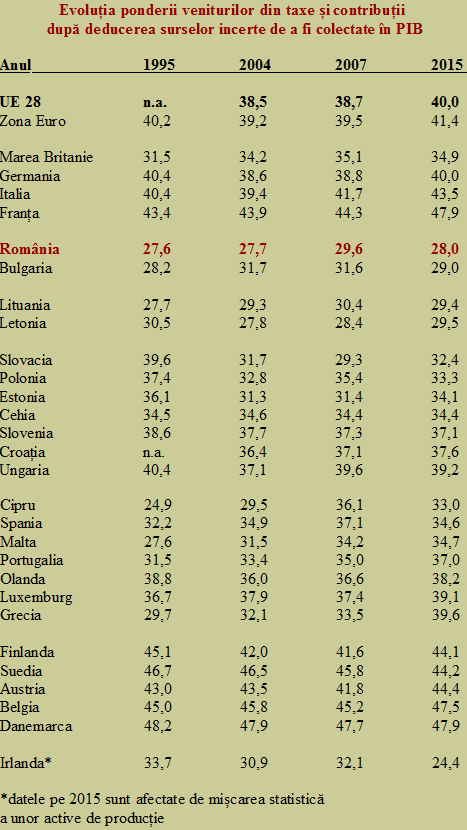

Eurostat records list Romania as the country with the lowest public revenue among the EU member states, except for the strictly circumstantial case of Ireland.

Eurostat records list Romania as the country with the lowest public revenue among the EU member states, except for the strictly circumstantial case of Ireland.

With only 28% of GDP representing clear revenues from taxes, available for subsequent reallocation to expenses, we are below Bulgaria (29% of GDP) and far from the EU average (40%).

Ireland appears on the list with revenues of 24.4% of GDP in 2015 only because a few large transnational companies have statistically relocated their business to this country with only four and a half million inhabitants, following the announced exit of UK from the EU. The result was a statistical advance of GDP / capita from year to year by 25.5%, obviously impossible to obtain from the real development of the economy.

We should mention that in order to eliminate various expedients for obtaining money for the budget and detect exactly the part related to the stable taxation policy of the member states, Eurostat calculated only what can clearly be collected to the budget. This part depends strictly on the countries’ economic performance, all comparable with one another.

Romania – in a totally different movie than the European practices

*

- Evolution of the revenues from tax and contributions, after deduction of uncertain sources to be collected, as share of GDP

- Year

- Ireland*

- * data for 2015 are influenced by the statistical evolution of some production assets

*

Romania is clearly positioned outside the framework of the European practices in terms of budget revenues. The country should increase taxes and / or improve their collection by 5% to reach the level of Bulgaria, about 20% to catch up with Slovakia, Poland and the Czech Republic and about 40% if it was to get close to the EU average, as Hungary.

Instead of harmonizing the local practice with the European experience, we went around in circles in thinking about taxation and constantly lamented about the quality of public services, insufficient investments and too low salaries in healthcare or education.

Moreover, unlike most of the states that relatively recently accessed the EU, we (along with our Bulgarian friends) have decreased the share of state revenues in GDP after the accession, instead of increasing or even maintaining it at about the same level.

Briefly, you cannot make bricks without straw and cannot get blood out of a stone. If it were possible, we should see major Western economies, with all their GDP per capita, functioning with an income as a share of GDP below 30% and how they would manage money effectively without stealing. There is no reason why, given our level of economic development and citizens’ consciousness, we should be more efficient.

Before reaching a Western-like way to allocate benefits to expenses, we should FIRST establish the same Western-like manner of increasing the budget revenues. Or at least in a manner closer to the central and eastern region of the continent. Whether the voters like it or not, better quality services need higher taxes paid, anywhere in the world. And transition to Eurozone requires even higher revenues as share of GDP.

The fairy tale about reducing taxation simultaneously with the rise of social benefits delivered for the moment because we had a provision, about to run short, in the small labour’s share of the economy’s result; this part which historically maintains low could accommodate some increase for the moment, without causing major problems.

It cannot work this way repeatedly because the direction will rapidly close and the competitiveness will be impaired, as we have now competitiveness based on price rather than quality, including (more recently) in terms of workforce.

Specific problem: a comparison with Poland

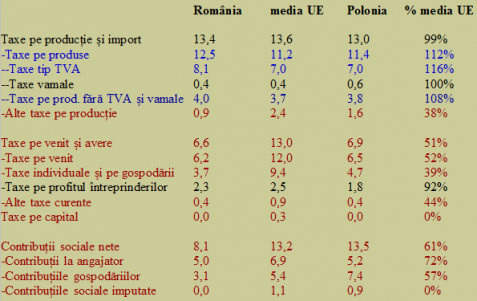

Below we present the actual situation (for 2015), for which we also considered Poland as a reference and model, as well as an excuse for our small revenue as a share of GDP:

*

- Tax on production and imports Romania EU average Poland % of EU average

- Taxes on production and imports

- – Taxes on goods

- — VAT type of taxes

- — Custom duties

- — Taxes on products, except for VAT and custom duties

- – Other taxes on products

- Income and wealth taxes

- – Income taxes

- – Individual taxes on households

- – Corporate taxes

- – Other current taxes

- Capital tax

- Net social contributions

- – Contributions from employer

- – Households’ contributions

- – Imputed social contributions

*

One can see how taxes on goods and imports are absolutely at the European level and would even exceed it if we found some more taxes related to production.

In terms of collected VAT, we are even 16% above the EU average as share of GDP, although we are among the last in terms of payment compliance rate, so the solution is not found here.

The difference comes from the critical aspect of the income and wealth taxes, as only the taxation of businesses is at European level.

In terms of individual and household taxation we are in the poorest state, with only 39%, which means that we should increase the amounts collected this way to the budget two and a half times (!!) for our ” Europeanisation” or at least by 30% to overtake the Poles.

The Poles are ahead of us in terms of budget revenues as share of GDP for a single reason. The reason is called social contributions, which are even higher in their case than the European average. Again, the difference does not come from the employers or businesses, but the households’ contributions. They are too small, being the ones that generate most of the difference between us and the Poles and not the contribution level for employers which is almost similar.

Is there anyone who dares to tell the Romanians that households pay taxes and social contributions too low for them to benefit from acceptable conditions in hospitals or schools?

Until then, it is a stupidity to pretend that you can abundantly provide benefits in the election years, asserting indefinitely that we have GDP growth.