*

The concept of family tax within the EU

- 18 countries do not have the family unit concept

- In four countries, the concept is optional: Ireland, Germany, Poland, Spain

- The concept exists only in six countries: Denmark, France, Greece, Luxembourg, Malta, the Netherlands

- In all the EU countries, the employer withholds the income tax

*

The Coalition for the Development of Romania (CDR) warns the Government officials that the amendments proposed to the current fiscal system expose the economy to risks and instability.

The lack of realism and sustainability of the global income taxation (IVG) will result in the implementation of the progressive tax rates, which CDR does not uphold, mentions a release sent out by the association.

The Coalition announced on Wednesday the suspension of discussions with the Ministry of Finance on the way to apply the tax system proposed by the Government until the institution presents an impact study.

According to the Coalition, the study should contain two essential elements:

- Alternative measures to offset the budget deficit caused by the decrease of the tax rates

- The sources of financing to counterweight the significant decrease in tax revenues caused by the elimination of the withholding income tax

*

American system – complex and complicate

Family unit = married persons

The system is optional

Employers withhold taxes

Four categories of taxpayers

- Married persons who submit a common tax statement

- The family carer

- Unmarried persons

- Married persons who submit separate tax statements

*

That is why CDR proposes the preparation and analysis of the impact study and reconsidering the opportunity to implement the income tax system.

Conclusions of assessment carried out by CDR

*

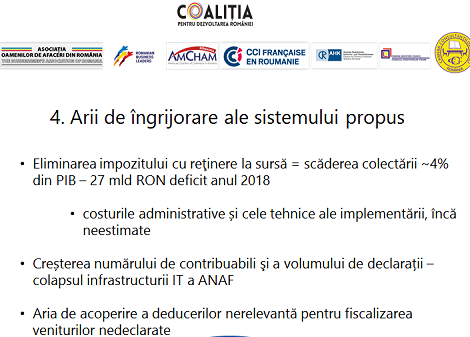

Areas of worries related to the proposed system- Elimination of the withholding tax system = decrease in collecting the tax by approximately 4% of GDP – 27 billion lei, deficit in 2018

- Administrative and technical costs of the implementation, not evaluated yet

- Increase in number of taxpayers and the volume of tax statements – collapse of the tax authority’s IT infrastructure

- Coverage area of the deductions, not relevant in terms of taxation of the unreported incomes

*

- The IVG implementation is unsustainable – the elimination of the withholding system and the monthly payment of the tax on income (i.e. salaries, dividends, interest, etc.), as well as the elimination of the anticipated tax payment (i.e. on income from the independent activities, rents, etc.), will result in a drastic decrease of budget revenues in 2018. Compared to 2016, the decline of the revenues as a share of GDP will be at least 4%. The implicit effect would be the implementation of new taxes in the next years.

- The IVG implementation is unrealistic – it assumes that over 7 million households will voluntary register with the National Agency for Fiscal Administration (ANAF) in about half a year, in a context where the concept of „household” as a pillar of the new system is not yet regulated by the Romanian legislation, and the tax collection mechanism is unclear. Analysing other tax systems (such as the one in the US), taxation is applied on an individual basis and only optional (if it is to the benefit of the taxpayer), at the level of a family consisting of a husband, a wife and children.

- The IVG implementation is expensive – ANAF’s IT system, which is currently encountering a hardware deficiency and risks being blocked by the artificial increase in the number of people subject to taxation, will have to be adapted. Higher spending will be needed for improving the professional skills of tax authorities and the taxpayers’ level of education so that the new tax rules to be applied.

- The problem of tax advisors – in order to be functional, the new system would need 35,000 „tax advisors”. At present, 5,489 consultants are registered in the Register of the Chamber of Fiscal Consultants, of which 4,101 are active, many of whom are already employed. Also, these „tax advisors” would work maximum three months a year for a double annual salary compared to real tax consultants, whose work requires skill and a much more complex work.

The Coalition is a private, apolitical initiative, built as an agreement of collaboration through collective participation, and brings together 45 organizations and associate members.

The coordination of the Coalition is ensured by a Board of Directors consisting of the presidents and vice-presidents of the Businessmen’s Association of Romania (AOAR), the American Chamber of Commerce in Romania (AmCham), the French Chamber of Commerce in Romania (CCIFER), the Romanian-German Chamber of Commerce and Industry (AHK), the Foreign Investors Council (FIC) and the Romanian Business Leaders (RBL).