Entrepreneurs and leaders of Romanian private companies are distrustful about the consumption-based economic growth model because it does not offer but a short-term perspective, according to the Romanian business environment winter Barometer published on Wednesday by EY Romania.

Entrepreneurs and leaders of Romanian private companies are distrustful about the consumption-based economic growth model because it does not offer but a short-term perspective, according to the Romanian business environment winter Barometer published on Wednesday by EY Romania.

92% of business people who responded to the EY survey don’t endorse the growth pattern based on consumption.

Most participating executives consider the growth based on consumption extremely worrying (26%) or very worrying (33%). Another 33% are „just” worried.

The proportion of those who consider the current growth model as being „extremely worrying” has tripled compared to the previous edition of the barometer, in 2016 (9%), while the proportion of those who consider it „very worrying” has doubled (from 16%).

*

- How much does the Romanian economic growth model based on consumption worry you?

- Q2 – Evolution winter 2018 vs autumn 2016

- Extremely worrying

- Very worrying

- Worrying

- Does not worry me

- Not at all worrying

- It is a good model

*

Proportions are only apparently paradoxical, according to EY consultants.

„Entrepreneurs say: Well, consumption leads to an increased demand, but in the short term. And they ask themselves: „What shall I do next year and after that?”, explained Ioana Mihai, EY Associate Partner for corporate finance solutions.

Incidentally, companies’ investment plans and their development face, overall, the obstacles that are already known:

- tax and legislative uncertainties jeopardize the investment plans of 85% of companies and hinder the development of 80% of them. Only 13% of companies feel that their investments are not affected;

- lack of vision in the public policy and political instability are barriers for 69% of companies.

Bureaucracy is ranked third in the top barriers (46% of responses)

More relevant, however, is the fact that other common dissatisfactions are placed far from top obstacles to the development of companies: the tax level, with 21% and difficult access to financing, with 9%.

Adaptation to uncertainty

Most signals from the EY Barometer on the entrepreneurs’ expectations for the next 12 months express the concentration of their concerns on the adaptation to the uncertainty of the fiscal and economic environment overall.

Even the progress in approaching the development, registered lately, shows the concern about the uncertainties of the future.

„Among the lessons learned (following the financial crisis) is the shift from an opportunistic and intuitive approach to projects to an analysis-based approach. Entrepreneurs make more educated decisions and try to cover their financial risks,” says consultant Ioana Mihai.

However, on the other hand, as credit appetite has not increased, companies protect their liquidity and/or seek alternative sources of financing by renegotiating contracts with suppliers.

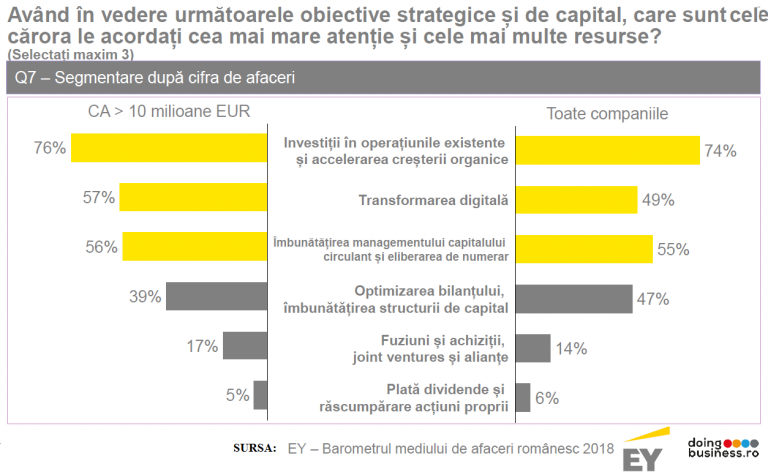

So, the second most important strategic and capital-related priority for business leaders is „the cash release and improved management of the circulating capital” (55% of responses).

*

- Considering the following strategic and capital-related priorities, which are those on which you focus the highest attention and resources?

