Drastic polarisation of the business environment – a phenomenon that makes half of the companies in Romania to „fight” on 2% of the total turnover – has consequences.

Drastic polarisation of the business environment – a phenomenon that makes half of the companies in Romania to „fight” on 2% of the total turnover – has consequences.

A related phenomenon, the distortion of the competitive environment in key sectors of the Romanian economy, has been monitored for years by the Competition Council.

By measuring a so-called aggregate Index of Competitive Pressure – IAPC, the Competition Council notes in official documents that there are 13 industries with a IAPC below 35%, which form the group of industries the most inclined towards anti-competitive practices.

By the potential danger of lack of competition, the most sensitive industries from Romania are, according to the Competition Council’s analysis:

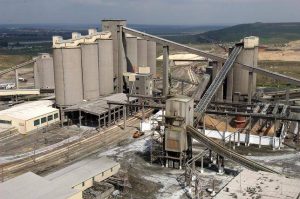

1.Cement

This is the industry with the lowest score in terms of competition pressure since the first implementation of this index, in 2013. The reason for this score stays in a combination of specific industry factors.

This is the industry with the lowest score in terms of competition pressure since the first implementation of this index, in 2013. The reason for this score stays in a combination of specific industry factors.

The production and trade of cement involve the presence of a small number of producers. The number of players has remained constant even after the concentration involving Lafarge and Holcim when the firm CRH entered the market. Besides the low number of market players, the evolution of cement producers did not significantly fluctuate in terms of market share.

The product is homogenous and the entry barriers are considerable, as the investment needed to open a cement plant is very large and difficult to recover in time. Given these circumstances, the Council considers that the production and trade of cement is the industry the most prone to register a low competition pressure.

2. Notary services

Liberal professions have scores that place them in the first part of the ranking in terms of competition pressure.

Liberal professions have scores that place them in the first part of the ranking in terms of competition pressure.

A notable exception of the liberal professions’ scores is represented by the notary services, which by contrast register the second lowest competition pressure among all industries analysed in the IAPC ranking.

The low score of the notary services is mostly the result of strong quantitative entry barriers, as the number of notarial offices is limited by regulations imposed by the National Union of Notaries Public from Romania.

Also, another factor causing a low competition pressure is the inelastic demand for such services, characterized by the strict necessity for some of these services.

3. Banking services associated with debit cards (arguments also valid for paragraph 7)

Across all banking institutions, concentration is moderate, although the top five players still hold more than half of the market for each service considered separately.

Across all banking institutions, concentration is moderate, although the top five players still hold more than half of the market for each service considered separately.

The relatively low scores for all banking survives analysed (credit cards, debit cards and current account associated services) are due to certain structural features of the banking sector.

Some of these features are: the indispensability of some services, relatively limited possibilities of differentiation in terms of services offered and a certain degree of network captivity of users.

The network captivity can be caused from an inertia perspective by virtue of established relationships with certain banks or for some services can be independent to consumers.

4.Natural gas production

Positioning of this industry near the bottom of the ranking is not surprising. Entry is difficult, being conditional upon the access to deposits, doubled by the need of considerable investment in mining infrastructure.

Positioning of this industry near the bottom of the ranking is not surprising. Entry is difficult, being conditional upon the access to deposits, doubled by the need of considerable investment in mining infrastructure.

Moreover, although there are several producers, only two of them produce most of the quantity of natural gas.

The competitive pressure is also alleviated by the product’s features, as this product is homogeneous, without any possibility of differentiation.

5.Retail pharma

One of the lowest competitive pressure values estimated by IAPC.

One of the lowest competitive pressure values estimated by IAPC.

This result is due to the specifics of this industry that provide products for basic necessities, with a very low price elasticity; the demand does not significantly fluctuate during the year, except for some seasonal trends.

Moreover, as there is a large overlap in the products traded, differentiation options are significantly reduced.

There are also some regulations in place that provide for specific demographics on which new pharmacies can be open, so market entry is strongly conditional upon those criteria. In this context, potential competitive pressure shows a very low value.

6. Passenger rail transportation

This sector is characterized by low competitive pressure, mostly due to the industry specifics. Although in recent years passenger rail operators also appeared, they operate only on a small number of routes, so that the CFR remains the clear leader of this industry.

This sector is characterized by low competitive pressure, mostly due to the industry specifics. Although in recent years passenger rail operators also appeared, they operate only on a small number of routes, so that the CFR remains the clear leader of this industry.

Entering such market is relatively difficult, as there are some administrative, but especially economic barriers (significant investment in rolling stock, long payback period).

Another reason for the low number of operators is that not all routes can be operated in a cost-effective manner. In these circumstances, competitive pressure varies regionally.

7. Banking services associated with credit cards

8. Film distribution

This is a relatively concentrated industry, with few companies active in this sector.

This is a relatively concentrated industry, with few companies active in this sector.

Productions are relatively homogenous, most movies produced by major studios being distributed through all cinema networks.

9 – Agglomerated wood production

The number of active enterprises is very low and the costs for starting such business are very high, as the initial large amount also covers environment related investment, besides the assets for production.

The number of active enterprises is very low and the costs for starting such business are very high, as the initial large amount also covers environment related investment, besides the assets for production.

The product homogeneity and the lack of options for significant differentiation also reduce the competitive pressure in this industry.

10 – Home insurance (also valid for paragraph 12)

Home insurance is very similar to banking services in terms of IAPC scores. There are some similarities between the market entry conditions and number of market players, although the number of companies active on the market is lower in the insurance sector, compared to banking.

Home insurance is very similar to banking services in terms of IAPC scores. There are some similarities between the market entry conditions and number of market players, although the number of companies active on the market is lower in the insurance sector, compared to banking.

