The application of pension change in the mid-year, by nine percentage points last year (when the pension point was arbitrarily rounded from 917.50 lei to 1,000 lei) and ten percentage points this year, has the effect of increasing, but also more and more unbalancing the purchasing power of pensions, an income that theoretically was relatively stable over the course of a year.

The application of pension change in the mid-year, by nine percentage points last year (when the pension point was arbitrarily rounded from 917.50 lei to 1,000 lei) and ten percentage points this year, has the effect of increasing, but also more and more unbalancing the purchasing power of pensions, an income that theoretically was relatively stable over the course of a year.

The phenomenon was amplified and will continue to be amplified by the way inflation has evolved and will place the perception of those concerned in a sort of a roller coaster. With uneven increases that will drive the standard of living advance in a „stop and go” manner throughout the budget year.

Of course, it can be said that changing the value of the pension point at the beginning of the year would also have a similar effect.

It is only that in the current programming period, the expectation for resuming pension increases that citizens become accustomed to is made at times arbitrarily set. That radically changes the situation at the political level but, unfortunately, also at the level of the budget provisions.

*

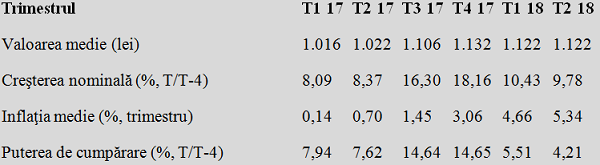

- Quarter Q1 17 Q2 17 Q3 17 Q417 Q1 18 Q2 18

- Average value (RON)

- Nominal increase (%, Q/Q4)

- Average inflation (%, quarter)

- Purchasing power (%, Q/Q4)

*

Specifically, instead of clearly connecting an average salary for a given year to a stable average pension over that budget year, a correlation should be made with a pro-rata value based on how many months it stayed at a certain level of the retirement point, and how many months at another level (we remind that pensions are based on wages by taxing them by CAS).

„Drug withdrawal”

To get a better example, in 2018, the average pension point value is RON 1,050, which resulted from six months with RON 1,000 and six months with RON 1,100. If we also add the inflation rate, to which the significant increase in wages also contributed (especially in the public sector), we obtain a lesser growth in purchasing power than in 2017.

As well as a more pronounced imbalance in the purchasing power advance, with the emphasis on the result of a picture type, made at a certain moment (chosen) instead of a continuous and sustainable process. Official data leads to a double increase in the purchasing power of pensions in the second half of 2017 compared to the first half.

Followed by a decline to one-third in the first half of 2018 and, of course, the current return toward the seven percentage points from the first half of 2017 (most probably a nominal increase of about 11.5% in the second half of the year, generated by the 10% indexation combined with the decrease of the average pension in 2018 compared to Q4 2017, to which the inflation decrease to 3.5% will be added).

Consequences of “drug withdrawal”: increasingly difficult financing

By this way of working, the „drug withdrawal” state will deepen and financing will be more and more difficult. In 2019, even if no indexation of the pension point would be applied, 4.8% higher budget revenue would already be needed (it starts from the pension point of RON 1,100, not from the average of RON 1,050 provided under the 2018 budget).

After a certain short-term moderation of these latent imbalances in 2019 (15% indexing will be made earlier, in April before the elections for the European Parliament scheduled in late May), two indexations would be made in 2020, one in the spring, by 10.7% (the percentage results from a new arbitrary rounding up to RON 1,400) and another in autumn by 26.8% (in October, before the national elections in November).

The imbalance will be even more pronounced, with a nominal difference of 40% between the first and the last quarter. It is one thing to have a pension point of RON 1,460, equally distributed throughout the year, and something else to start from RON 1,265 at January 1, maintain it at RON 1,400 for six months and then steeply increase it to RON 1,775.

Practically, to an annual average pension point of RON 1,460 in 2020, we shall have a starting level of RON 1,775 in 2021. Already 21.5% higher, implicitly involving the corresponding need for budget allocations.

Obviously, such a growth rate cannot be reached in wages (from which, we remind, pensions are paid) in the context of preserving the stability of prices (the National Commission for Strategy and Prognosis foresees an increase of only 7.2% in the average gross salary at an average inflation right within the target of 2.5%).