- Q7 – segmenting by turnover

- Turnover > EUR 10 million All companies

- Investment in existing operations and accelerating organic growth

- Digital transformation

- Circulating capital improvement and cash release

- Balance sheet optimisation, capital structure improvement

- Mergers and acquisitions, joint ventures and alliances

- Dividend payment and buying back own shares

*

Even the most important priority does not signal a shift to a higher stage in the development of companies’ business: 74% of leaders focus „the highest attention and most resources on investment (only) in existing operations and accelerating the organic growth,” according to the EY Barometer.

One of the discouraging factors is the lack of public investment in infrastructure. „Companies are not encouraged by the fact that the state does not invest in infrastructure,” says Gabriel Sincu, EY Tax Associate Partner.

Comparison with the rest of the world

The digital transformation strategic option is relevant for 49% of companies and this could be the result of a maturing phase, according to EY consultants. Digital transformation ranks the second at the global level as well, according to Capital Confidence Barometer (CCB).

The rest of the priorities are different, the most important priority for the rest of the world is to identify business opportunities, including mergers, acquisitions and alliances, and dividend payments to shareholders ranks third.

Otherwise, the proportion of global optimists in terms of profitability over the next 12 months is more than double that of Romanian executives (74% versus 35%).

The same less optimistic tendency among Romanian respondents can also be noticed in terms of the stability of markets (52% of CCB respondents vs 32% of Romanian respondents), access to credit (53% vs 40%) and the evolution of the companies’ valuation (51% vs 31%).

*

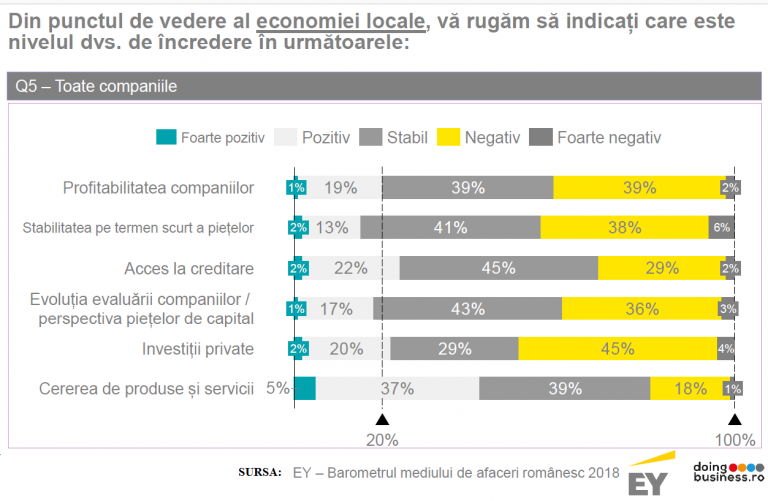

- From the perspective of local economy, please indicate your confidence level in the following:

- Q5 – all companies

- Very high positive stable negative very low

- Companies’ profitability

- Stability of markets in sshort-term

- Access to credit

- Evolution of companies’ valuation/ perspective of capital markets

- Private investment

- Demand for products and goods

*

Romanian entrepreneurs are more pessimistic about all indicators of the local economy than those of the global economy:

- demand for products and services (42% „positive” and very positive answers at the level of local economy versus 60%, the global economy),

- access to credit (24% vs. 40%),

- private investment (22% vs 41%),

- profitability (20% vs. 35%),

- evolution of companies’ valuation (18% vs 31%) and

- market stability (15% vs. 32%).

„The biggest discrepancies appear in the case of the market stability and the evolution of investments, which can be explained by the fiscal and legislative instability in Romania. Stopping or reducing investment means including a lower appetite for company acquisitions, a decrease in competitiveness and a reduction of profitability,” according to the EY report.

The barometer „proves the context of respondents’ concerns about the risks of pro-cyclical and pro-consumption policies in 2018 as well, which an impact on current account deficits, tax deficit, inflation, and increasing vulnerability to external pressures,” said Mihaela Matei, Special Projects Coordinator at EY Romania, when presented the results of the survey.

At the same time, „the economic gaps compared to the other EU countries maintain. In the context of a record economic growth, but which mainly supports imports of goods and services, Romania remains the second poorest country in Europe with a poor infrastructure and questionable perspectives for the transition from growth strategies based on low costs to growth strategies based on innovation and knowledge,” according to the official mentioned.