In a full economic advance, governments in power in the last years have chosen to redirect the money for investments towards measures of increasing wages in the public sector and pensions, with an impact on Romania’s economic growth potential. A potential GDP that was already suffering from the demographic change that diminishes the workforce volume.

What is obvious in the assessment of public investment in Romania – a common denominator of recent years:

governments have never kept investment commitments set by the budget law. Investments were the first to be sacrificed – paradoxically, in a full economic growth – which compromised the future imminently.

***

2019 had even a worse start than the last four years that started badly:

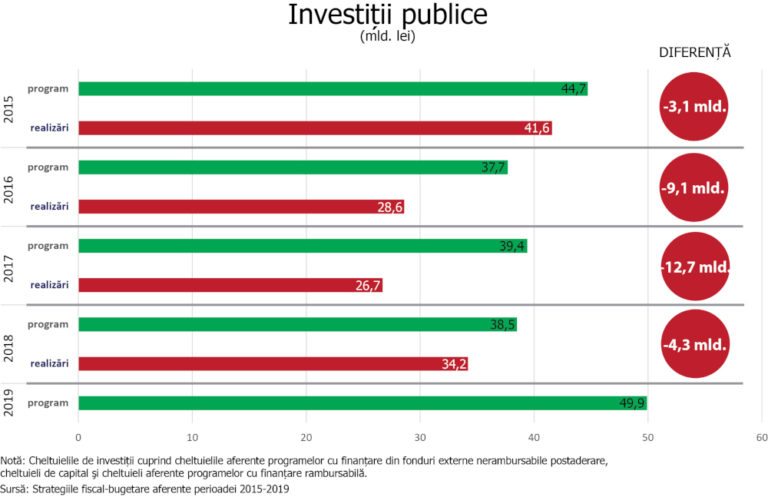

For 2019, the Government has budgeted total investments (from public sources and European funds) of about RON 49.9 billion, according to the Fiscal-Budget Strategy – a real record of the last years. A record in terms of allocations.

In the last four years, though, the investment target has been missed without fail, according to data analysed by cursdeguvernare.ro.

The start of this year does not mark a paradigm shift. Based on the budget implementation in the first two months, the state spent RON 722.6 million on investments exclusively financed from public funds, down by 78.3% compared to the same period of 2018, when the capital expenditure amounted to RON 3.3 billion.

For the projects financed from European funds, RON 2.5 billion have been allocated in January and February, 21.9% less than in the first two months of 2018, according to the data provided by the Ministry of Public Finance (MFP).

Total public investment: many billions less in budget implementation compared to allocations based on budget laws

*

- Public investment

- Planned Difference

- Implemented

*

Note: investment expenditure comprises the expenditure related to programs financed from external post-accession non-reimbursable funds, capital expenditure and expenditure related to programs with reimbursable financing

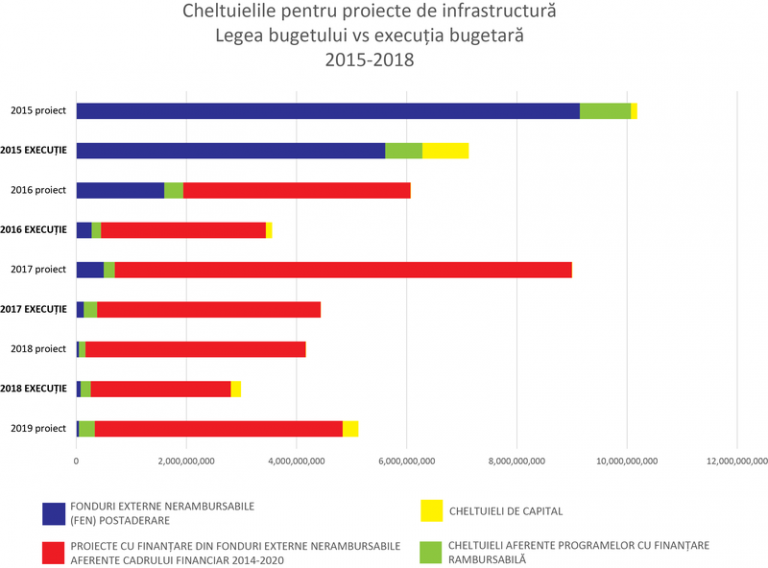

Infrastructure investments have suffered the most significant adjustments, and the difference between the program announced at the beginning of the year and the implementation calculated at the end amounts to billions of euros, with most of the failure placed in the area of projects financed from European non-reimbursable funds.

