The financing costs of Romania and Hungary have increased, while costs of other Central European countries have maintained steady in the last week – with the mention that Romania has, anyway, double yields compared to Hungary.

The financing costs of Romania and Hungary have increased, while costs of other Central European countries have maintained steady in the last week – with the mention that Romania has, anyway, double yields compared to Hungary.

But perspectives for Bucharest are even more unfavourable, though.

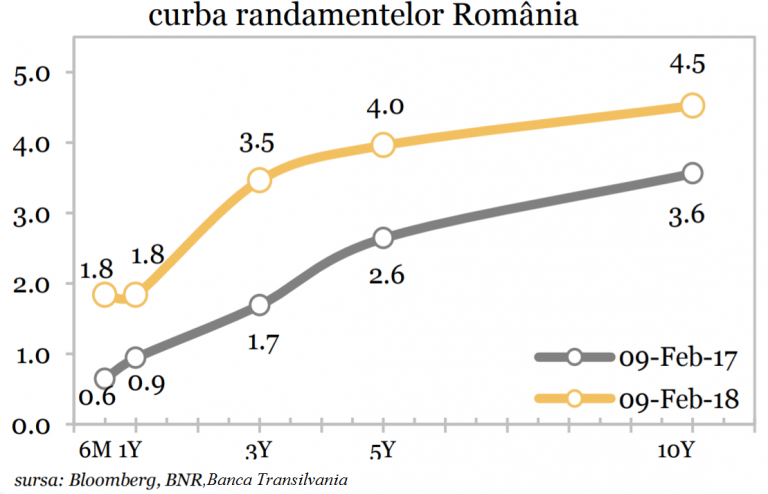

In Romania, „interest rates have consolidated on mid and long-term maturities on the government securities market. The yield curves reached 4.525% for the maturity of 10 years,” according to a note released on Monday by Banca Transilvania (BT).

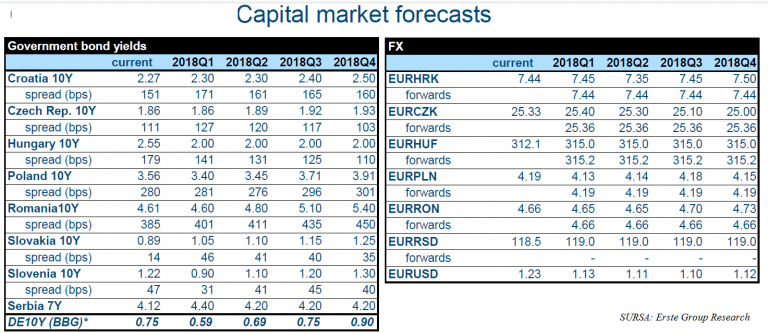

The perspective for Romanian yields is less favourable than for Hungarian ones: the Romanian ones could increase to 5.4% at the end of the year and the Hungarian yields could decline from 2.55 – 2.6%, now, down to 2% even starting this quarter, a level that could maintain until December, according to Erste Group Research (EGR) estimates.

*

- Yield curves – Romania

*

Yields for short-term maturities remained almost constant „under the influence of a significant liquidity surplus in the market,” EGR analysts say in a report issued Monday.

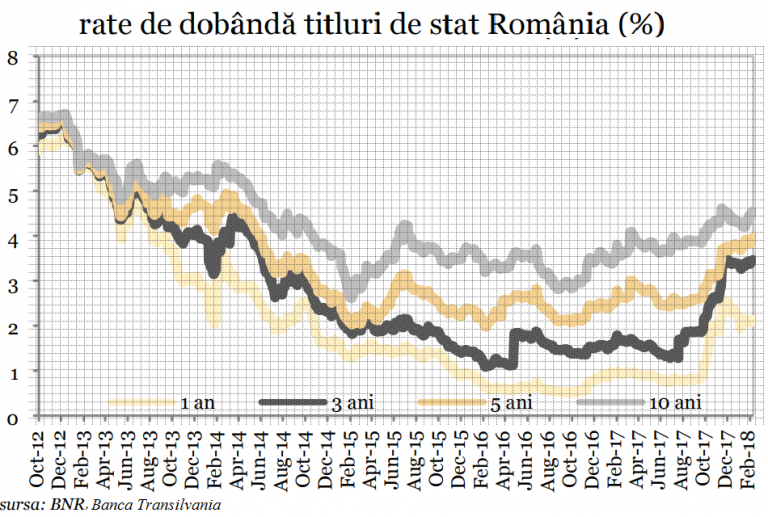

The deficit of trade balance of goods registered a record level in the last month of 2017 (EUR 1.6 billion), and the inflationary pressures forced the BNR to raise the monetary policy rate for the second time in a month, to 2.25%.

