewhere around EUR 4 billion a year) will translate into stimulating the economic growth, at the cost of threatening the country’s financial stability (see table).

*

- Month

- Inflation rate

- Output gap

*

The relatively rapid change (over the next 12 months) of the inflation position will come for some as a revelation but it has already been foreseen, according to the economic forecasting models. A five times higher inflation after a year is not a game, especially in terms of the adaptation capacity of public perceptions after five years of relative stability of prices.

The output gap shows the difference from the level of the economic growth that could have been obtained under conditions of economic stability. Its advance from 2% now to a rather problematic + 3,42% at the beginning of 2019 indicates a major danger of macroeconomic slippage and major risks of losing the stability on the EU scoreboard.

We have already exceeded the allowed levels for house prices and labour cost, we now have only 11 out of 14 indicators that we still meet after we have been among the brightest in our class, and most likely, if we keep the current economic path, we shall go down even further.

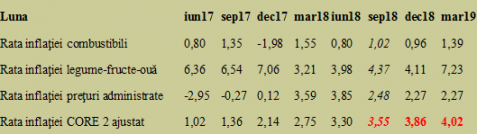

The situation does not look promising at all, even if we mention the rather favourable assumptions as to the evolution in time applied for fuel prices (which in the main scenario would speed down the price increases), volatile prices (the vegetables -fruits – eggs mix would lower the inflation index by half in 2018), and even the administered prices, which would depreciate the price advance at the beginning of 2019.

*

- Month

- Inflation rate – fuels

- Inflation rate vegetables -fruits – eggs

- Inflation rate administered prices

- Inflation rate CORE 2 adjusted

*

Regarding the administered prices, the government officials have now missed a favourable momentum for increasing the energy prices, the negative rate of nearly three percentage points in June 2017 being out of step with the inflammation, by a base effect, up to 3.85% as of June 2018.

It draws attention, in this context, the exit of the inflation rate which is under the influence of the monetary policy, the so-called CORE 2 adjusted, from the BNR target range of 2.5% plus/minus 1% after the third quarter of 2018. As well as the estimate of further deterioration of this indicator to more than four percentage points starting 2019.

All this data may seem dull but will soon translate into the everyday life where there will be changes visible in the pockets. From the shopping carts to the interests paid for loans, we will pay the invoice for the fairy-tale told by politicians, with more bread obtained without extra work (and efficiency).

Finally, but not least, two questions on which it would be worth reflecting.

- For those who have been working for years to save some money, it is worth thinking about what option is better. To suddenly get a little more money on monthly basis, but lose some of their whole life savings’ value? Or to accept the correlation of the incomes with the increases of wages and the inflation without losing money already set aside?

- And for those who would like to put now some money in 12-month term deposits, if the inflation rate will be 3.05% in June 2018, at what bank could they earn more real money in one year? More exactly, what financial institution offers now a nominal annual interest rate of 3.63%, to remain with 3.05% after tax?