In the period 2016-2018 (when the money for the European financial period 2014-2020 has been released), the budget implementation for infrastructure was by over RON 6.8 billion below the amounts allocated in the budget laws for each year.

In the period 2015-2017, another RON 5.2 billion has been cut from the post-accession funds related to the previous financial year.

*

- Expenditure on infrastructure projects

- Budget law vs. budget implementation 2015-2018

- Planned

- Implementation

- External post-accession non-reimbursable funds (FEN) Capital expenditure

- Projects financed from external non-reimbursable funds related to financial framework 2014-2020 Expenditure related to programs financed from reimbursable funds

*

A hallucinating situation of infrastructure: expensive loans have increased over the level from budget law; European free money was only half

Beyond the poor performance in attracting European money over the past two years, the Government has chosen to spend more money on programs with reimbursable funds than originally planned in the budget.

For example, in 2018, RON 183.2 million representing interest bearing financing was spent, by RON 66.1 million more than in the Budget Law provisions.

In 2017, the Government spent on projects with reimbursable financing by RON 42.7 million more than it planned at the beginning of the year.

„Cutting public investment is the main reason for the decline in potential GDP (…). The workforce factor and the capital factor are the two major pillars of potential GDP. All our hopes remain in the productivity of these factors, which again does not occur without efforts.

But, eventually, private investment without a minimum of public investment is not made or is made in areas that do not lead to much productivity and added value. We need infrastructure investments that would open some regions with a potential such as Moldova region,” economist analyst Aurelian Dochia explains for curdeguvernare.ro.

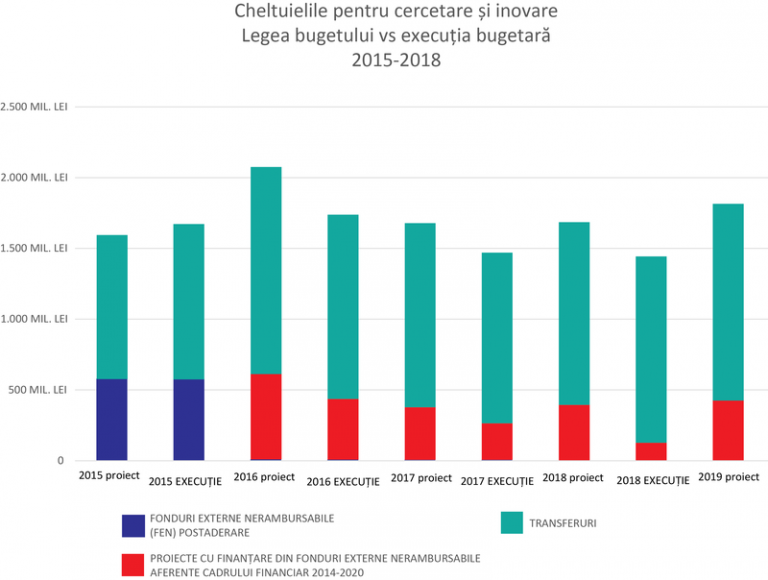

A Tomahawk in the engine for the future: more than three times less for research compared to budget laws

Other investments capable to support the economy on long-term are in the R&D field, which is itself affected by lower funding compared to budget laws.

In 2018, for example, nearly RON 400 million has been allocated to projects financed from EU funds, but the implementation was of only RON 126.5 million.

Romania has set to spend 1% of GDP from public funds on research and innovation. It is, though, so far from this objective that even Bulgaria allocates more than double the amount allocated by Romania.

*

- R&D expenditure

- Budget law vs. budget implementation 2015-2018

- Planned Implemented

- External post-accession non-reimbursable funds (FEN) Transfers

- Projects financed from external non-reimbursable funds related to financial framework 2014-2020

- Note: Transfers represent the amounts allocated to research projects through the Ministry

*

In 2017, they were by RON 95.4 million below the amounts originally planned. In 2016, researchers received by RON 161 million less. Last year, the implemented amounts were in terms of transfers RON 26.3 million above the amounts originally planned in the budget but the total amount was lower than in the Budget Law. Even smaller than in 2017.

Growth potential, in danger

The Governor of the National Bank of Romania (BNR), Mugur Isarescu, restated the warning that consumer-driven economic growth is not sustainable in the long run and Romania needs policies for encouraging investment.

„We are in the ninth year of consecutive economic growth. But there are some components of recent growth that could have been more favourable. For example, the investment contribution was lower than it should have been and consumption expenditure was the main driver of the GDP growth in recent years. Although undoubtedly the well-being level has considerably increased, for these gains to last, a change is needed in the policies aimed at encouraging investment, so that the future economic growth will not lead to a widening of macroeconomic imbalances,” Mugur Isarescu said.

