Officially published statistical data reveals a massive paradox:

Officially published statistical data reveals a massive paradox:

Romania is the country that can register a robust year-on-year growth based on a construction sector which is on a downward trend.

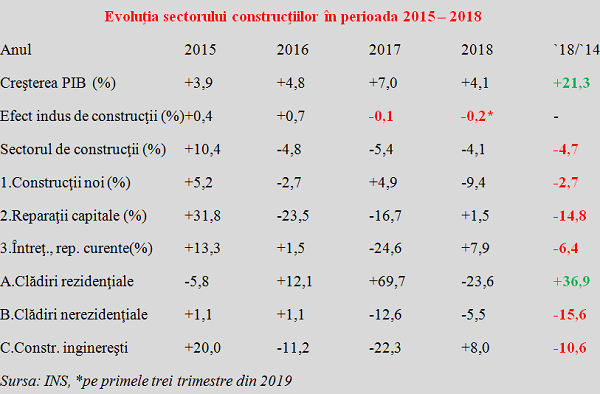

We chose 2014 as a reference basis for 2018, as it marked the emergence from the economic crisis and the resumption of the GDP growth trend.

As we can see, in contrast to the overall economic growth, the construction sector had a relatively weak evolution until it got to have a negative impact on the economic outcome over the past two years.

That appears to be bizarre for a country undergoing a process of development and recovering the gap to the West.

*

Evolution of the construction sector between 2015-2018

Year

GDP growth

Construction sector impact

Construction sector

- New constructions

- Overhauls

- Maintenance, on-going refurbishment

A- Residential buildings

B- Non-residential buildings

C- Engineering construction

*

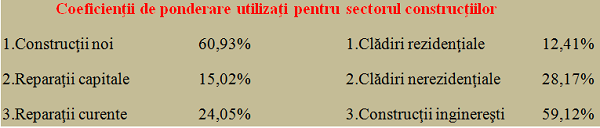

In order to have a clearer picture of the relative importance and the effects on the overall sectorial outcome, it would be important to see how the weights used for the calculation in the structure and by construction objectives.

Simplified, the situation would be like this:

new buildings count for about 60% and refurbishments to existing buildings for 40% or 40% buildings (of which less than one third for habitation!) and 60% engineering constructions (see table).

*

Weighting coefficients used for the construction sector

- New constructions Residential buildings

- Overhauls Non-residential buildings

- On-going refurbishment Engineering construction

*

2018 – below, yes! – than 2014

So we witnessed declines in 2018 compared to 2014 almost across the board, with significant values in non-residential buildings (to be seen rather as greenfield investments), overhauls (namely bringing back industrial halls to parameters, etc.), and construction engineering (here it should be read that activity, already anaemic in terms of infrastructure, with an emphasis on motorways, declined).

Decreases largely driven by the inability to use the European funds made available (of course, by complying with rules that made them less attractive to local private interests) and budgetary allocations increasingly managed by the populist system which means cutting from investments in order to allocate social benefits and wages (in order to meet, even with a near miss, deficit rules).

The only segment that has grown over the last four years, the residential construction, suddenly speeded down in 2018 after the significant expansion in 2017 (which, however, did not prevent us from having a negative overall impact on GDP). In addition, to be noted, it represents less than one eighth in the sectorial structure in terms of weight in the final outcome.

In this context, the question is whether we could go on with this economic development style with the handbrake on in constructions.

A terse comparison with „others”

For the time being, we have managed somehow, but if we look at the rest of the EU countries, it seems that we are doing what it should. For this, it is enough to remember that European statistics place us only on the 16th position out of 28 in the EU by construction sector share, with only 0.7% of the European total.

That is, well below the GDP share of about 1.25%, and especially well below economies with a GDP similar to ours, such as the Czech Republic (1.2% construction share in EU) and Portugal (1.0% share). So countries that already have a much more efficient road system than ours.

Also for reference, our Hungarian neighbours have a 0.7% construction share in the EU with 0.8% of EU’s total GDP, whereas in Bulgaria’s case weights are the same, namely 0.3%. Even though Poland also has a percentage gap similar to ours (3% of the EU GDP, with 2.4% in construction), the ratio of their indicators, placed at 80%, does not resemble the one below 60% in our case.

Sooner or later, the costs of insufficient infrastructure development will contribute to capping the economic growth and affect the standard of living, including public services (roads, schools, hospitals), despite the apparently favourable economic growth figures, currently on paper.