The season of dividends starts also in 2018 strongly stimulated by the government memorandum that forces state-owned companies to allocate „at least” 90% of their 2017 profits to dividends.

The season of dividends starts also in 2018 strongly stimulated by the government memorandum that forces state-owned companies to allocate „at least” 90% of their 2017 profits to dividends.

On the other hand, energy companies have investment plans of hundreds of millions of euros.

Only the amount representing the dividends from the 2017 profits to be received by the Government from the largest companies where it is a shareholder will exceed 3.53 billion lei, according to the calculations of cursdeguvernare.ro, based on the preliminary results of the companies and on brokers’ estimations.

The amount is comparable to what was collected last year, which also includes the so-called „special dividends” generated from reserves.

The state budget in 2018 provided for over RON 3,593 million in dividend revenues, very close to the estimation above, based on the results reported by companies in the first three quarters of 2017.

*

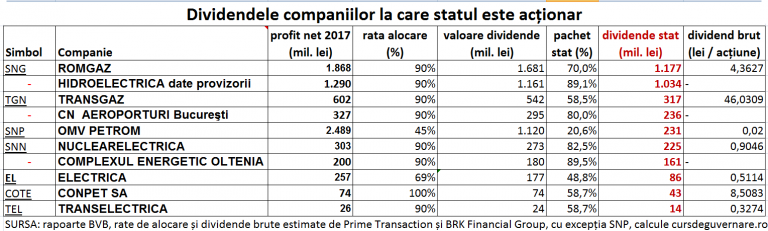

- Dividends of companies where the state is a shareholder

- Symbol Company Net profit in 2017 (million lei) allocation ratio value of dividends (million lei) state-owned stake dividends to the state (million lei) gross dividends (RON/share)

*

To dividends from last year’s profits it could be added, the same as in 2017, other levies from companies’ own funds, although much of the profits stated in previous years have already been written off because of the Government’s hunger for money.

The state collected last year more than RON 2.5 billion from the usual dividends and about RON 1.2 billion from the so-called „special dividends” taken from the reserves, according to a statement made in October by the Minister of Finance at the time, Ionut Misa.

Dividends vs. investments

Energy companies, which provide most of the state dividend revenues, have high investment needs.

Romgaz (SNG), for example, will continue to develop the exploration project in north-eastern Muntenia (Caragele), to which EUR 100 million will be allocated, for investments in new wells, said the company’s General Manager in November last year.

Romgaz (SNG), for example, will continue to develop the exploration project in north-eastern Muntenia (Caragele), to which EUR 100 million will be allocated, for investments in new wells, said the company’s General Manager in November last year.

Transgaz (TGN) borrowed last week EUR 60 million from the EBRD for the construction of a segment of the trans-European BRUA pipeline. The total investment in BRUA is estimated at EUR 480 million, of which almost EUR 180 million are European funds.

Transelectrica (TEL) also gets indebted for investment. „The net financial result in the period January-December 2017 was negative, of RON 21 million, due to the evolution of the position corresponding to other financial revenues influenced by the exchange rate of the domestic currency related to foreign currencies (euro and dollar) in which the company obtained bank loans to finance investment programs,” says the 2017 preliminary report.

Transelectrica (TEL) also gets indebted for investment. „The net financial result in the period January-December 2017 was negative, of RON 21 million, due to the evolution of the position corresponding to other financial revenues influenced by the exchange rate of the domestic currency related to foreign currencies (euro and dollar) in which the company obtained bank loans to finance investment programs,” says the 2017 preliminary report.

Companies listed on the Stock Exchange are, overall, careful about maintaining investors’ interest and prices of their shares at the highest levels, according to the stock market analysts. On the other hand, the energy companies’ investment projects require hundreds of millions of euros.

State-owned companies should be assessed on a case-by-case basis to determine what share of their profits will go to dividends, according to Razvan Nicolescu (foto), a senior expert at Deloitte and former Energy Minister.