„The above developments, coupled with those in the global government bond markets, led to an upward shift in the yield curve by five base points on average last week. The interest rate on the 10-year maturity increased by 0.9% to 4.525% (plus 4.9% in 2018),” says a BT report.

*

- Interest rates on government bonds in Romania

*

Last week’s auction launched by the Romanian Ministry of Finance on the primary market gave „mixed” signals: „modest” market demand in the Monday’s auction for the bonds with the maturity in 2022 and „issuances below objectives but with a strong interest from investors in the Thursday’s auction for bonds with maturity in 2024,” consider EGR analysts.

The state attracted 45 million lei with the bond issue with the maturity in April 2024 at an average annual cost of 4.35% at a recent additional auction, reminds a BT note.

„It is hard to discern how much of this growth on the curve (yields) was the result of the correction on the global stock markets and how much due to domestic factors such as the inflation surge and the risks associated with the current account and budget deficits,” says the EGR report.

The other CEE states

Hungarian benchmark yields with a 10-year maturity jumped to 2.6% recently versus 2.02% at the end of last year, and the spread of German bonds rose to 19 percentage points, up to 179 pp.

„This means that despite the MNB’s efforts to maintain the entire yield curve as low as possible, the domestic government bond market has not resisted to the global market shifts,” the EGR report said.

„This means that despite the MNB’s efforts to maintain the entire yield curve as low as possible, the domestic government bond market has not resisted to the global market shifts,” the EGR report said.

The National Bank of Hungary (MNB) has changed its rhetoric not long ago, saying it will primarily focus on the spreads of the yields of the country’s bonds and those of the major global issuers, especially Germany. So, the effect of global turmoil could not be avoided.

In Poland, both 10-year government securities and the zloty exchange rate varied within a narrow range. The yield of 10-year bonds rose from 3.55% to 3.6% and could further increase to 3.91%.

The case of the Czech Republic is the happy one: low macroeconomic risks, current account surplus. The central bank followed its policy of a gradual increase in the interest rate and the koruna went up.

The yield of Czech bonds with a 10-year maturity is and will be 1.86% at least in the first quarter of 2018, with marginal growth perspectives up to 1.93% at the end of the year. Global turmoil had no impact on Czech bonds, EGR analysts say.

Currency perspective

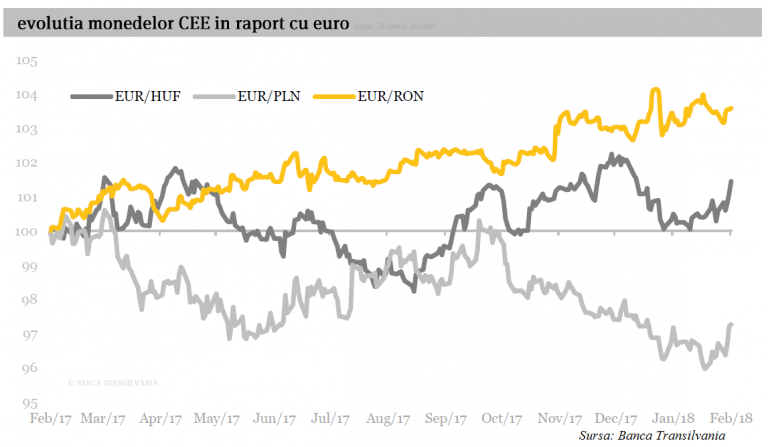

The comparison must also consider the currency evolution.

*

- Evolution of CEE currency against euro

*

Compared to the Romanian leu, euro evolved within a relatively tight range between 4.63 and 4.66 lei during the last week, „Nothing special”, says EGR, whose estimate is 4.73 lei/euro in the last quarter of 2018.

However, stability is expected from the Hungarian forint, from 312 forints/euro now, to 315 during the year.

In Poland, the zloty’s variation is also insignificant: euro went up from 4.15 zloty last Monday to 4.19 zlotys now and could be only 4.15 zloty in the last quarter.