The current pace of developing the natural gas system infrastructure exposes our country to the risk of long-term energy insecurity in case of some predictable adverse scenarios.

The current pace of developing the natural gas system infrastructure exposes our country to the risk of long-term energy insecurity in case of some predictable adverse scenarios.

The quantity available for consumption could decrease by 20% in 2020 and over 30% in 2030 if the only projects were those on which a definitive investment decision has been made, according to the study „Prospects for natural gas in Romania”, launched on Tuesday by the Oil and Gas Employers’ Federation (FPPG).

„The scenario of a prolonged interruption of gas supplies through Ukraine in January-February indicates an energy security risk for Romania,” the study said.

The largest contribution to the domestic supply security can be made by the Black Sea deposits in the horizon of 2030.

At the same time, the measures taken by the authorities shock and the support provided to Transgaz (TNG, operator of the National Transmission System – SNT) is not adequate.

„Romania’s special vulnerability”

Romania’s interconnection with neighbouring gas transmission systems is not sufficient, says another study conclusion.

The study states that „Romania’s special vulnerability” to the transit through Ukraine, as well as Russia’s interruption of flows on this route as of 2020, emphasize the importance of a strategic planning and the immediate development of infrastructure projects and alternative natural gas supply solutions„.

If the development of gas infrastructure is limited to projects that now have a „final investment decision”, „the disruption level in Romania in 2020 will be more than 20% (namely, the available quantity for consumption decreases by 20%)” and go above 30% in 2030.

Estimates „emphasize our country as the most exposed in the long run to a massive disruption of the natural gas supply through Ukraine”.

And even if all the projects of common interest (PIC) in the country and the region are to be realized after 2020, „the disturbance remains significant, namely over 20% in 2030„, says the study, made by experts Vasile Iuga and Radu Dudau.

Projects of common interest that would somehow diminish the supply disturbance are:

- BRUA,

- Eastring,

- Greece-Bulgaria bidirectional interconnector,

- Trans-Adriatic TAP pipeline or

- the capacity increase of the GNL regasification terminal from Revithoussa, Greece, according to the study.

*

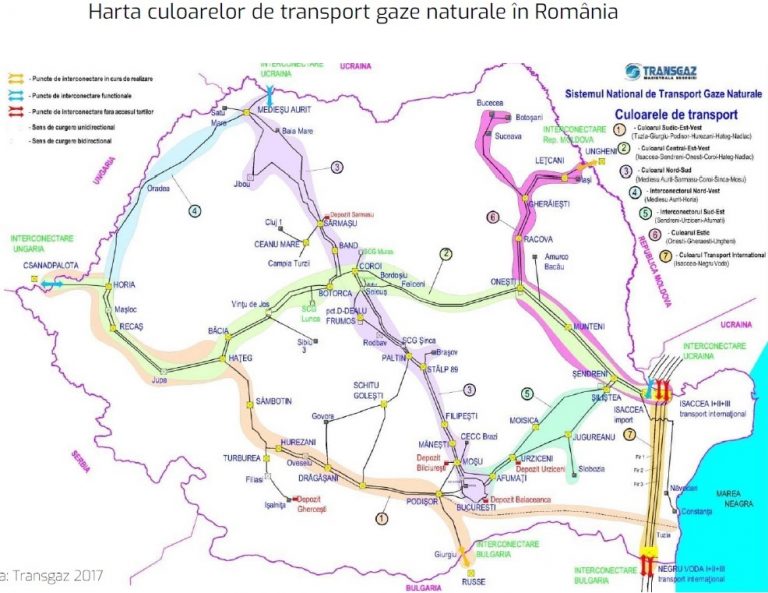

- Map of natural gas transmission corridors in Romania Interconnection points – implementation underway

- Functional interconnection points

- Interconnection points with no access provided to third parties

- unidirectional flow

- two ways flow

- National Gas Transmission System Transmission corridors

- South –East- West corridor

- Centre – East – West corridor

- North – South corridor

- North – West interconnector

- South East interconnector

- East corridor

- International transmission corridor

*

„Increasing difficulties in meeting the demand for natural gas in Romania are anticipated in the context of a rising demand and a declining domestic production, which is, however, not less than half of the total natural gas production of countries from the Southern Corridor.”

