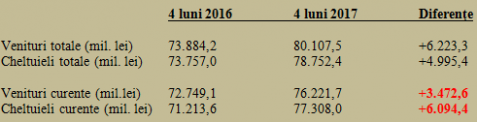

The consolidated general budget ended the first four months of 2017 with a small surplus of 0.17% of the estimated GDP for the current year, according to data released by the Ministry of Finance. Compared to the same period of last year, both public revenues increased by slightly more than 6 billion lei and public expenditures by about five billion lei.

The consolidated general budget ended the first four months of 2017 with a small surplus of 0.17% of the estimated GDP for the current year, according to data released by the Ministry of Finance. Compared to the same period of last year, both public revenues increased by slightly more than 6 billion lei and public expenditures by about five billion lei.

To be noted though, CURRENT revenues increased by only 4.8%, well below the rate of total revenues (+ 8.4%), while CURRENT expenditures advanced by 8.6%, significantly above the rate of + 6.8% recorded by total expenditure. In translation, for the time being, and in the current situation, the overall result may look good, even better than last year (when the four-month surplus was + 0.02% of GDP).

*

- Total revenues (million lei)

- Total expenditure (million lei)

- Current revenues (million lei)

- Current expenditure (million lei)

*

So, we reached a point where we need to be very careful because the result looks much better than the TREND of the public finances.

„Budgetary doping” took place by sharply increasing the salaries in the budgetary sector (+18.1% in staff expenditures, namely two and a half times the increase of total state revenues and almost four times the rate of increase of the current revenues) and without the basis of a productivity growth in the real economy.

Where deficits are hiding, though

If selecting the most important components of the budget revenues, we can see, synthetically, the effect of the economic policies presented during the election campaign and later implemented. The combination meant to stimulate the economic growth, by reducing VAT while increasing the revenues, had the following result:

*

- Period four months 2016 four months 2017 Change

- VAT

- State insurance contribution

- Partial total

*

The result of this mix is almost double the amount of 1,228.0 million lei that appear as a surplus of the general consolidated budget at the end of the first third of this year.

VAT has been cut from 24% to 19% and the decrease in revenues was much lower than the one resulting from the rule of three, amid the growth (stimulated) of consumption, which brought the share of the imported products to 50% of the total.

At the same time, the taxation of state wage increases based on the system of moving more money from one pocket to another induced an increase of coverage in the social security budget (up to 75% and with a slight increase since the beginning of the year), health insurance budget (reached 88%, but stationary) and unemployment (brought to a implausible and unnecessary 217%)

*

- Budgets Specific contributions Expenses Coverage

- – social security

- – national health insurance fund

- – unemployment budget

- Source: Ministry of Finance, own calculations

*

To be noted, although it managed to make the necessary transfers from the state budget to balance the social security budget (otherwise, mandatory according to the law), the Executive remained indebted in the healthcare sector, where a deficit of nearly one billion lei has been already registered at the end of the first four months (more precisely, 845 million lei).

How the officially announced surplus fits in with the deficiencies of the healthcare system remains to be clarified by those who have decided to tighten the belt for hospitals and medicines to favour the income increases that smell of election bonus and the positive results on paper. Obviously, for those who are sick or already passed away, the income increase remained to be worth the paper on which they were written.

Local surplus to offset general deficit

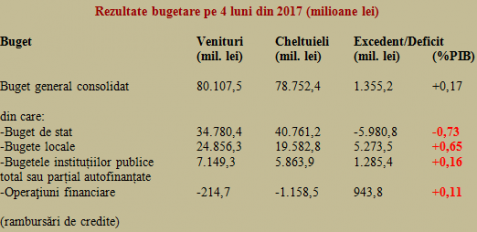

To identify the structure of surpluses and deficits within the consolidated general budget, we made a suggestive selection of the main components. From which it is clearly seen how „who takes the lion’s share”. More precisely, it maintains local budgets on a solid surplus despite the many problems faced by municipalities, to compensate for the centrally distributed benefits that cause a budget deficit of -0.73% after the first four months of the year.

*

- Budget results after first four months of 2017 (million lei)

- Budget Revenues (million lei) Expenditure (million lei) Surplus/Deficit (million lei) %GDP

- General consolidated budget

- Of which:

- – state budget

- – local budgets

- – budgets of fully or partially self-financed public institutions

- – financial operations

- (loans reimbursements)

*

It should also be noted that, as a direct consequence of tax cuts, the share of state budget revenues in total public finances dropped to only 43%, while expenditure stood at 52%. The contrast increases this way between the resources weakened by tax cuts and the social obligations undertaken, which characterizes a sort of left-right policy.

Salaries and pensions instead of investment

A selection of expenditures made in the first four months of the year shows the effects of the philosophy of increasing the wages in the public sector, way beyond the economic growth, plus the increase in pensions and social benefits, along with the sharp decline in investment.

The result is the impact accepted on the potential of future growth to send money to today’s consumption.

*

- Evolution of budget expenditure on first four months of 2017

- Period four months 2016 (billion lei) four months 2017 (billion lei) Change (billion lei) Share

- Total expenditure

- Of which:

- – staff expenditure

- – social assistance

- – goods and services

- – projects financed by external grants (cumulated 2007-2013 and 2014-2020)

*

Unfortunately, this unhealthy mix will expand in the second half of the year, when there are planned new wage increases in the public sector and a hard to explain and sustain increase of pensions by another nine percent, which will bring the increase of this category of income to 15% in 2017 (and all the years to come). This is somewhat triple the economic growth forecast, to which pensioners obviously do not contribute.

But let’s suppose, under these circumstances, that all would be good, beautiful and feasible. There is a simple question though: who will pay the bill?