Romania equalled the UK at the top of European countries in terms of negative balance on the current account to GDP in the third quarter of 2018, with 1.5% (in nominal terms, EUR -3.2 billion for us and EUR -35.4 billion the British) according to data published by Eurostat. That, in the context that the European Union recorded a total current account surplus of EUR 38.7 billion (1% of EU28 GDP and you see how the performance would have been almost double without the UK result).

In fact, 18 countries out of 28 have had significant surpluses, Romania’s main partner countries in the foreign trade, Germany (EUR +51.7 billion) and Italy (EUR +15.1 billion), with the Netherlands (EUR +20.5 billion) between them on the podium of positive results.

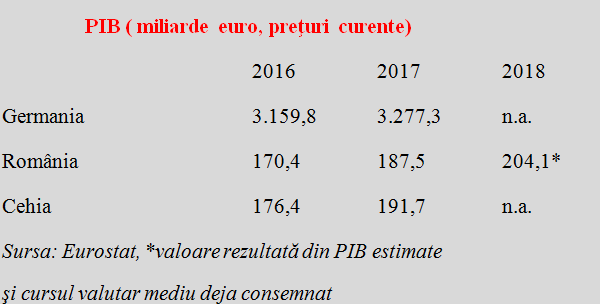

In order to have a relevant image beside the winner Germany, we chose for the comparison with us a country with a similar GDP to ours and a similar currency regime, which has already reached a convergence at a level somehow where we would like to reach before adopting the single currency: the Czech Republic.

*

- GDP (billion euro, current prices)

- Germany

- Romania

- Czech Republic

*

On „fast forward”, namely through the sustained policy of increasing revenue, it would be possible to equalize the Czech GDP in 2018 (the difference in the population should not be disregarded, as they are almost two times fewer, namely about 10.6 million people in 2017).

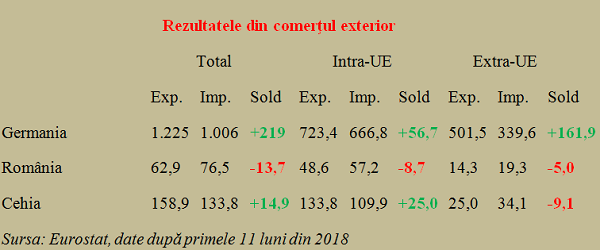

But, pay attention to the results of foreign trade:

*

- Results of foreign trade

- Total Intra-EU Extra-EU

- Export Import Balance Export Import Balance Export Import Balance

- Germany

- Romania

- Czech Republic

*

It can be seen that the Czech Republic followed the German model and recorded a significant surplus in trade of goods with foreign countries.

With dimensions of the economy comparable to Romania, Czech exports were about two and a half times our exports and the trade balance about the same size. Only that it was on minus in our case and on plus in theirs.

Very interesting, although it scored a minus of 80% on the extra-EU relationship, the Czech Republic managed an impressive plus of 25 billion in the intra-EU segment, an area to which it is more strongly oriented than us (Romania has about three quarters of the foreign exchanges with the EU, the Czech Republic goes up to five-sixths).

Equally interesting is the German surplus (an economy with a shared trade, somewhat surprisingly, below 60% with EU countries and some over 40% outside the EU), a trade surplus that, with about 7% of GDP, is similar to our deficit and higher than Czechs’ deficit, even if the economies’ proportion stays the same.

And much more interesting is what Germans made with the extra money resulting from their competitiveness and massive deliveries abroad.

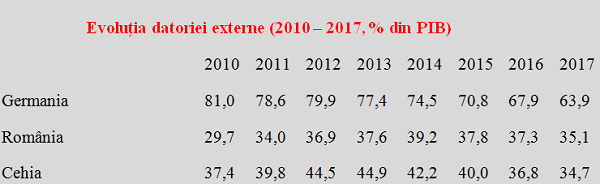

That is, since they have nagged others to make order in their public finances and allocate public money in a responsible way, they have reduced their external debt share of GDP to the 60% threshold imposed by the Maastricht criteria, from over 80% recorded no earlier than 2010 (and that despite the fact that they pay interest with an order of magnitude below Romania).

*

- Evolution of foreign debt (2010-2017, % of GDP)

- Germany

- Romania

- Czech Republic

*

When you get to pay half of your deficit on interest…

It is worth noticing how, since 2013, the Czechs have entered a similar trend, reduced the gap to us (we came after a tripling in public debt as a result of the measures taken around 2007-2008 just before the economic crisis) and with an economic growth lower than ours, they managed to lower the external debt as a share of GDP below ours (although they also paid interest a few times lower).

Basically, without exaggerating but firmly, Germany has reduced its debt stock by about EUR 200 billion since 2013 and took advantage of good economic results that generated revenues in foreign currency and economic exchanges with a favourable balance. While the Czechs have strived to do the same (see the rebounds in 2015 and 2017), we continued to systematically increase the stock of financial liabilities (the explanation was that our external deficits did not help) and be content with the drop expressed in percentage of GDP.

*

- Foreign debt evolution (2010-2017, billion euro)

- Germany

- Romania

- Czech Republic

*

Beyond the fact that we have tax revenues to public budget (about 25% of GDP) much lower than Germany (about 40% of GDP) or the Czech Republic (about 35% of GDP), we got to pay extra each year about a half of the deficit of 3% of GDP only allowed for interest, given the increase in public debt between the year of the EU accession, 2007 (it was 11.9% of GDP then) to a peak of 39.2% of GDP in 2014 and about 35 % of GDP now but for interest rates that went well beyond 4% per year.

Instead of looking at the external deficits stimulated by the excessive revenue policy in relation to the otherwise robust economic growth, we have further come up with socially desirable social policies but unsustainable in the medium term and with contradictory measures (if not even harmful to the economic environment) on the taxation side.

That, instead of optimizing fund allocations with the growth and freeing up somehow more quickly the tax space filled with debts. If not by the „soft” German reduction of the stock, at least by stabilizing it as Czechs did. Whose indebtedness level we are surely heading to (with much higher payments as interest), but without any effect on investment and infrastructure, but on consumption, for the net benefit of other economies.

There are some issues to which we should pay attention. To see what determines the countries that were proven to be successful in doing so, and how we can converge, as good EU members, towards the good practices in terms of macroeconomic stability, even though we are rushing to eliminate the development gaps.