Bizarre regulations

Romanian experts’ study notes, however, the actions of the Chamber of Deputies’ Industry and Services Committee and the recent authorities’ decisions having adverse effects on the development of the natural gas sector and, consequently, of the economy:

- some of the interests livening the committee seek for establishing a monopoly of OPCOM (the state trading platform) on the centralized gas market, although more than 90% of centralized transactions take place on the Romanian Commodities Exchange (BRM).

A volume of 64.27 TWh of natural gas was sold on BRM between January and November 2017 in 593 auctions, accounting for over 50% of the volume of wholesale transactions and no less than 60% of Romania’s total gas production in 2016, says the study.

- the introduction by the Chamber of Deputies of the tax on extra revenues has the effect of reducing the competitiveness of domestic gas production compared to imports delivered by Gazprom, which has a quasi-monopoly on regional sales.

Besides, such a tax on „extraordinary profits” (windfall tax) should have a limited validity (1-2 years), not an indefinite term,” the study says.

- ANRM’s decision to establish an index on the Central European hub in Vienna (CEGH), which does not include long-term contracts, as a reference price for calculating the royalty on natural gas production. The study considers the decision negligent and inappropriate.

„Romania does not deliver natural gas on CEGH, which has a decoupled evolution from the Romanian market,” the study notes.

Instead, „international practice consists of:

- either paying royalties at a reference price formed on those markets (which, in Romania, would involve efforts of authorities and market participants to develop a trading, liquid and transparent hub)

- or at the actual price formed by producers (in fact, the maximum of the actual price recorded and the reference price set by law) „.

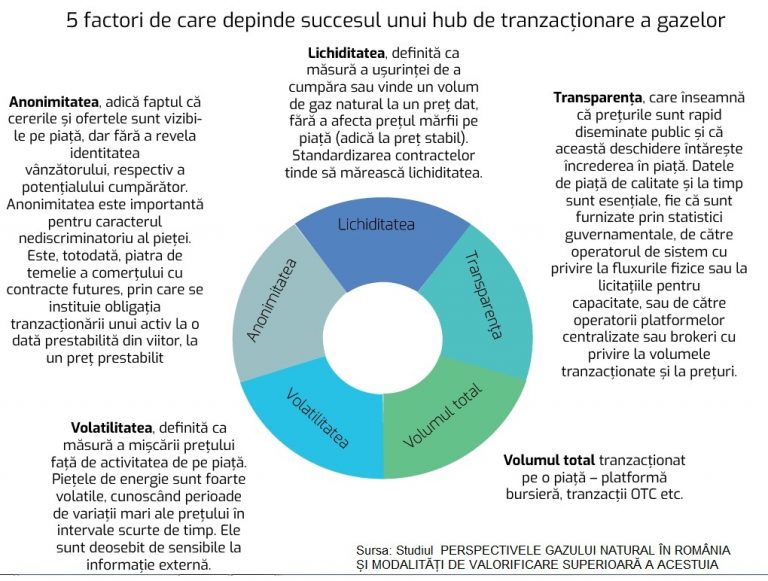

Authorities should work on the success of a trading hub in Romania, which depends on several factors:

Five factors on which the success of a gas transactions hub depends

Five factors on which the success of a gas transactions hub depends

Anonymity, meaning that demands and offers are visible on the market without revealing the identity of the seller or the potential buyer. It is important for the not discriminatory nature of the market. In the same time, it is the cornerstone of future contract trading by which the obligation is set for trading an asset at a pre-set date from the future, at a pre-established price

Liquidity, defined as a measure of the ease in selling or buying a volume of natural gas at a given price without affecting the merchandise price on the market (which means, at a stable price). Standardizing contracts tend to increase liquidity.

Transparency – means that prices are quickly publicly disseminated and this openness strengthens the confidence in the market. Quality and timely market data are essential, whether they are provided by government statistics, the system operator, on physical flows or the capacity auctions, or the operators of the centralized platforms or brokers, on traded volumes and prices.