Recent exits of some insurance companies have increased market concentration in certain areas, but that was not homogenous on types of insurance.

In terms of IAPC results it can be seen that score is lower for compulsory insurance (RCA and some home insurance) as there are no significant differences between the services offered by insurance companies.

Compared to compulsory insurance, the scores are higher for the voluntary insurance (CASCO and life insurance), where differentiation has a greater impact on consumers, indicating the existence of higher competitive pressure.

11 – Freight rail transportation

Compared to the passenger rail transportation, competitive pressure is higher for the freight rail transportation. That because there is a higher number of operators in freight transportation.

Compared to the passenger rail transportation, competitive pressure is higher for the freight rail transportation. That because there is a higher number of operators in freight transportation.

Furthermore, the position of the traditional operator, CFR Marfa, is not as strong as in the case of passenger transportation.

Moreover, there is significant competitor similar to the size of CFR Marfa.

12.Civil liability auto insurance

13.Fuel distribution

This industry is among those with the lowest competitive pressure. This score is mainly the result of the structural characteristics of this industry, the most important being the high degree of market concentration created by the presence of a small number of market players.

This industry is among those with the lowest competitive pressure. This score is mainly the result of the structural characteristics of this industry, the most important being the high degree of market concentration created by the presence of a small number of market players.

Even if there are also independent distributors, most of the market is dominated by the filing station networks owned by the international groups.

Although the industry registered slight increases as filling station networks expand on the market, their hierarchy based on market shares is not strongly affected.

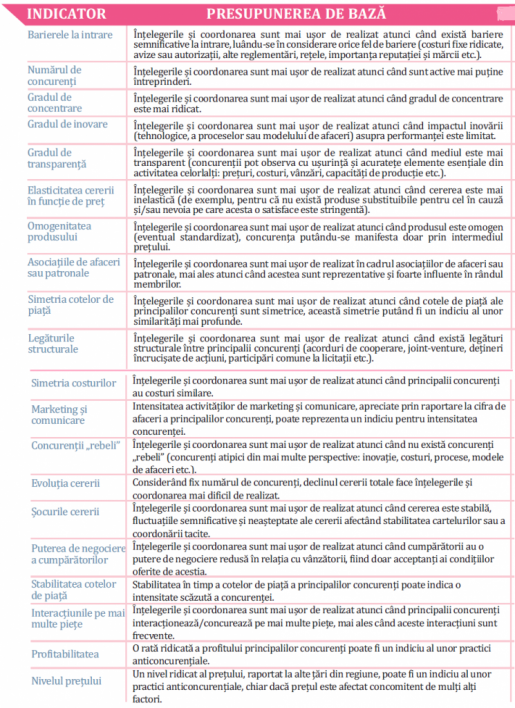

What are the primary indicators of IAPC

The Competition Council’s project regarding the aggregate Index of Competitive Pressure started in 2013. As competition is a complex and multidimensional phenomenon, there is no unique, specific competition index that can be used to directly measure tendency toward free expression of competition in certain national industries.

Therefore, IAPC proposes to measure this tendency by a set of 20 primary indicators, each reflecting part of the competition’s complexity.

*

Indicator Main assumption

Entry barriers Agreements and coordination are easier to achieve when there are significant barriers to entry, taking into consideration any type of such barrier (high fixed costs, permits or authorizations, other regulations, networks, importance of reputation and brand)

Number of competitors Agreements and coordination are easier to achieve when there are fewer enterprises on the market

Degree of concentration Agreements and coordination are easier to achieve when the concentration is higher

Degree of innovation Agreements and coordination are easier to achieve when the impact of innovation (in technology, processes or business model) on performance is limited

Degree of transparency Agreements and coordination are easier to achieve when the environment is more transparent (competitors can easily and accurately observe essential elements of the activity of others: prices, costs, sales, production capacities, etc.)

Price elasticity of demand Agreements and coordination are easier to achieve when demand is more inelastic (for instance, because there are no other products that can substitute the product offered and/or the need covered is stringent)

Product homogeneity Agreements and coordination are easier to achieve when the product is homogeneous (possibly standardized), competition being possible only in terms of price

Business or employer associations Agreements and coordination are easier to achieve within business or employer associations, especially when they are representative and highly influential among their members

Structural links Agreements and coordination are easier to achieve when there are structural links between the main competitors (cooperative agreements, joint venture, crossholdings of shares, joint participation in tenders, etc.)

Symmetry of costs Agreements and coordination are easier to achieve when the main competitors have similar costs

Marketing and communication The intensity of marketing and communication activities, considered by comparison to the turnover of the main competitors, may be seen as an indicator for the intensity of competition

“Maverick” competitors Agreements and coordination are easier to achieve when there are no “maverick” competitors (atypical competitors in several respects: innovation, costs, processes, business models, etc.)

Evolution of demand Considering that the number of competitors is fixed, the decline of the overall demand can make the agreements and coordination more difficult to achieve

Shocks of demand Agreements and coordination are easier to achieve when demand is stable, fluctuations in demand affecting the stability of cartels or tacit coordination between competitors

Buyer’s negotiation power Agreements and coordination are easier to achieve when buyers have low bargaining power, being mere acceptants of the conditions offered by sellers

Stability of market share The stability of market shares over time may indicate a low intensity of competition

Multi-market interaction Agreements and coordination are easier to achieve when the main competitors interact in several markets, especially when these interactions are frequent

Profitability A high profitability of the main competitors may be an indication of anti-competitive practices

Price level A high price level, relative to other countries, may be an indication of anti-competitive practices, even though the price is affected by many other factors simultaneously

*

Creation of IAPC within the Competition Council is not a unique approach; the Dutch competition authority (NMa) also proposed a somewhat similar approach in 2012.