Potential GDP, defined by the specialised literature as the highest rhythm in which an economy can grow, had a good evolution in recent years, but the lack of structural reforms seems to affect its future evolution, according to the country report published by the European Commission in February.

The three factors that influence the evolution of this indicator are the capital (investment), the labour and the total productivity of factors.

„Potential growth has mainly generated by the total productivity of factors. The potential GDP growth has strengthened in recent years and reached 4.5% in 2017. It is estimated that has maintained at a high level in 2018, but will gradually decline,” the document indicates.

Last year, also the total productivity of factors was the main element contributing to the potential growth, despite a slight decrease. The workforce had a modest but positive contribution in 2018 as a result of the decrease in structural unemployment and the increase in labour participation.

„However, according to estimates, after 2018 total productivity of factors will slow down and the workforce’s contribution to the potential growth will worsen due to the slower increase in the working-age population,” EC experts warn.

Ageing population and migration are other factors affecting the workforce and, implicitly, the contribution of this factor to potential GDP growth.

The European Commission anticipates a potential GDP fall to 4.1% this year, from 4.6% in 2018. The National Commission for Strategy and Prognosis (CNSP) has a projected potential GDP of 5.1% for 2019, compared to 4.9% in 2018. It should be noted that at the beginning of last year, CNSP had a forecast of 5.2% for potential GDP in 2018, later revised downwards to 4.9%.

*

- Main economic, financial and social indicators – Romania

- Real GDP (y-o-y change)

- Potential growth (y-o-y change)

- Contribution to potential GDP growth (y-o-y change)

- Total workforce (hours) (y-o-y change)

- Capital accumulation (y-o-y change)

- Total productivity of factors (y-o-y change)

*

Both the Commission and the CNSP anticipate a potential GDP slowdown in the coming years.

Foreign deficit, another inhibiting factor

The European Commission also notes that the deepening of the current account deficit, generated by the advance in the imports of goods, in the context of the consumption increase, is not favourable to the potential GDP growth.

The change in the structure of imports „raises concerns,” the report says. Specifically, the Commission’s specialists note that imports of consumer goods increased much faster than capital goods (investment) or intermediate supplies.

„Since 2015, imports of consumer goods have been increasing at an annual average rate of 13.5%, while imports of intermediate supplies and capital goods increased by 6.7% and 9.1% respectively (…) A current account deficit driven by consumption and not investment does not support potential GDP growth,” the document says.

Romania attracted last year foreign direct investments amounting to EUR 4.9 billion. In 2017, they were EUR 4.8 billion, EUR 4.5 billion in 2016, and EUR 3.5 billion in 2015, according to BNR data.

The deficit increase was anticipated by economists, in the context in which the local private environment needs time to respond to an increasing demand occurred “overnight”.

“There is always a time gap between the moment of revenue growth, which occurs very quickly, as it is basically a governmental decision applied as of tomorrow, while the answer may take several years, and meanwhile, we are in an open market, at the European level, and then imports come to replace what is missing. Those who can react immediately win. Those who need time for investments are at a disadvantage,” explained Aurelian Dochia.

The National Commission for Strategy and Prognosis (CNPS) forecasts potential GDP growth at 5.1% this year, from 4.9% in 2018 and a gradual decline starting in 2021.

CNSP forecasts made in the last five years show that the medium-term data were more optimistic and they have been corrected over time. In 2016 and 2017, the CNSP was revising upwards the potential GDP growth forecasted for 2018 towards 5.2%.

In the winter of this year, the potential GDP estimate was revised downwards to 4.9%.

*

- Forecast indicator

- Winter 2019 Potential GDP

- Output-gap

- Autumn 2018 Potential GDP

- Output-gap

- Summer 2018 Potential GDP

- Output-gap

- Spring 2018 Potential GDP

- Output-gap

- Autumn 2017 Potential GDP

- Output-gap

- Spring 2017 Potential GDP

- Output-gap

- Winter 2017 Potential GDP

- Output-gap

- Autumn 2016 Potential GDP

- Output-gap

- Spring 2016 Potential GDP

- Output-gap

- Winter 2016 Potential GDP

- Output-gap

- Autumn 2015 Potential GDP

- Output-gap

- Spring 2015 Potential GDP

- Output-gap

- Winter 2015 Potential GDP

- Output-gap

*

Romania’s average potential growth was of 4.8% between 2001-2008 and afterwards sharply declined to 1.6% between 2009-2013 – the period severely affected by the economic crisis – a presentation of the institution indicates.

The annual average growth potential for 2014-2021 would be 4.8%.