Romania’s economy is becoming more and more vulnerable due to the increasing number of businesses that state no revenues, register losses and debts exceeding their paying capacity and propagate a toxic behaviour, tolerated by regulations and a lenient supervision.

Romania’s economy is becoming more and more vulnerable due to the increasing number of businesses that state no revenues, register losses and debts exceeding their paying capacity and propagate a toxic behaviour, tolerated by regulations and a lenient supervision.

Moreover, according to a study by economist Iancu Guda, most of the toxic companies are registered in sectors related to the consumption, which means their existence has been encouraged by the Government’s policy of an unsustainable stimulation as a result of the fiscal loosening and wage increases.

Toxic companies

Companies that do not have any activity (zero revenue) accounted for 28% of all companies registered in Romania at the end of 2017, compared to 19% in 2009, indicates the study.

Over-indebted companies (negative own equity) accounted for 45% of all companies registered in Romania at the end of 2017, compared to 37% in 2008, also tells the study quoted.

The phenomenon also came to the attention of the National Bank of Romania (BNR), which notes that „undercapitalised companies (over 60,000) account for 30% of the debt registered in the sector of non-financial companies, but for 62% of the non-financial arrears in the economy.”

In addition, these statistics „do not fully reflect the picture” of the economy because they are based on companies that submit their financial statements for half a year and „are considered to be more efficient”, according to BNR Report on financial stability.

Ghosts from „consumption area”

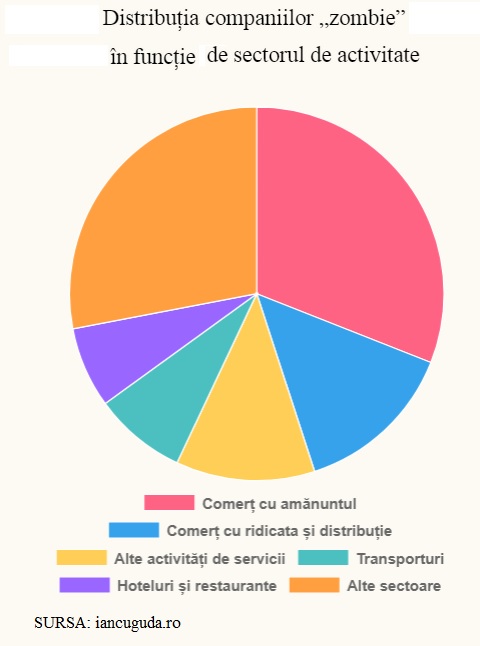

In the consumption-related sectors, two-thirds of more than 60,000 undercapitalised and loss-making companies are still active, respectively:

- retail (31%)

- wholesale trade (14%)

- other activities and services (12%)

- transport (8%) and

- hotels and restaurants (7%)

*

- Distribution of “zombie” companies by field of activity

- retail

- wholesale trade and distribution

- other activities and services transport

- hotels and restaurants other sectors

*

These are companies that:

- have a negative own equity (could not pay their debts even if they sold all their assets),

- have a negative net result (losses) and

- have a negative operating profit or below the interest expense

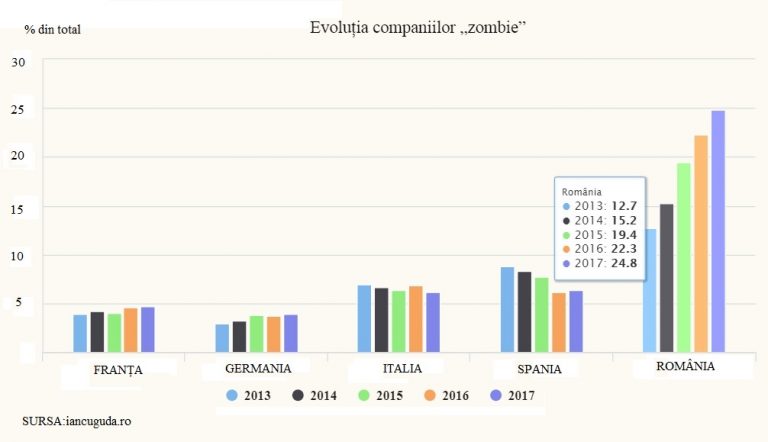

The proportion of „zombie companies”, as Iancu Guda calls them, has almost doubled over the past five years, to 24.7% at the end of last year, and „is 4-6 times the average in developed countries” shows the study mentioned.

*

- % of total Evolution of „zombie” companies

- France Germany Italy Spain Romania

*

In this case, companies that at least succeeded to submit their financial statements for three consecutive years have been taken into account.

The vulnerability of the business environment due to the high proportion of „ghost” companies increases to the extent of „the negative effects these companies propagate on several channels,” namely:

- the increase of unemployment when the default is ordered and even before that,

- losses caused to creditors and

- tax losses;

- „Zombie” companies propagate a harmful effect of worsening payment behaviour by the contagion effect to business partners;

- „A high proportion of toxic companies in the business environment also has the following effects:

- Lower the confidence level among companies,

- Decrease competitiveness of active companies in Romania and caps the competition (which means it does not stimulate innovation) and long-term investment due to unfair competition practices.”

The BNR says that „over the past three years, loss-making firms accounted for more than a third of active companies and losses amounted to RON 33 billion in 2016″.

Penalizing these companies and possibly removing them from the register after a certain more restrictive period, a harsher legislation and a more efficient distribution of the non-reimbursable funds, possibly by strategically allocating them to active and efficient companies are just some of the solutions for the phenomenon of companies that are toxic for the economy.