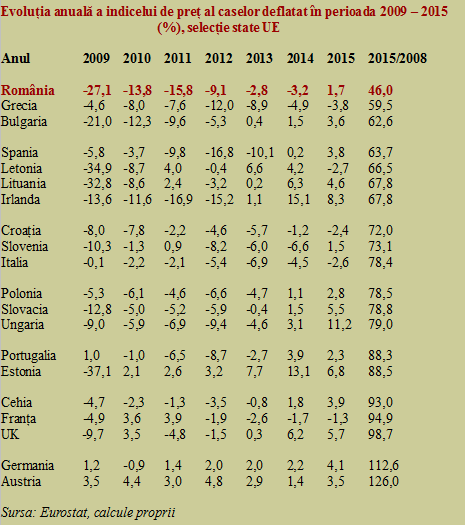

Romania is the EU country where house prices fell the most in real terms compared to 2008, according to data presented by Eurostat. The decrease to just 46% in the selling price of housing in 2015 compared to the value recorded before the crisis sent us on the first place at this indicator, much ahead the counties that ranked next, Greece (59.5%) and Bulgaria (62.6%).

Romania is the EU country where house prices fell the most in real terms compared to 2008, according to data presented by Eurostat. The decrease to just 46% in the selling price of housing in 2015 compared to the value recorded before the crisis sent us on the first place at this indicator, much ahead the counties that ranked next, Greece (59.5%) and Bulgaria (62.6%).

This evolution is one that raises serious questions as the economic crisis has been much stronger in Greece, where public debt has exploded to unsustainable values and unemployment is four times higher than ours.

Even if Bulgaria initially followed a similar trend, slightly attenuated, their downward tendency reversed since 2013 (see table).

*

- Annual evolution of house price index, deflated, between 2009-2015 (%), EU states selection

- Year

- Source: Eurostat, own calculations

*

We made a selection of data and have grouped the evolution for the geographically grouping of states to be obvious in terms of house price change, with the amendment of interesting similarities of final results existing between the Baltic countries plus Ireland and the Iberian Peninsula (obtained on completely separate paths).

Noteworthy is the fact that house prices have fallen in Poland despite that it was the only country where GDP has not decreased in any year during the crisis and the final alignment was kept in the end to neighbors Slovakia and Hungary.

In contrast, the Czech Republic emerged as a sort of median between the couple Austria – Germany (where prices significantly rose) and colleagues from the Visegrad group, so that it was aligned to the situation of the pair countries separated by the English Channel, France – UK.

Legend:

- HPI – The price index of houses

- HPI (abbreviation in English of the house price index) shows the change in price of residential property (apartments and houses of any kind, both newly built and existing ones, irrespective of the end use of the original owners). This price is adjusted by inflation measured by the harmonized index of consumer prices to reflect the real buying value of a home.

- HPI is a key indicator for macroeconomic analysis as it provides an important warning signal for a potential real estate bubble. In this regard, it has been included in the European system of macroeconomic imbalance indicators and the value of + 6% per annum has been established as warning limit.

As far as we are concerned, Eurostat could not make calculations based on sufficiently robust data to see evolution during 2005 – 2008 but the values available as annual rates for the period 2006 – 2015 suggest an increase in annual average price of about 2% for Romania.

Two conclusions could be drawn:

- A major part of the loan problems occurred until 2008, inclusive, come from the transaction values greatly exaggerated compared to 2005. As prices rose totally unduly during the period of excitement surrounding the EU accession, so have they fallen, leaving new owners to pay installments too high for the strongly diminished value of the newly acquired houses.

- Warning, the return to higher house prices is inevitable for us, as it can be seen from the evolution in all the former socialist states. Moreover, the lower the starting value in this return, the sharper will be the increase, risking to switch on a red light on the dashboard of macroeconomic imbalances (see the situation in Hungary, Ireland or Estonia), which is now more closely followed at the European level.