BNR Board of Directors has adopted the new lending terms for individuals, according to which the maximum level of indebtedness will be 40% of the net income for loans in RON and 20% for loans in foreign currency, regardless of their destination.

BNR Board of Directors has adopted the new lending terms for individuals, according to which the maximum level of indebtedness will be 40% of the net income for loans in RON and 20% for loans in foreign currency, regardless of their destination.

Total indebtedness is determined as the proportion of total monthly payment obligations relative to the monthly net income, according to a release of the central bank, issued on Wednesday night.

The maximum indebtedness rate is increased by 5 percentage points for loans relating to the purchase of the first home to be inhabited by the borrower. The regulation applies to both banking institutions and IFNs.

Thresholds are not applicable to refinancing.

All credit requests made prior to January 1, 2019, including those related to some government programs addressed to individual clients such as First Home program, are settled based on the regulation in place at the time when the request was submitted to the bank, even if the loan is granted after 1 January 2019.

Impact

Indebtedness levels allowed are much tougher than those practiced by banks (70%) and even more severe than the previously analysed version for the real estate credit: 55% for the fixed interest loans in RON and 45% for the variable interest loans.

The threshold is more permissive for consumer credit compared to the previous version (30% and 25% respectively, for variable interest loans).

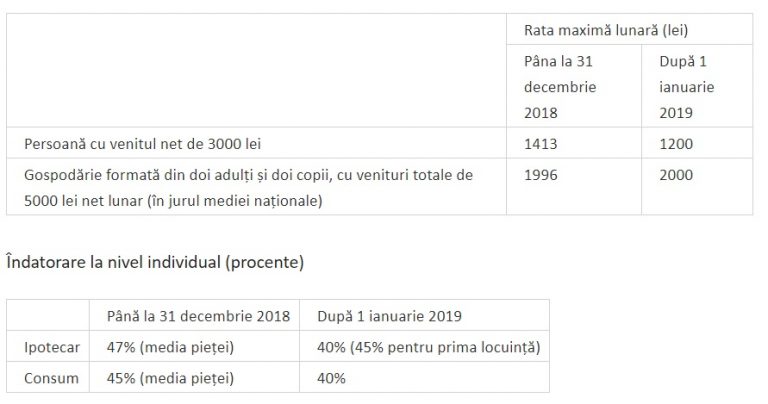

BNR, therefore, considers that the decision will have an insignificant impact on the economic growth and gives an example regarding the level of maximum instalments incurred by borrowers:

*

- Maximum monthly instalment (RON)

- Until December 31, 2018 After January 1, 2019

- An individual with a net income of 30,000 RON

- Household including two adults and two children with net monthly incomes totalling 5,000 RON (around the national average)

- Individual indebtedness (per cents)

- Until December 31, 2018 After January 1, 2019

- Real estate (market average) (45% for the first home)

- Consumption (market average)

*

The new regulation adds „facilities for the sustainable growth of the lending activity to the population:

- more permissive rules for purchasing the first home to be inhabited by the borrower,

- non-application of the indebtedness limit for a maximum of 15% of the portfolio of new loans for individuals, at the level of each creditor,

- reduction of bank bureaucracy in granting loans”.

The National Bank of Romania has repeatedly expressed its concern about the indebtedness of the population, especially in the case of people with the lowest incomes, who had an average indebtedness of 53%, compared to 20% in the case of debtors who earn more than twice the average national wage.

The central bank did not intervene on the indebtedness after 2007 after it set clear debt thresholds in 2004: 30% for consumer loans and 35% for real estate loans, as well as a minimum level of the advance for real estate loans at 25%.

BNR removed the direct limitation on the indebtedness and advance payments that were to be set by each bank under the risk rules and the bank’s management subsequently justified the measure with the need to liberalize the capital movement in line with the rules of the EU membership.

Then the crisis followed.