Volatility – defined as the measure of the price movement against the market activity. Energy markets are very volatile and have periods of high price variations within a short period of time. They are extremely sensitive to the external information.

Total volume traded on a market – exchange platform, OTC transactions, etc.

Royalties stake

The balance between state’s interests and those of gas producers regarding a certain level is achieved by delicate negotiations. On the one hand, the „price” of natural resources must be in line with their value and, on the other hand, it must encourage investment.

But more recently, the Parliament’s vote on Law on offshore oil operations was postponed Monday for next week, the tax regime for Black Sea natural gas being primarily at stake.

The new postponement of the law comes in the context when US deputy secretary of state for Europe and Eurasia, Wess Mitchell, said on Monday in Bucharest that „we are closely following the developments and we hope that the Parliament adopts a law on the offshore to encourage investment by tax-related mechanisms and the way it is structured.”

The US official believes that „the solution for Romania will be to systematically create an environment where its resources support the European energy security.”

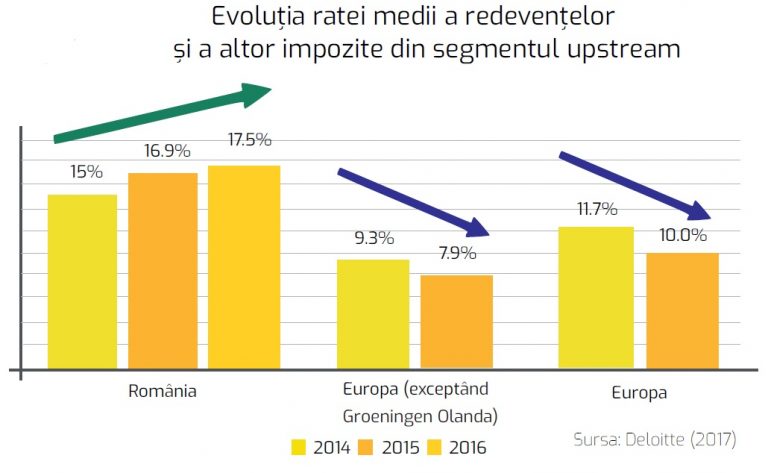

Further, the study recalls that, while the aggregate taxation in the upstream segment has increased in Romania from 15% to 17.5% of the profit between 2014 and 2016, in Europe it has decreased, in the context of the crude oil price collapse (consequently, also in the profit of producing companies) from 11.7% to 10% – even to 7.9%, if the Groningen giant deposit in the Netherlands, which has a separate tax system due to its special productivity, is exempted from analysis (a Deloitte Romania analysis).

*

- Evolution of average royalty rate and other taxes in the upstream segment

- Romania Europe (excepting Groningen) Europe

*

In 2016, Romania applies an effective tax rate among the highest in the EU oil and gas sectors, well above the 2015 average of 10%.

„Of course, the abovementioned regulations adopted or in the proposal stage, on the reference price for calculating royalties tend to determine a further increase in the effective tax rate.

