Finance Minister Ionut Misa announced on Thursday, at the beginning of the cabinet meeting, new amendments to the Tax Code, measures promised months ago by PSD that has been regularly revising them.

Finance Minister Ionut Misa announced on Thursday, at the beginning of the cabinet meeting, new amendments to the Tax Code, measures promised months ago by PSD that has been regularly revising them.

Without any further comments, we shall outline them below and we shall see whether the political decision will turn these figures into tax policies or not.

With a note: important figures are missing from the Ministry of Finance’s list, which should support the political considerations that are obvious, as well as the budgetary impact, which usually causes troubles for all governments.

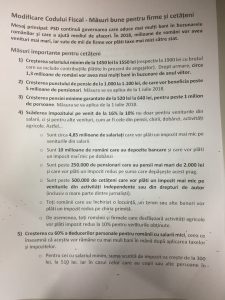

Decisions announced by Minister Ionut Misa are:

- Increase the minimum wage from RON 1,450 to RON 1,550 (respectively to RON1,900 with the gross amount which will include the contributions currently paid by the employer). The measure would apply as of January 1, 2018

- Increase the pension point from RON 1,000 to RON 1,100. The measure will apply as of July 1, 2018

- Increase the minimum guaranteed pension from RON 520 lei to RON 640. The measure will apply as of July 1, 2018

- Cut the income tax from 16% to 10%, not only for salary income but also for other types of income such as pensions, rental income, interest rates, agricultural activities, copyrights, self-employment

- 70% increase in deductions for low paid Romanians. For the minimum wage, the amount exempted from tax will increase from RON 300 to RON 510. For people with children, an amount of RON 160 is added for each child (compared to RON 100 now)

- Transfer social contributions to the employee. Of the total contributions paid for the gross salary, 37.25% will be paid. In total, of the gross salary, 35% will be contributions paid by the employer on behalf of the employee. Contributions left to the employer, namely 2.75%, decrease to 2,25% and will cover the risks of unemployment, accidents, sick leave, salary claims. All these will be covered by a single contribution called „Work insurance contribution”

- CAS for particular work conditions decreases from 31.3% to 29%

- CAS for special work conditions decreases from 36.3% to 33%

- Independent activities (doctors, lawyers, notaries, journalists, writers, artists, etc.) will no longer pay contributions to the amounts obtained from these activities. Contributions will be calculated based on the national minimum wage.

- Companies with a turnover below EUR 1 million will pay a 1% tax on turnover instead of the current 16% corporate tax

- Businesses can no longer be criminally prosecuted for a VAT fraud unless there is material evidence that the respective entity has encountered tax evasion firms

Minister Ionut Misa also announced two measures to fight tax evasion or avoidance.

The first one is the implementation of the European Directive 1164 from 2016 on fighting profit shifting abroad by multinational companies. Through this directive:

- Deduction of interest will be limited

- A tax is introduced on the amounts transferred abroad by multinationals, to reduce their tax base

- Transfers between business groups to their subsidiaries from tax haven will be prevented

- No more tax benefits from abusive arrangements between companies will be granted

The second measure: the seizure of the means of transport (car, truck, ship, train, airplane) used by those who evade excise duties on goods, in addition to the seizure of the goods involved in evasion.

Putting announced measures into context: Tax Code – as an electoral poster

The first thing worth to be mentioned is the very political, almost electoral form of the announced measures.

The first thing worth to be mentioned is the very political, almost electoral form of the announced measures.

The Finance Minister’s intervention looked like the political speeches – important details of some measures are missing, important figures related to the budget impact are missing.

Instead, for each measure, there were repeated mentions such as „1.3 million Romanians will have more money in their pocket next year.”

Additionally, the measures announced by the minister have been listed under the motto „Good measures for citizens and businesses” and the pages also contained „directing instructions” of the party’s communicators.

„PSD continues to be in the government that brings more money into Romanians’ pockets and helps the business environment. In 2018, millions of Romanians will have larger incomes, and hundreds of thousands of companies will pay lower taxes to the state,” is written in the main message that Ionut Misa should have read in front of the media present at the beginning of the government meeting on Thursday.