Romania ranks last among the EU countries both in terms of assets and liabilities of households to GDP, according to the latest data published by Eurostat for 2015.

Romania ranks last among the EU countries both in terms of assets and liabilities of households to GDP, according to the latest data published by Eurostat for 2015.

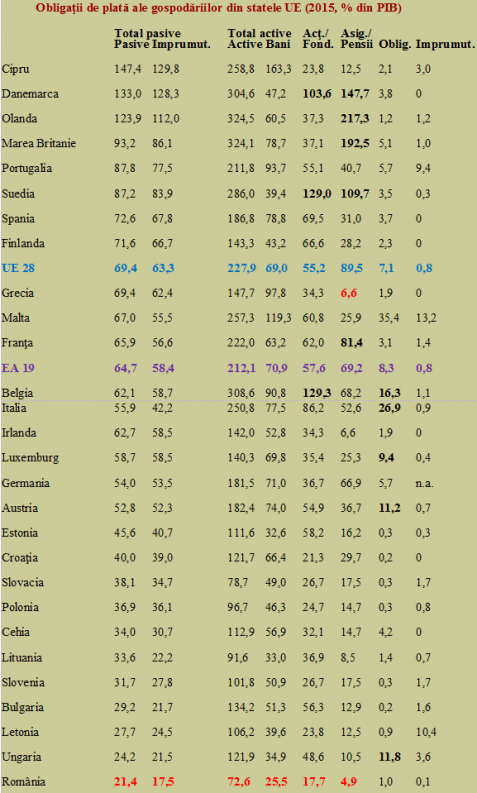

With assets (holdings) of only 72.6% of GDP and liabilities (obligations) of 21.4% of GDP, we are positioned well below the averages of 227.9% for assets and 69.4% for liabilities recorded at the EU level.

The amounts that the population borrowed represent only 17.5% of GDP, while the cash and the amounts from the deposits total 25.5% of GDP.

For reference, we note that we are preceded, at the bottom of the European list by our neighbours Hungary and Bulgaria, as well as Latvia (see table).

Noting that, however, all of them slowly exceed the 100% threshold of GDP in terms of total assets.

*

- Payment liabilities of households in the EU countries (2015, % of GDP)

- Total liabilities Total assets Shares/Funds Insurances/Pensions

- Liabilities Loan Assets Money Obligations Loan

*

Of course, the low monetization of the economy and the lack of diversified investment options have their say in Romania’s case. However, there are serious differences in terms of population’s asset structure not only compared to the developed Western countries but also to our colleagues from the former socialist bloc.

That should give us food for thought from the perspective of European convergence on multiple levels. The European convergence is something more than the criteria for joining the Eurozone or the scoreboard indicators, on which we are much better even than older member countries. Basically, we should pay more attention to the financial flows of the European households.

For example, the Greeks have more cash and bank deposits (relative to GDP) than the Germans, the French, the Dutch or the Danes. Overall, (surprisingly, given the situation of the country), the household liabilities are almost exactly at the level of the EU average, including in terms of borrowed money. But beware, they are by more than an order of magnitude below the EU average in terms of insurances and pensions, where they rank second to last, with only 6.6% of GDP.

Guess who appears after the Greeks in this respect, with less than a half compared to the Hungarians and one-third compared to the Poles (ironically, precisely those countries which have nationalized the second pillar of the pension system, namely the mandatory one, administrated by private companies)? With less than five percent of GDP insurance and pension accumulation, Romania is the EU laggard and has been going round in circles for two years at a 5.1% contribution from the gross national average wage, instead of reaching the target of 6%, at least.

It is noteworthy to see how the developed countries are doing at this point, where they are „light years” ahead of us. The Netherlands -217.3% of GDP, the UK – 192.5% of GDP or Denmark – 147.7% of GDP have more than a half of population’s assets placed in insurances and pensions. Not to mention the real people’s capitalism measured by the holdings of shares or the investments in accumulation funds: Belgium – 129.3%, Sweden – 129% of GDP and Denmark – 103.6% of GDP. At this point, Romania also is at the bottom of the European list with only 17.7% of GDP, behind Croatia (21.3%), Latvia (23.8%) and Poland (24.7%) and, surprisingly, far from the neighbours Hungary (48.6%) and Bulgaria (56.3%, even a little above the EU average).

In terms of cash and deposits, we also rank the last (25.5% of GDP), with the Lithuanians and Hungarians being ahead of us, and at a level below half of the Bulgarians’ level. The same goes with the government securities that we could have purchased to obtain an interest rate slightly higher than from a bank and have a part of the public debt as large as possible to ourselves and not to others (see, as profile percentages, Italy – 26.9% of GDP and Belgium – 16.3% of GDP or even Hungary – 11.8% of GDP compared to our only 1 percent).

Altogether, we have much to improve in several indicators measured at the level of population. Even more than in those emphasized at the country level, to close the gap between the macroeconomic figures and the living standards of a theoretically European origin, felt by each family.

It is useless that we have relatively small total obligations and debts given that the assets are also small, poorly distributed and the uncertainty of tomorrow undermines the stability of personal finances.