The official data available since 2010 show an unbalancing in public finance that began in 2016 and reached a worrying level in 2018.

The official data available since 2010 show an unbalancing in public finance that began in 2016 and reached a worrying level in 2018.

Unfortunately, at the current level of taxation and collection capability, Romania has shown quite clearly that it can support in a sustainable way only 52% to 53% of the social assistance expenditures cumulated with the amounts needed to pay the public sector employees.

How much it can be done that has been proven to be sustainable

Simplified, the post-crisis adjustment model shows that about 7% of GDP can be allocated to public sector wages and 11% of GDP to social assistance (of which about two thirds to pensions, namely, interesting coincidence, also 7% of GDP). Of course, with the possibility of some minimal adjustments and offsets between these key components for the economic policy, but the idea would be that it is not recommended to exceed the 60% threshold of taxpayer money.

In fact, for about 30% of the budget revenues (to which, with the related risks, the three percentage points allowed by Maastricht criteria are mechanically added), about 18% is the share of pensions + salaries for which the influence on the general budget deficit would be negligible. That of course in the context in which we go with a budget of about 70% of the EU practice as a share of GDP.

In fact, the pronounced trend of increasing social assistance and health and education revenues would require a significant increase in budget revenues. Abruptly put, an increase in tax rates, because the hope of improving the revenue collection still remains a mirage of the public finance.

Otherwise, for the macroeconomic balance (which is like health, you are aware of its true value only when you lose it), we should maintain spending close to the level that was proven to be possible and reasonable for the financial stability in the interval 2013-2015, in line with the EU requirements.

*

- Year

- Social assistance (% expenditure)

- Staff expenditure (% expenditure)

- Social assistance (% GDP)

- Staff expenditure (% GDP)

*

How we are doing for the moment

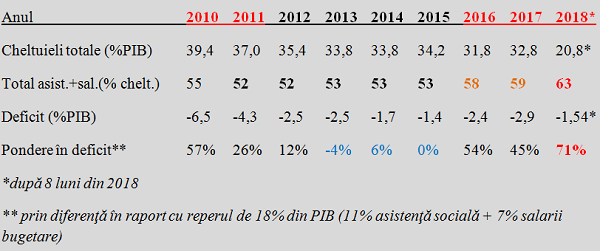

According to data available for the current year after eight months, the share of staff expenditure in the total budget expenditure went sharply up by another five percentage points and heads towards the 9% of GDP threshold. That is, above the 8.3% level achieved both last year and in the crisis year 2010 (when to be noted, public spending went close to 40% of GDP and the deficit rose to -6.5% of GDP).

*

- Year

- Total spending (% GDP)

- Total social assistance + salaries (% expenditure)

- Deficit (% GDP)

- Share in GDP **

- * after eight months of 2018

- ** by difference related to the benchmark of 18% of GDP (11% social assistance + 7% public sector salaries)

*

Although social assistance has reached the highest share of allocations, slightly higher than in 2010, staff expenditure has contributed decisively to inflaming the public deficit towards a contribution (calculated in relation to the 18% level arbitrary chosen but based on the previous experience) similar to the one from the peak of the crisis.

After the first eight months of the current year, even before other income increases (strategically extended for the coming years), the situation of pensions and public sector wages in terms of deficit share is reported to be even more problematic, despite the fact that it is on a trend of robust economic growth, even though not at the level initially expected.

And what we are heading to

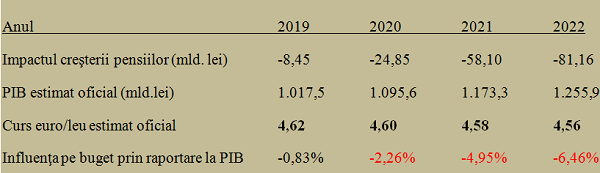

The increase in the amount needed for paying pensions from a level just above RON 60 billion a year in 2018 to about RON 140 billion per year will lead, according to the official data provided by CNSP, to the following situation of budgetary influences in the period 2019-2022 (even according to the figures from the explanatory memorandum of the new pension law):

*

- Year

- Impact of pension increase (billion RON)

- Officially estimated GDP (billion RON)

- Officially estimated Euro/RON exchange rate

- Influence on the budget by reference to GDP

*

The idea of the budget deficit (if we decide to go to the 3% of GDP threshold, otherwise reserved for crisis situations) is to create it for public infrastructure projects and to co-finance EU aid schemes with the chance to return the amounts spent in the form of economic achievement. Not to send it foolishly into consumption based on debt and increased foreign deficit.

Or, the one hundred per cent official data show that the new law will lead, even in the optimistic scenario of reaching the official GDP growth forecasts and systematically decreasing the euro/RON exchange rate, to a pension-only influence (we remind, only two-thirds of social assistance spending) more than double the public deficit allowed.

Incidentally or not, the deficit figure in 2010 (6.5%), registered after the pension increase approved in high speed in 2008 and the one (only) of influence in 2022 budget (6.46%) are like two peas in a pod. We will need again public spending pushed to 40% of GDP (assuming that we also achieve it in line with the official forecasts). Let’s see from where we get revenue collection to maintain the budget balance.