The voting machine of the Chamber of Deputies (decision chamber) approved on Wednesday – 174 votes for, 98 against and 3 abstentions – the Law on the establishment of the Sovereign Development and Investment Fund (FSDI):

33 large companies and a capital contribution of RON 9 billion are to be managed by an institution whose leaders will be appointed by the Government who seem to have the immediate mission to sell state assets by non-transparent criteria.

The project has been included in the programs of the last three governments, but Prime Ministers Grindeanu and Tudose have blocked the initiative that has Liviu Dragnea among the signatories.

A controversial project that does not take into account some of Eurostat’s recommendations issued in April 2018, which PNL and USR immediately announced they would challenge to the Constitutional Court.

The big problem of this fund: the lack of transparency in the activity, since major governmental decisions are taken at the Parliament Palace, not at Victoria Palace, in the context that we are talking about the assets of some strategic companies.

Amendments, problems, problems …: a way of concealing debts

Compared to the version approved by the Senate, important amendments occurred:

- The cash contribution to the social capital was increased to RON 9 billion, compared to RON 1.85 billion, as approved by the Senate.

- 10 companies with uncertain profitability were added to the Fund’s portfolio.

- Performance indicators will be established by the MFP, but without „consulting an advisory committee”, which included in the initial version representatives of the BNR, ASF and the market.

The law was passed without expecting Eurostat to classify the FSDI as a company outside the public administration sector, with no impact on the budget deficit and public debt.

At the same time, the Legislative Council’s comments were ignored:

- „Sources of financing, for replacing some reduced budgetary revenues, or, if the case, the increase in expenditures committed, had to be identified”;

- „It would have been necessary to produce an impact assessment” to „estimate the costs and benefits and identify the difficulties in the implementation of the law”;

- „Does not provide in a clear manner for the elements justifying the exemption of FSDI from the applicability of the corporate governance law”.

The explanatory memorandum of the law only states that „in later years” state revenue losses will be recovered by transferring the dividends by the companies to which it will become the majority shareholder, replacing various ministries.

In 2018, the state expects to receive more than RON 3.5 billion from the companies where it is the shareholder.

FSDI portfolio

The Fund’s portfolio will comprise state holdings in 33 companies.

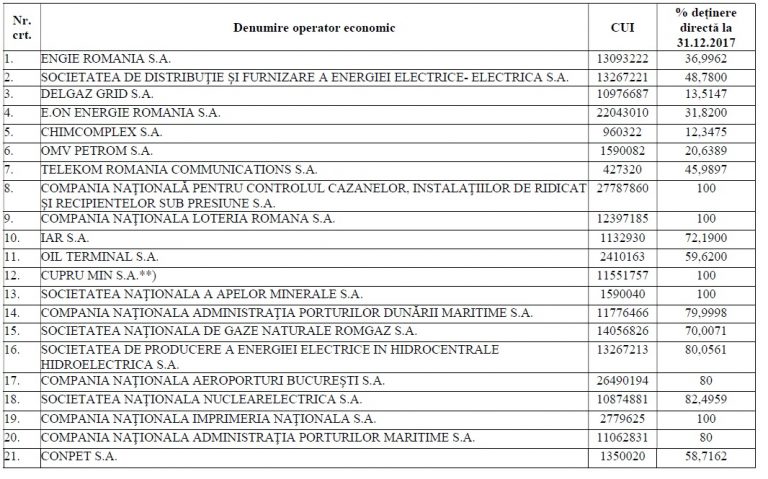

In the bill submitted to the Senate debate, 21 companies were included:

*

- Name of company Fiscal registration code % direct shareholding at 31.12.2017

*

The Senate also included at the time of voting stakes of Antibiotice Iasi and Unifarm National Company.

During the vote on Wednesday in the Chamber of Deputies, the list has been extended to 10 other companies with volatile profitability:

Complexul Energetic Oltenia, Compania Nationala de Cai Ferate CFR, Societatea Nationala de Radiocomunicatii, Compania Nationala Posta Romana, Societatea Nationala Aeroportul International Timisoara – Traian Vuia, Uzina Termoelectrica Midia, Telecomunicatii CFR, Societatea de Tratament Balnear si Recuperare a Capacitatii de Munca (TBRCM), Compania Nationala Administratia Canalelor Navigabile, Compania Nationala Administratia Porturilor Dunarii Fluviale.

Big questions

- Rights and obligations arising from the quality of the Romanian state as a majority FSDI shareholder are exercised on its behalf by the Ministry of Public Finance (MFP).

- „FSDI aims at:

- developing and financing from own funds and attracted funds, cost-effective and sustainable investment projects in various economic sectors through a direct participation or other investment funds or investment companies, stand-alone or along with other institutional or private investors, as well as the management of its own financial assets, in order to obtain profit”, according to the law.

- The Fund’s investment strategy will be approved by the Government and should be „correlated with a set of short, medium and long-term performance indicators targeting:

- infrastructure development in Romania;

- job creation;

- stimulating innovation and new technologies;

- increasing human capital in the long run;

- increasing the competitiveness of the Romanian economy”, according to a PSD’s amendment adopted by the Economic Policy Committee.

- The achievement of FSDI’s targets is also assessed by MFP.

- Financing of the FSDI will be made by:

- revenues from dividends paid by companies from the portfolio;

- revenues from transactions with financial instruments issued by other entities,

- revenues from selling shares from the portfolio,

- loans, including through bond issuing.

- The FSDI will be held accountable to the majority shareholder (represented by MFP) for accomplishing the mandate and will report quarterly to the MFP the statement of assets and liabilities as well as the approved investments.

Aurelian Dochia: I cannot understand the economic fundamentals of this Fund; it is naive to talk about governance criteria

cdg.ro: The Chamber of Deputies has approved the establishment of FSDI, how useful do you think it is beyond the controversy registered over the last year?

cdg.ro: The Chamber of Deputies has approved the establishment of FSDI, how useful do you think it is beyond the controversy registered over the last year?

I cannot understand the economic fundamentals of this fund.

First, companies with good returns and profits pay, or at least were paying, this profit to the state budget – let us not forget that in 2017 there were consistent payments to the state.

In the new formula, money comes out of the Ministry of Finance’s pocket and goes into the pocket of a fund that will not be subject to public control. This is the biggest problem.

cdg.ro: At the declaratory level, we shall have somebody in charge of major investment…

This would be the second issue, I do not know on what criteria the investments will be made.

I understand that we are talking about financing the construction of hospitals, motorways…. The money for these projects could come from other sources, not to mention the fact that the Ministry of Finance can also make investments.

cdg.ro: But the Fund will have more freedom of action

The fund can also attract money through loans, and it is obvious that it will guarantee these loans with the shares it holds. The Fund can also sell shares, and therefore have a very big decision role in the administration of the assets it holds.

Again, the issue is the unclear control over these activities.

cdg.ro: No argument for the FSDI’s utility?

I do not believe we needed this tool, especially since we generally have a problem with the efficient management of stakes held in state-owned companies.

It seems that things will improve in this area, we have the ordinance 109, the Ministry of Finance has created a monitoring structure that could have become professional but we see that we are regressing.

I think this fund is well regarded by the political class – we are talking, aren’t we, of the emergence of an institution with well-paid positions, where the political relationship will have a decisive say in terms of appointments. It’s naive to talk about governance criteria.