The average euro/leu exchange rate registered in 2017 the highest increase in the last five years, and the rate at the end of the year had the most consistent advance in the last eight years, according to official data.

The average euro/leu exchange rate registered in 2017 the highest increase in the last five years, and the rate at the end of the year had the most consistent advance in the last eight years, according to official data.

However, the levels of 1.72% and 2.61%, respectively, are relatively low compared to the international practice, where fluctuations within the Euro-dollar-pound trio are much more important.

The difference is that those economies are stronger and allow for higher fluctuations in exchange rates, while the Romanian economy is much less robust and expectations regarding the local currency’s stability are much higher, precisely because in most of the nine years between 2009 and 2017, variations were quite minor, up to one percent or slightly above.

As a matter of fact, Romania would have passed the test of the ERM II mechanism, which precedes the euro adoption, in terms of exchange rate fluctuations, imposed within the range of +/- 15% on this criterion (for reference let us remember that Slovaks did not fall exactly within the range at the 2009 accession and a change in the central parity was needed at the last minute).

It should be noted that, even in the peak crisis, when GDP fell by more than seven percent and the exchange rate was re-set to the limit that would have been imposed by ERM II, the year-end change has been limited to slightly more than six percent. Which at that moment represented in itself a success that had gone unnoticed if it would not have been criticized by those who were hoping for a chaos in the currency market.

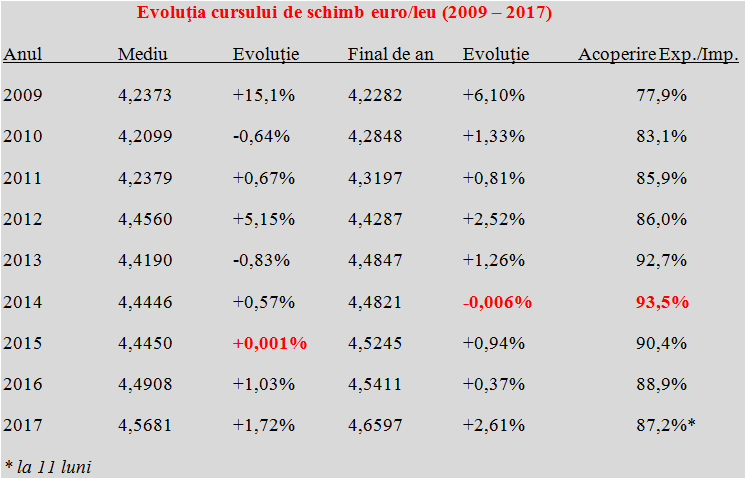

Back to our theme, the decision to accelerate exports, the field that brought us out of the economic crisis has been reversed as soon as we saw ourselves out of the problems. We can see that if we observe both the import coverage ratio by the exports (FOB/FOB values, namely the most favourable ones) and the evolution of the exchange rate – see the table.

*

- Evolution of euro/leu exchange rate (2009-2017)

- Year average change year-end change export/import coverage ratio

*

It can be easily deduced the importance of a reasonably high coverage ratio (at least 90%) for the capacity to pay for imports of goods with money obtained from the export of goods. Not that it would not have been worthwhile to go even higher, to 100%, to reduce dependence on foreign investment that come to fill the gap created and balance the currency market, along with the surplus in services.

It is certain that the increasingly clearer shifting toward almost exclusively domestic consumption (foreign trade has come to negatively affect GDP) could not affect the exchange rate more clearly. Modified from 4.49 lei/euro, the initial average level planned and used for the 2017 budget to 4.56 lei/euro, near reached (without any rounding).

And this in the context in which the trend does not look good at all, if we look at the gap between the starting value in 2017, the annual average and the value reached when the year ended. With an average placed at less than a quarter, as a position in the increase range versus the starting level and more than three quarters compared to the final level.

It is important to note that in the analysed period it is only the second year when the average value is between the starting and the final value (after 2012, which looks similar to 2017 both in terms of the exchange rate evolution over the year and the coverage ratio). Which could be bad but also good, if we would somehow manage to rebalance the growth with the focus on exports and bring the average value of the exchange rate back BELOW the levels registered at the beginning of the year and at the end of the year, as in all other years presented.

All in all, previous data, based on a long practice, shows that a slow, orderly, calm and limited retreat on positions that can be rationally supported is optimal. The decrease in the average euro/leu exchange rate from almost 4.57 lei/euro, the average level for 2017, to 4.55 lei/euro (included in the 2018 budget law) appears rather hazardous, given the start from the level of 4.66 lei/euro, even if we admit the happy case of the average below the limits of the interval.

The inflation differential is increasingly clearer between us and the Eurozone and leaves little operating room. But an appreciation in real terms of the Romanian leu (desirable in principle, but in disagreement with the fiscal-budgetary measures) in the context of an expanding trade deficit makes no sense, it would only further affect the external competitiveness. The maximum attention would be towards reversing the decrease tendency in the coverage ratio to at least the critical threshold of 90%.

Of course, the variation of the national currency will also be in the way of a nominal drop of the exchange rate and the central bank will try to mitigate the speculative exuberance. The currency regime we chosen is a controlled floatation, but it can neither be transformed into a sort of floating control, because the market is a market. And at the end of the day you can only admit, with higher or lower costs, possibly supplemented by professionalism, the harsh reality of the economic fundamentals and free transactions.