Interconnection

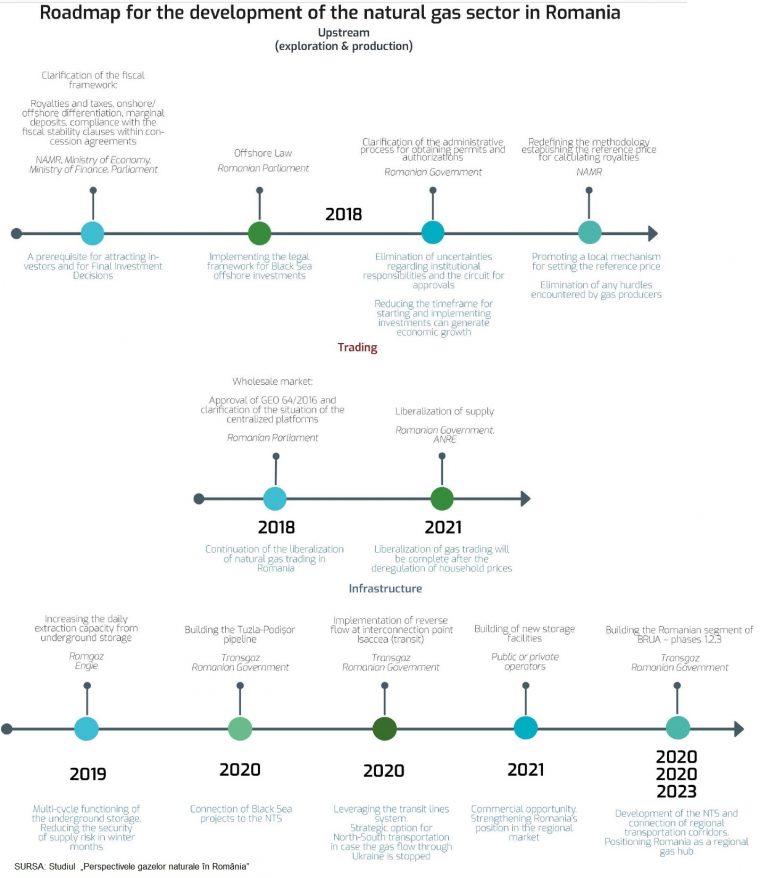

For an effective regional interconnection, more steps must be taken in the upstream segment, trading systems and the infrastructure:

Regional interconnection – advantages in terms of „energy security, but also commercial, economic and political benefits”:

Regional interconnection – advantages in terms of „energy security, but also commercial, economic and political benefits”:

- gives Romania an important position in the functioning of regional markets and in energy security arrangements.

- predictability and security of supply to consumers by the development of a transparent and liquid domestic market, also supported by the two-way connection with the Central European Gas Hub of Baumgarten (CEGH) through BRUA: will give to consumers;

- increased revenues from transport tariffs by increasing the volume transported through the SNT, which assumes its strategic role of ensuring the transition from the Southern Gas Corridor to Central and Western Europe;

- the access of Romanian gas producers to regional and European markets will stimulate investments in the upstream segment and infrastructure.

„This is an indispensable condition for the development of the offshore gas sector,” the study says.

- domestic and industrial consumers in Romania will benefit from the effects of competition between natural gas sources by connecting to regional transport corridors, which allows supplying from the Caspian Basin (Southern Corridor), East Mediterranean and GNL (Vertical Corridor) and others;

- underground storage of natural gas (which has a significant geological potential for expansion) can be developed and modernized on a commercial basis in a regional market context, according to the report.

Transgaz

The role of the National Transmission System Operator (SNT) is obstructed by the fact that, in recent years, it achieved „only to a small proportion the investment plans for the maintenance and development of gas infrastructure,” the study says.

Here is the status of Transgaz investment projects included in 2017-2026 investment plan presented in the recent ENTSO-G (European Network of Transmission System Operators for Gas) report on the aggregate regional investment plan for the infrastructure of Southern Corridor countries.

*

- Transgaz investment plan for 2017-2026

- Project Status Entry into service

- Bulgaria-Romania interconnection Final investment decision (DFI) Dec 2016

- SNT development in South-Eastern Romania Non-DFI, advanced stage 2018

- SNT interconnection with the distribution system and reversing the flow in Isaccea Non-DFI (PIC 6.15) 2019

- New SNT developments for the exploitations in the Black Sea Non-DFI 2019

- Developing SNT on the Romanian territory: BRUA 1st phase – DFI (PIC 6.24.2)

- 2nd phase – Non-DFI, advanced stage (PIC 6.25.7) 2020

- Development of Southern Corridor on the Romanian territory Non-DFI, advanced stage (PIC 6.24.8) 2020

- Eastring- Romania Non-DFI (PIC 6.25.1) 2021

- BRUA expansion – 3rd phase Non-DFI (PIC 6.25.3) 2023

*

The physical interconnection capacity is further limited by the low operating pressure compared to the pressure regimes in the neighbouring countries.”

Transgaz’s investment capacity is diminished by the Government itself, which has not abandoned the dividend distribution of almost the entire profit obtained in 2017, despite the request from the company’s management for the distribution proportion to be limited to 50%.