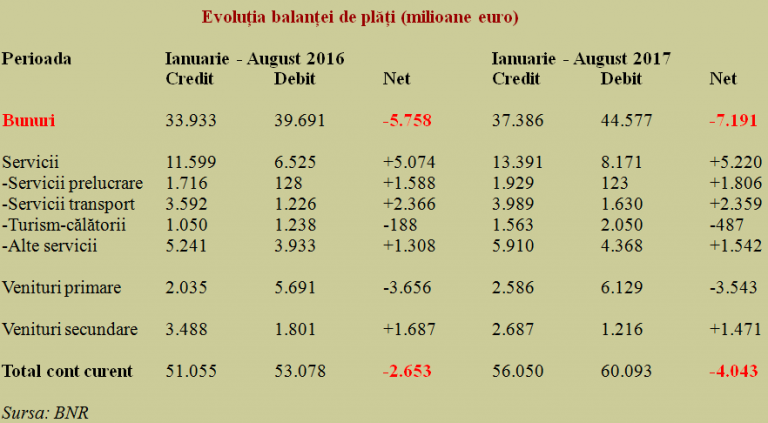

The balance of payments current account recorded a deficit of more than four billion euros in the first eight months of the year, which means a 52% increase over the same period in 2016.

The balance of payments current account recorded a deficit of more than four billion euros in the first eight months of the year, which means a 52% increase over the same period in 2016.

The minus registered on the goods’ side increased by almost 25% and exceeded to seven billion euros threshold, while the plus in the service sector’s contribution increased by slightly less than 3%, amid the slight decrease (-0.3%) in the amounts brought by the transport services.

The difference in the growth rate between exported and imported goods was negative (+ 10.2% compared to 12.3%), which contributed to worsening the minus resulted from the products exchange with the foreign partners to 4% of the GDP estimated for the current year. Simplified, Romania is losing about half a percent of GDP per month in the foreign trade of goods.

On the other two major components of the balance of payments, the good news is that the minus recorded by the primary incomes (from work, direct, portfolio and other investment, as well as other primary income such as taxes or subsidies) decreased by 3.1 % in the first seven months of the year.

The bad news is that on the secondary income side, where we find the amounts transferred by those working abroad, the positive balance dropped by 12.8% over the same period of the previous year. However, the situation improved significantly from the end of the previous month, when the decrease was even higher (-18.8%).

Inflows of secondary incomes in the first eight months (most of which were the amounts sent by the „strawberries pickers” to relatives in the country) amounted to only EUR 2.7 billion, compared to slightly more than EUR 3.5 billion last year (see table). Only the simultaneous decrease of the amounts sent from Romania abroad (from EUR 1.8 billion to EUR 1.2 billion) has mitigated the downturn in the net result (see table).

*

- Evolution of the balance of payments (million euros)

- Period Jan-Aug 2016 Jan-Aug 2017

- Goods

- Services

- – manufacturing services

- – transport

- – tourism – travel

- – other services

- Primary incomes

- Secondary incomes

- Total current account

*

The largest amount contributed to the current account in the services category came from transportation (+EUR 2,359 million, net) but stagnated compared to the same period of last year. Achievements were better by more than 11% and contributed nearly four billion euro, but the development of the relative competitiveness should be analysed because the 33% increase rate in the outflows was much higher.

The second largest positive contribution to the balance of payments was brought by the services of processing goods owned by third parties (+ EUR 1,806 million), which is a very important amount in supporting the balance of payments but represents a pure export of a relatively cheap workforce.

The negative balance in tourism has strongly expanded, more than two and a half times (-EUR 487 million, compared to only -EUR 188 million last year). Although the payments collected advanced by almost 50%, due to a significant increase in revenues, the expenses incurred by Romanians traveling abroad went up by more than 65%.

Non-residents renounce deposits in RON

The balance of non-residents’ long-term deposits declined by about one-sixth in the first eight months of 2017, from EUR 3.64 billion at the end of last year to just EUR 3.05 billion. This was in the context of payments related to these deposits amounting to EUR 1.2 billion and the tendency to renounce the investments in RON became clear.

Direct investment by non-residents was also down 18%, from EUR 3.09 billion in the first eight months of 2016 to just EUR 2.52 billion between January and August 2017. It is noteworthy that capital participations (including reinvested profits) amounted to EUR 2.80 billion, while the intragroup loans posted a slightly negative balance of – EUR 0.28 billion (Romanian subsidiaries credited the parent companies in net terms).

Foreign debt status

Total foreign debt rose by 1.3% compared to the level recorded at the end of 2016 (+ 2.2%), to EUR 94.08 billion, after a positive evolution in August (the increase had been +2.2% at the end of July). Payments related to the external debt amounted to EUR 44.2 billion in the first eight months of this year.

*

- Evolution of the foreign debt balance by components (2011-2017)

- Year

- DETML

- Short-term foreign debt

- Total foreign debt

- * after eight months

*

The mid to long-term foreign debt service rate, which was 21.1% in August 2017, was well below the 30% level recorded in 2016. The coverage ratio of goods and services imports maintained slightly below the theoretical limit recommended of 6 months (5.9 months) and below the level of 6.3 months recorded at the end of last year, after improving compared to July (5.8 months).

*

- Short-term foreign debt coverage ratio

- Month

- Coverage ratio

*

A good progress in terms of macroeconomic stability, external payment obligations committed on short-term have avoided the threshold of EUR 25 billion to which they were rapidly heading since the beginning of the year and turned in on EUR 24.55 billion.

Short-term foreign debt coverage ratio of the BNR’s foreign reserves (recommended to be over 100%) also climbed back to 86.2% after declining to only 85.3% in July.