The trade deficit in the first eight months of this year was EUR 6,133.8 million, about 28% higher than the same period of the last year. Imports coverage rate based on exports dropped below 90% threshold that we exceeded in each of the years between 2013-2015.

The trade deficit in the first eight months of this year was EUR 6,133.8 million, about 28% higher than the same period of the last year. Imports coverage rate based on exports dropped below 90% threshold that we exceeded in each of the years between 2013-2015.

In the first eight months of 2016, imports grew at a pace significantly higher than exports (6.8% against 4.0%, in euro).

Noteworthy is the vigorous resumption of the foreign trade, which shows a trend change as compared to the previous month and steady rates as compared to the same month of the previous year (+ 13.4% for export and + 14.4% for import).

*

- Evolution of the imports coverage ratio by exports between 2009-2015

- Year 2009 2010 2011 2012 2013 2014 2015 2016*

- Coverage ratio FOB/FOB

- *on the first eight months

*

Considering the ratio of the value of the negative balance of foreign trade of goods to the preliminary GDP of the current year, the results is already minus 3.63% of GDP. That means a worrying final outcome close to minus EUR 10 billion.

With regard to the current account, situation was partially compensated by the addition registered in services and the money transfer from Romanians working abroad.

The negative balance of the extra-Community trade has visibly increased

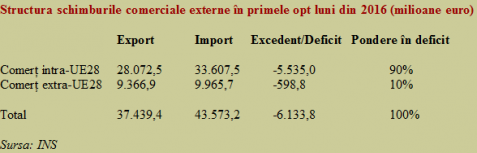

Trade with EU countries was EUR 28.07 billion in exports (75.0% of total exports) and EUR 33.61 billion in import (77.1% of total imports). About 90% of the deficit comes from the intra-Community trade, which means a lack of competitiveness as compared to the EU colleagues in covering the additional domestic demand, especially on the consumer goods segment.

On the extra-Community side, exports amounted EUR 9.37 billion (25.0% of total exports) and imports EUR 9.97 billion (22.9% of total imports). The negative balance on this section continued to deepen and reached to almost 10% of the trade deficit. To recall, our country had managed in 2013 and 2014 to balance trade with non-EU region and even get a small surplus.

*

- Structure of the foreign trade in the first eight months of 2016 (million euro)

- Export Import Surplus /Deficit Share of deficit

- Intra-EU28 trade

- Extra- EU28 trade

- Total

- Source: National Institute of Statistics

*

Good evolution of machinery and transport equipment exports, cancelled by consumer goods imports

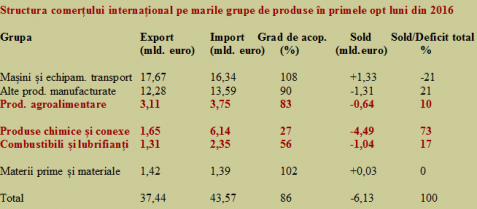

Structurally, 47.2% of the Romanian exports are represented by machinery and transport equipment. It is basically the only category of products with a positive outcome that also improves by 21% the negative balance of the total trade. This result is cancelled on the segment of other manufactured products, with external deliveries EUR 1.3 billion below imports.

*

- Structure of international trade on main product categories in the first eight months of 2016

- Category export (billion euro) import (billion euro) Coverage ratio (%) Balance (billion euro) Balance/Total deficit (%)

- Machinery and equipment for transport

- Other manufactured products

- Agri-food products

- Chemicals and related products

- Fuel and lubricants

- Raw materials

- Total

*

The gap between exports and imports of chemicals and their related products is the biggest problem of the foreign trade. Against the background of closing large production capacities from the socialist period, it has come to represent almost three quarters of the trade deficit. If we add the import of fuel and lubricants, oddly high for a country with resources and tradition in refining, we will reach to 90% of the negative result.

The difference of 10% comes from the agri-food products, where situation has been deteriorating in the recent years as result of the increasing purchasing power of the population who puts pressure on imports; about two years ago we had managed to balance trade of these goods. The food industry has failed to keep pace with the changing Romanian consumers’ expectations with regard the quality-price ratio.

As regards the small addition at the raw materials category (exports outpaced for the first time the fuels and lubricants category!) it is not good news taking into account the decrease resulted in the value added for the exported products.