„Every company is a case. Sometimes you can take 100%, sometimes you cannot take anything. You need to look at the company’s indebtedness, its investment plans, whether its indebtedness allows loan contracting. As a rule, any percentage is wrong,” the expert said, quoted by Agerpres.

„Every company is a case. Sometimes you can take 100%, sometimes you cannot take anything. You need to look at the company’s indebtedness, its investment plans, whether its indebtedness allows loan contracting. As a rule, any percentage is wrong,” the expert said, quoted by Agerpres.

Previously, the Energy Minister Anton Anton had declared that 90% of the companies’ profits would go to the state budget and from there would return to companies for investment. Minister’s argument: companies have not spent the money.

„If I had found that the companies where we are shareholders had made investments from the money they earned, I would have been disturbed by the fact that the profit disappears. But after seeing that the companies have collected the money in their treasury, boasting that they have some reserves, the fact that these reserves go, and I emphasize that, do not go investor’s pockets as dividends but to the national budget and return to the national investment budget, I believe this is about a faster movement of money and maybe this will make investments more efficient and the number of investments will increase,” Anton Anton said.

Rising yields

Romania could repeat the record of 2017, when it ranked first in a global ranking of frontier markets, with yields exceeding 40% in dollars in the first half of the year.

In 2018 as well, the BET TR index of the Bucharest Stock Exchange (BSE) approaches the peak of the last five years. The index is of a „total return” type because it „reflects both the evolution of the prices of the companies it includes (13 most important and most liquid shares on BSE, editor’s note) and the dividends they pay” according to its statute.

The big state-owned energy companies have a share of over 27% in the BET TR portfolio, and they will also pay the most substantial dividends.

The big state-owned energy companies have a share of over 27% in the BET TR portfolio, and they will also pay the most substantial dividends.

The yields on dividends of the most popular shares on the BSE are more than promising. The dividend “dictatorship” continues on the BSE: it will remain in power in 2018 as well,” write analysts with Prime Transaction investment company.

*

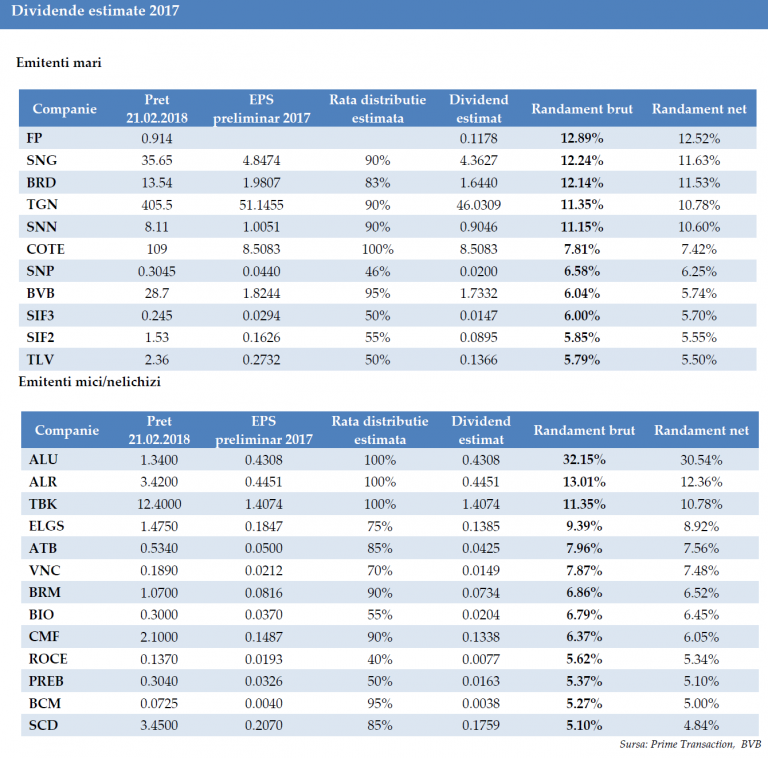

- Dividends estimated in 2017

- Large share issuers

- Company price preliminary 2017 EPS estimated distribution ratio estimated dividend gross yield ned yield

- Small not liquid share issuers

*